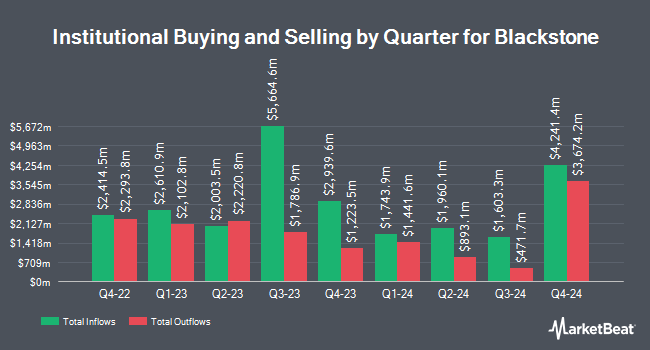

Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in Blackstone Inc. (NYSE:BX - Free Report) by 12.2% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 155,953 shares of the asset manager's stock after acquiring an additional 17,019 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank's holdings in Blackstone were worth $26,889,000 at the end of the most recent quarter.

A number of other large investors have also recently bought and sold shares of BX. Sather Financial Group Inc increased its position in Blackstone by 202.5% in the 3rd quarter. Sather Financial Group Inc now owns 6,050 shares of the asset manager's stock valued at $926,000 after acquiring an additional 4,050 shares during the period. Aljian Capital Management LLC acquired a new position in shares of Blackstone in the third quarter valued at approximately $1,951,000. Icon Wealth Advisors LLC lifted its holdings in shares of Blackstone by 2,185.4% during the third quarter. Icon Wealth Advisors LLC now owns 18,946 shares of the asset manager's stock worth $2,901,000 after purchasing an additional 18,117 shares during the period. Wealthcare Capital Partners LLC acquired a new position in Blackstone in the 4th quarter valued at $2,102,000. Finally, Highland Capital Management LLC lifted its stake in shares of Blackstone by 214.2% in the 4th quarter. Highland Capital Management LLC now owns 22,303 shares of the asset manager's stock worth $3,845,000 after acquiring an additional 15,205 shares during the period. Institutional investors and hedge funds own 70.00% of the company's stock.

Insider Activity at Blackstone

In related news, Director Ruth Porat purchased 301 shares of the company's stock in a transaction that occurred on Tuesday, February 18th. The stock was purchased at an average price of $164.85 per share, with a total value of $49,619.85. Following the completion of the transaction, the director now owns 36,829 shares of the company's stock, valued at approximately $6,071,260.65. This trade represents a 0.82 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 1.00% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on BX. BMO Capital Markets raised their price objective on shares of Blackstone from $134.00 to $157.00 and gave the company a "market perform" rating in a research report on Thursday, December 19th. JPMorgan Chase & Co. lifted their price target on Blackstone from $149.00 to $154.00 and gave the company a "neutral" rating in a research note on Friday, January 31st. Piper Sandler boosted their target price on shares of Blackstone from $168.00 to $179.00 and gave the stock a "neutral" rating in a research report on Monday, December 23rd. UBS Group reiterated a "neutral" rating on shares of Blackstone in a research note on Monday, March 3rd. Finally, TD Cowen upgraded shares of Blackstone from a "hold" rating to a "buy" rating and upped their target price for the stock from $149.00 to $230.00 in a research report on Monday, December 9th. Thirteen analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $172.38.

Read Our Latest Report on BX

Blackstone Stock Down 1.0 %

Shares of NYSE:BX opened at $138.02 on Wednesday. The company has a market capitalization of $100.67 billion, a P/E ratio of 38.02, a P/E/G ratio of 1.07 and a beta of 1.55. The stock's fifty day simple moving average is $167.98 and its 200-day simple moving average is $167.25. Blackstone Inc. has a 52-week low of $115.82 and a 52-week high of $200.96. The company has a quick ratio of 0.71, a current ratio of 0.67 and a debt-to-equity ratio of 0.61.

Blackstone (NYSE:BX - Get Free Report) last issued its quarterly earnings results on Thursday, January 30th. The asset manager reported $1.69 EPS for the quarter, topping analysts' consensus estimates of $1.50 by $0.19. Blackstone had a net margin of 20.99% and a return on equity of 19.58%. As a group, equities research analysts forecast that Blackstone Inc. will post 5.87 earnings per share for the current fiscal year.

Blackstone Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, February 18th. Stockholders of record on Monday, February 10th were given a $1.44 dividend. The ex-dividend date was Monday, February 10th. This represents a $5.76 dividend on an annualized basis and a dividend yield of 4.17%. This is an increase from Blackstone's previous quarterly dividend of $0.86. Blackstone's payout ratio is currently 158.68%.

Blackstone Company Profile

(

Free Report)

Blackstone Inc is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services.

Read More

Want to see what other hedge funds are holding BX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Blackstone Inc. (NYSE:BX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Blackstone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone wasn't on the list.

While Blackstone currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.