Zumiez (NASDAQ:ZUMZ - Get Free Report) is expected to release its earnings data after the market closes on Thursday, March 13th. Analysts expect Zumiez to post earnings of $0.76 per share and revenue of $276.47 million for the quarter. Persons that are interested in participating in the company's earnings conference call can do so using this link.

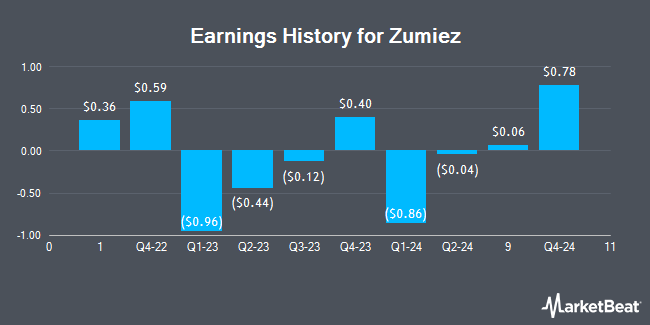

Zumiez (NASDAQ:ZUMZ - Get Free Report) last issued its earnings results on Thursday, December 5th. The apparel and footwear maker reported $0.06 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.02 by $0.04. The business had revenue of $222.50 million for the quarter, compared to analyst estimates of $222.06 million. Zumiez had a negative net margin of 5.60% and a negative return on equity of 2.67%. Zumiez's revenue was up 2.9% on a year-over-year basis. During the same period in the prior year, the firm earned ($0.12) earnings per share. On average, analysts expect Zumiez to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Zumiez Trading Down 0.1 %

NASDAQ ZUMZ traded down $0.02 on Friday, hitting $14.10. 278,933 shares of the company were exchanged, compared to its average volume of 275,938. The company has a market cap of $270.34 million, a PE ratio of -5.49 and a beta of 1.23. Zumiez has a 12 month low of $12.90 and a 12 month high of $31.37. The stock has a fifty day moving average of $16.05 and a 200-day moving average of $20.23.

Zumiez Company Profile

(

Get Free Report)

Zumiez Inc operates as a specialty retailer of apparel, footwear, accessories, and hardgoods for young men and women. The company provides hardgoods, including skateboards, snowboards, bindings, components, and other equipment. It operates stores in the United States, Canada, Europe, and Australia under the names of Zumiez, Blue Tomato, and Fast Times.

Featured Articles

Before you consider Zumiez, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zumiez wasn't on the list.

While Zumiez currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.