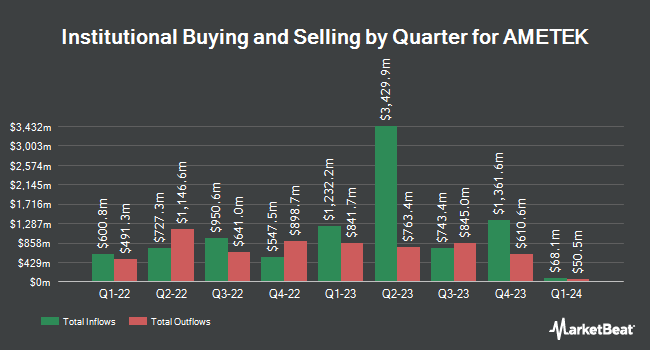

Zurcher Kantonalbank Zurich Cantonalbank grew its position in AMETEK, Inc. (NYSE:AME - Free Report) by 16.5% in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 88,898 shares of the technology company's stock after buying an additional 12,584 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank's holdings in AMETEK were worth $16,025,000 at the end of the most recent quarter.

A number of other large investors have also made changes to their positions in AME. Oddo BHF Asset Management Sas acquired a new position in AMETEK in the third quarter valued at about $3,724,000. Everence Capital Management Inc. bought a new position in shares of AMETEK during the 4th quarter valued at about $999,000. Czech National Bank grew its position in shares of AMETEK by 6.3% in the 4th quarter. Czech National Bank now owns 50,153 shares of the technology company's stock valued at $9,041,000 after purchasing an additional 2,987 shares during the period. BNP Paribas Financial Markets increased its stake in AMETEK by 23.2% during the 3rd quarter. BNP Paribas Financial Markets now owns 355,828 shares of the technology company's stock worth $61,099,000 after purchasing an additional 67,025 shares in the last quarter. Finally, Assenagon Asset Management S.A. raised its holdings in AMETEK by 434.5% during the 4th quarter. Assenagon Asset Management S.A. now owns 541,517 shares of the technology company's stock worth $97,614,000 after buying an additional 440,197 shares during the period. Institutional investors own 87.43% of the company's stock.

AMETEK Price Performance

NYSE:AME opened at $177.34 on Thursday. The stock has a market capitalization of $40.91 billion, a PE ratio of 29.91, a P/E/G ratio of 2.73 and a beta of 1.14. AMETEK, Inc. has a 1-year low of $149.03 and a 1-year high of $198.33. The firm has a fifty day simple moving average of $183.27 and a 200 day simple moving average of $180.19. The company has a current ratio of 1.24, a quick ratio of 0.75 and a debt-to-equity ratio of 0.15.

AMETEK (NYSE:AME - Get Free Report) last announced its quarterly earnings data on Tuesday, February 4th. The technology company reported $1.87 EPS for the quarter, beating analysts' consensus estimates of $1.85 by $0.02. The company had revenue of $1.76 billion during the quarter, compared to the consensus estimate of $1.82 billion. AMETEK had a net margin of 19.83% and a return on equity of 16.94%. The company's quarterly revenue was up 1.8% on a year-over-year basis. During the same quarter last year, the firm posted $1.68 EPS. On average, research analysts expect that AMETEK, Inc. will post 7.15 EPS for the current fiscal year.

AMETEK Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Friday, March 14th will be paid a $0.31 dividend. This is a positive change from AMETEK's previous quarterly dividend of $0.28. The ex-dividend date is Friday, March 14th. This represents a $1.24 annualized dividend and a yield of 0.70%. AMETEK's dividend payout ratio is currently 20.91%.

AMETEK declared that its Board of Directors has authorized a stock buyback plan on Friday, February 7th that authorizes the company to repurchase $1.25 billion in outstanding shares. This repurchase authorization authorizes the technology company to purchase up to 2.9% of its shares through open market purchases. Shares repurchase plans are usually a sign that the company's board of directors believes its shares are undervalued.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the stock. BNP Paribas upgraded shares of AMETEK from a "neutral" rating to an "outperform" rating and set a $210.00 price target for the company in a report on Thursday, January 16th. Robert W. Baird lowered their target price on AMETEK from $200.00 to $197.00 and set a "neutral" rating for the company in a report on Wednesday, February 5th. Truist Financial boosted their price target on AMETEK from $221.00 to $222.00 and gave the company a "buy" rating in a report on Thursday, January 16th. Bank of America upgraded AMETEK from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $195.00 to $225.00 in a report on Monday, December 16th. Finally, StockNews.com upgraded AMETEK from a "hold" rating to a "buy" rating in a research note on Sunday. One investment analyst has rated the stock with a sell rating, two have given a hold rating, eight have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $204.67.

Check Out Our Latest Research Report on AME

Insider Activity

In other AMETEK news, Director Steven W. Kohlhagen sold 1,320 shares of the firm's stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $189.41, for a total transaction of $250,021.20. Following the completion of the sale, the director now owns 22,029 shares of the company's stock, valued at $4,172,512.89. This trade represents a 5.65 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Insiders own 0.61% of the company's stock.

About AMETEK

(

Free Report)

AMETEK, Inc manufactures and sells electronic instruments and electromechanical devices in the North America, Europe, Asia, and South America, and internationally. The company's EIG segment offers advanced instruments for the process, aerospace, power, and industrial markets; process and analytical instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries; instruments to the laboratory equipment, ultra-precision manufacturing, medical, and test and measurement markets; power quality monitoring and c devices, uninterruptible power supplies, programmable power and electromagnetic compatibility test equipment, and sensors for gas turbines and dashboard instruments; heavy trucks, instrumentation, and controls for the food and beverage industries; and aircraft and engine sensors, power supplies, embedded computing, monitoring, fuel and fluid measurement, and data acquisition systems for aerospace and defense industry.

Featured Stories

Want to see what other hedge funds are holding AME? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AMETEK, Inc. (NYSE:AME - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AMETEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMETEK wasn't on the list.

While AMETEK currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report