Zurcher Kantonalbank Zurich Cantonalbank grew its stake in Principal Financial Group, Inc. (NYSE:PFG - Free Report) by 18.4% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 115,582 shares of the company's stock after buying an additional 17,931 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank owned approximately 0.05% of Principal Financial Group worth $9,928,000 at the end of the most recent reporting period.

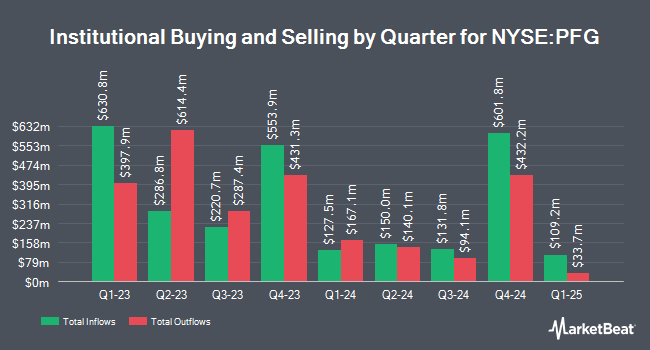

A number of other institutional investors have also recently made changes to their positions in the stock. Acadian Asset Management LLC lifted its position in Principal Financial Group by 403.6% in the 2nd quarter. Acadian Asset Management LLC now owns 354,447 shares of the company's stock worth $27,800,000 after buying an additional 284,067 shares during the last quarter. Massachusetts Financial Services Co. MA bought a new stake in shares of Principal Financial Group in the 2nd quarter worth approximately $19,698,000. Bank of Montreal Can boosted its stake in shares of Principal Financial Group by 41.0% in the 3rd quarter. Bank of Montreal Can now owns 503,735 shares of the company's stock valued at $43,367,000 after purchasing an additional 146,473 shares in the last quarter. Mizuho Securities USA LLC grew its holdings in shares of Principal Financial Group by 818.1% during the 3rd quarter. Mizuho Securities USA LLC now owns 152,648 shares of the company's stock valued at $13,112,000 after purchasing an additional 136,021 shares during the last quarter. Finally, International Assets Investment Management LLC raised its position in Principal Financial Group by 6,593.7% in the 3rd quarter. International Assets Investment Management LLC now owns 132,200 shares of the company's stock worth $11,356,000 after purchasing an additional 130,225 shares during the period. Institutional investors own 75.08% of the company's stock.

Principal Financial Group Stock Down 1.1 %

Principal Financial Group stock traded down $0.93 during mid-day trading on Monday, hitting $85.42. The company had a trading volume of 1,041,549 shares, compared to its average volume of 1,138,715. Principal Financial Group, Inc. has a 12 month low of $72.21 and a 12 month high of $91.97. The company has a market capitalization of $19.54 billion, a PE ratio of -94.91, a price-to-earnings-growth ratio of 1.01 and a beta of 1.20. The stock's 50 day moving average price is $86.41 and its two-hundred day moving average price is $82.45. The company has a current ratio of 0.30, a quick ratio of 0.30 and a debt-to-equity ratio of 0.35.

Principal Financial Group (NYSE:PFG - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The company reported $1.76 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.02 by ($0.26). The firm had revenue of $3.01 billion during the quarter, compared to the consensus estimate of $3.92 billion. Principal Financial Group had a positive return on equity of 14.67% and a negative net margin of 1.47%. During the same quarter in the previous year, the firm earned $1.72 EPS. As a group, sell-side analysts anticipate that Principal Financial Group, Inc. will post 7.04 earnings per share for the current fiscal year.

Principal Financial Group Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Monday, December 2nd will be paid a dividend of $0.73 per share. This is an increase from Principal Financial Group's previous quarterly dividend of $0.72. This represents a $2.92 dividend on an annualized basis and a dividend yield of 3.42%. The ex-dividend date of this dividend is Monday, December 2nd. Principal Financial Group's payout ratio is currently -324.44%.

Analysts Set New Price Targets

PFG has been the topic of a number of recent research reports. Barclays raised their price objective on Principal Financial Group from $75.00 to $77.00 and gave the company an "underweight" rating in a research note on Friday, October 25th. Morgan Stanley reduced their price target on Principal Financial Group from $85.00 to $83.00 and set an "equal weight" rating on the stock in a research report on Monday, August 19th. Bank of America lowered their price objective on Principal Financial Group from $94.00 to $91.00 and set a "neutral" rating for the company in a research report on Thursday, October 10th. Royal Bank of Canada raised their target price on shares of Principal Financial Group from $87.00 to $91.00 and gave the stock a "sector perform" rating in a report on Tuesday, November 19th. Finally, Wells Fargo & Company upped their price target on shares of Principal Financial Group from $85.00 to $86.00 and gave the company an "equal weight" rating in a report on Thursday, October 10th. Two analysts have rated the stock with a sell rating, nine have assigned a hold rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $85.92.

Get Our Latest Analysis on Principal Financial Group

Principal Financial Group Profile

(

Free Report)

Principal Financial Group, Inc provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide. The company operates through Retirement and Income Solutions, Principal Asset Management, and Benefits and Protection segments. The Retirement and Income Solutions segment provides retirement, and related financial products and services.

Featured Articles

Before you consider Principal Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Principal Financial Group wasn't on the list.

While Principal Financial Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.