Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in shares of Hologic, Inc. (NASDAQ:HOLX - Free Report) by 2.8% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 364,776 shares of the medical equipment provider's stock after buying an additional 10,049 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned about 0.16% of Hologic worth $26,297,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

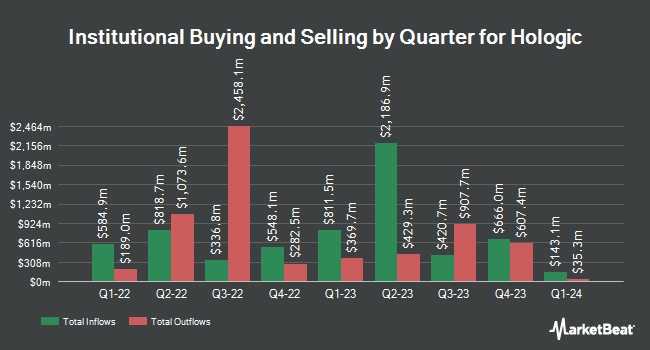

A number of other institutional investors also recently bought and sold shares of the stock. General Partner Inc. purchased a new position in Hologic during the fourth quarter valued at $26,000. Groupama Asset Managment lifted its position in Hologic by 9.9% during the 3rd quarter. Groupama Asset Managment now owns 33,177 shares of the medical equipment provider's stock valued at $27,000 after acquiring an additional 2,999 shares during the period. Venturi Wealth Management LLC boosted its stake in Hologic by 156.3% during the fourth quarter. Venturi Wealth Management LLC now owns 428 shares of the medical equipment provider's stock worth $31,000 after acquiring an additional 261 shares in the last quarter. First Horizon Advisors Inc. grew its holdings in Hologic by 38.3% in the third quarter. First Horizon Advisors Inc. now owns 484 shares of the medical equipment provider's stock worth $39,000 after purchasing an additional 134 shares during the period. Finally, Smartleaf Asset Management LLC increased its stake in shares of Hologic by 36.9% during the fourth quarter. Smartleaf Asset Management LLC now owns 590 shares of the medical equipment provider's stock valued at $43,000 after purchasing an additional 159 shares in the last quarter. 94.73% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of analysts have recently commented on the company. BNP Paribas raised Hologic to a "strong-buy" rating in a research report on Tuesday, December 10th. Jefferies Financial Group initiated coverage on Hologic in a report on Tuesday, December 10th. They issued a "hold" rating and a $85.00 target price on the stock. Wolfe Research initiated coverage on Hologic in a report on Friday, December 13th. They set a "peer perform" rating for the company. Leerink Partnrs cut shares of Hologic from a "strong-buy" rating to a "hold" rating in a research note on Thursday, February 6th. Finally, Stephens restated an "overweight" rating and set a $84.00 price objective on shares of Hologic in a research note on Thursday, February 6th. Eleven analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $84.62.

View Our Latest Report on Hologic

Hologic Trading Down 4.6 %

Shares of HOLX stock opened at $62.59 on Wednesday. The stock has a market capitalization of $14.04 billion, a P/E ratio of 19.74, a P/E/G ratio of 2.14 and a beta of 0.97. The company has a current ratio of 3.49, a quick ratio of 2.78 and a debt-to-equity ratio of 0.52. The firm's 50 day moving average is $67.87 and its 200 day moving average is $75.04. Hologic, Inc. has a 12-month low of $61.70 and a 12-month high of $84.67.

Hologic (NASDAQ:HOLX - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The medical equipment provider reported $1.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.02 by $0.01. Hologic had a return on equity of 19.72% and a net margin of 18.42%. Research analysts expect that Hologic, Inc. will post 4.28 earnings per share for the current year.

Hologic Company Profile

(

Free Report)

Hologic, Inc develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment. The company operates through four segments: Diagnostics, Breast Health, GYN Surgical, and Skeletal Health. It provides Aptima molecular diagnostic assays to detect the infectious microorganisms; Aptima viral load assays for Hepatitis B virus, Hepatitis C virus, human immunodeficiency virus, and human cytomegalo virus; Aptima bacterial vaginosis and candida vaginitis assays for the diagnosis of vaginitis; Aptima SARS-CoV-2 and Panther Fusion SARS-CoV-2 assays to detect SARS-CoV-2; ThinPrep System for cytology applications; and Rapid Fetal Fibronectin Test that assists physicians in assessing the risk of pre-term birth.

Featured Stories

Want to see what other hedge funds are holding HOLX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Hologic, Inc. (NASDAQ:HOLX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hologic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hologic wasn't on the list.

While Hologic currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.