Zurcher Kantonalbank Zurich Cantonalbank raised its holdings in shares of MongoDB, Inc. (NASDAQ:MDB - Free Report) by 23.3% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 15,143 shares of the company's stock after purchasing an additional 2,858 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank's holdings in MongoDB were worth $4,094,000 as of its most recent filing with the Securities and Exchange Commission.

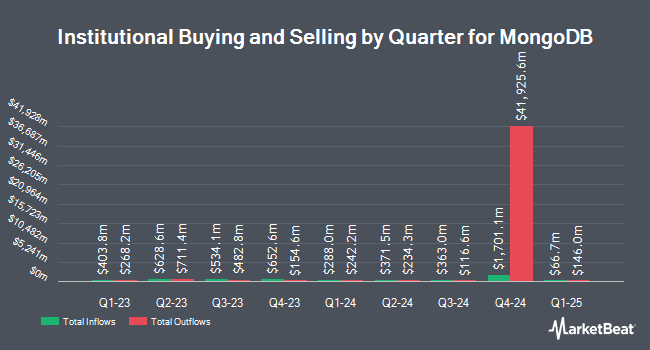

Other hedge funds also recently modified their holdings of the company. Jennison Associates LLC increased its stake in MongoDB by 23.6% in the third quarter. Jennison Associates LLC now owns 3,102,024 shares of the company's stock valued at $838,632,000 after purchasing an additional 592,038 shares in the last quarter. Swedbank AB raised its stake in MongoDB by 156.3% during the 2nd quarter. Swedbank AB now owns 656,993 shares of the company's stock worth $164,222,000 after buying an additional 400,705 shares during the period. Westfield Capital Management Co. LP lifted its holdings in MongoDB by 1.5% during the third quarter. Westfield Capital Management Co. LP now owns 496,248 shares of the company's stock worth $134,161,000 after acquiring an additional 7,526 shares in the last quarter. Thrivent Financial for Lutherans grew its stake in MongoDB by 1,098.1% in the second quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company's stock valued at $106,084,000 after acquiring an additional 388,979 shares during the period. Finally, Blair William & Co. IL increased its holdings in shares of MongoDB by 16.4% in the second quarter. Blair William & Co. IL now owns 315,830 shares of the company's stock worth $78,945,000 after acquiring an additional 44,608 shares in the last quarter. Institutional investors own 89.29% of the company's stock.

Insider Buying and Selling

In related news, CRO Cedric Pech sold 302 shares of the business's stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $256.25, for a total transaction of $77,387.50. Following the sale, the executive now owns 33,440 shares in the company, valued at $8,569,000. The trade was a 0.90 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CAO Thomas Bull sold 1,000 shares of MongoDB stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $282.89, for a total value of $282,890.00. Following the sale, the chief accounting officer now directly owns 16,222 shares in the company, valued at $4,589,041.58. The trade was a 5.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 23,600 shares of company stock worth $6,569,819. Corporate insiders own 3.60% of the company's stock.

MongoDB Price Performance

Shares of NASDAQ MDB traded down $1.14 during mid-day trading on Tuesday, reaching $324.01. The company had a trading volume of 917,469 shares, compared to its average volume of 1,447,469. The business's 50-day simple moving average is $284.45 and its 200 day simple moving average is $270.10. MongoDB, Inc. has a one year low of $212.74 and a one year high of $509.62. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84.

Wall Street Analysts Forecast Growth

MDB has been the topic of several recent analyst reports. Oppenheimer lifted their price objective on MongoDB from $300.00 to $350.00 and gave the company an "outperform" rating in a report on Friday, August 30th. Wells Fargo & Company upped their price target on shares of MongoDB from $300.00 to $350.00 and gave the company an "overweight" rating in a report on Friday, August 30th. Truist Financial raised their price objective on shares of MongoDB from $300.00 to $320.00 and gave the stock a "buy" rating in a report on Friday, August 30th. Wedbush raised MongoDB to a "strong-buy" rating in a research note on Thursday, October 17th. Finally, Morgan Stanley increased their price objective on MongoDB from $320.00 to $340.00 and gave the stock an "overweight" rating in a report on Friday, August 30th. One investment analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, MongoDB has an average rating of "Moderate Buy" and an average target price of $343.83.

Get Our Latest Stock Analysis on MDB

About MongoDB

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.