Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in shares of Fortune Brands Innovations, Inc. (NYSE:FBIN - Free Report) by 5.9% during the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 381,827 shares of the company's stock after buying an additional 21,362 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned 0.31% of Fortune Brands Innovations worth $34,185,000 at the end of the most recent reporting period.

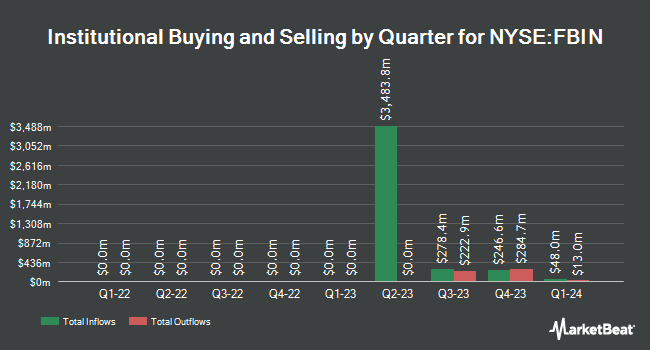

Several other hedge funds and other institutional investors have also recently modified their holdings of FBIN. Select Equity Group L.P. lifted its holdings in Fortune Brands Innovations by 48.8% during the 2nd quarter. Select Equity Group L.P. now owns 6,326,857 shares of the company's stock valued at $410,866,000 after buying an additional 2,075,673 shares in the last quarter. FMR LLC raised its stake in shares of Fortune Brands Innovations by 104.5% during the third quarter. FMR LLC now owns 5,920,248 shares of the company's stock valued at $530,040,000 after acquiring an additional 3,024,950 shares in the last quarter. Dimensional Fund Advisors LP boosted its holdings in shares of Fortune Brands Innovations by 10.0% in the second quarter. Dimensional Fund Advisors LP now owns 1,840,067 shares of the company's stock valued at $119,501,000 after purchasing an additional 167,758 shares during the period. Bank of New York Mellon Corp grew its stake in Fortune Brands Innovations by 1.8% in the second quarter. Bank of New York Mellon Corp now owns 1,378,297 shares of the company's stock worth $89,507,000 after purchasing an additional 24,139 shares in the last quarter. Finally, Robeco Schweiz AG increased its holdings in Fortune Brands Innovations by 26.5% during the 2nd quarter. Robeco Schweiz AG now owns 906,572 shares of the company's stock worth $58,873,000 after purchasing an additional 189,635 shares during the period. 87.60% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

FBIN has been the subject of several research reports. Jefferies Financial Group upped their target price on Fortune Brands Innovations from $100.00 to $111.00 and gave the stock a "buy" rating in a report on Wednesday, October 9th. Robert W. Baird lowered their price objective on shares of Fortune Brands Innovations from $94.00 to $90.00 and set a "neutral" rating for the company in a research note on Thursday, November 7th. UBS Group cut their target price on shares of Fortune Brands Innovations from $98.00 to $97.00 and set a "buy" rating on the stock in a research report on Thursday, November 7th. The Goldman Sachs Group upped their price target on shares of Fortune Brands Innovations from $86.00 to $98.00 and gave the stock a "buy" rating in a research report on Tuesday, October 8th. Finally, Evercore ISI cut their price objective on shares of Fortune Brands Innovations from $80.00 to $78.00 and set an "in-line" rating on the stock in a report on Thursday, November 7th. Seven equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $91.36.

View Our Latest Research Report on Fortune Brands Innovations

Fortune Brands Innovations Stock Up 0.4 %

Fortune Brands Innovations stock traded up $0.34 during midday trading on Friday, reaching $78.31. The company's stock had a trading volume of 510,466 shares, compared to its average volume of 1,195,705. Fortune Brands Innovations, Inc. has a 52-week low of $62.54 and a 52-week high of $90.54. The stock has a market capitalization of $9.73 billion, a P/E ratio of 22.15, a PEG ratio of 2.50 and a beta of 1.51. The company has a debt-to-equity ratio of 0.95, a current ratio of 1.32 and a quick ratio of 0.69. The stock's 50-day simple moving average is $83.75 and its 200-day simple moving average is $76.59.

Fortune Brands Innovations (NYSE:FBIN - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The company reported $1.16 EPS for the quarter, topping the consensus estimate of $1.15 by $0.01. The business had revenue of $1.16 billion during the quarter, compared to the consensus estimate of $1.24 billion. Fortune Brands Innovations had a net margin of 9.61% and a return on equity of 22.22%. The business's revenue for the quarter was down 8.4% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.19 earnings per share. On average, sell-side analysts expect that Fortune Brands Innovations, Inc. will post 4.19 EPS for the current year.

Fortune Brands Innovations Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Friday, November 22nd will be issued a dividend of $0.24 per share. This represents a $0.96 annualized dividend and a yield of 1.23%. The ex-dividend date of this dividend is Friday, November 22nd. Fortune Brands Innovations's dividend payout ratio (DPR) is 27.04%.

Fortune Brands Innovations Company Profile

(

Free Report)

Fortune Brands Innovations, Inc provides home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally. The company operates through three segments: Water, Outdoors, and Security. The Water segment manufactures or assembles, and sells faucets, accessories, kitchen sinks, and waste disposals under the Moen, ROHL, Riobel, Victoria+Albert, Perrin & Rowe, Aqualisa, Shaws, Emtek, and Schaub brands.

Recommended Stories

Before you consider Fortune Brands Innovations, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortune Brands Innovations wasn't on the list.

While Fortune Brands Innovations currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.