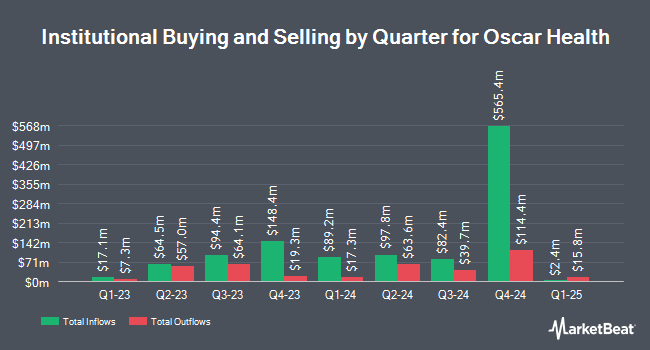

Zuckerman Investment Group LLC acquired a new position in shares of Oscar Health, Inc. (NYSE:OSCR - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 20,000 shares of the company's stock, valued at approximately $269,000.

Several other institutional investors have also modified their holdings of OSCR. Arizona State Retirement System grew its position in Oscar Health by 3.1% during the 4th quarter. Arizona State Retirement System now owns 47,918 shares of the company's stock worth $644,000 after purchasing an additional 1,454 shares during the last quarter. Xponance Inc. lifted its position in Oscar Health by 12.9% during the 4th quarter. Xponance Inc. now owns 14,394 shares of the company's stock worth $193,000 after acquiring an additional 1,649 shares during the period. KBC Group NV increased its holdings in shares of Oscar Health by 56.1% in the fourth quarter. KBC Group NV now owns 7,107 shares of the company's stock valued at $96,000 after purchasing an additional 2,555 shares during the period. Alliancebernstein L.P. increased its stake in Oscar Health by 1.1% in the 4th quarter. Alliancebernstein L.P. now owns 243,160 shares of the company's stock valued at $3,268,000 after buying an additional 2,600 shares during the period. Finally, PNC Financial Services Group Inc. raised its position in Oscar Health by 20.5% during the 4th quarter. PNC Financial Services Group Inc. now owns 17,896 shares of the company's stock worth $241,000 after buying an additional 3,040 shares during the last quarter. Hedge funds and other institutional investors own 75.70% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wells Fargo & Company lowered shares of Oscar Health from an "overweight" rating to an "equal weight" rating and decreased their target price for the stock from $20.00 to $16.00 in a research report on Thursday, March 13th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating, two have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $20.21.

Read Our Latest Report on OSCR

Oscar Health Trading Down 0.6 %

Shares of OSCR stock traded down $0.07 on Tuesday, reaching $12.35. 1,079,133 shares of the stock were exchanged, compared to its average volume of 4,604,314. The firm has a 50 day moving average of $13.95 and a two-hundred day moving average of $15.26. The stock has a market cap of $3.09 billion, a P/E ratio of -617.19 and a beta of 1.75. The company has a quick ratio of 0.73, a current ratio of 0.73 and a debt-to-equity ratio of 0.26. Oscar Health, Inc. has a 1-year low of $11.47 and a 1-year high of $23.79.

Oscar Health (NYSE:OSCR - Get Free Report) last announced its quarterly earnings results on Tuesday, February 4th. The company reported ($0.62) earnings per share for the quarter, missing analysts' consensus estimates of ($0.55) by ($0.07). Oscar Health had a return on equity of 2.28% and a net margin of 0.28%. On average, research analysts anticipate that Oscar Health, Inc. will post 0.69 EPS for the current year.

Oscar Health Profile

(

Free Report)

Oscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Read More

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.