Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in Avantor, Inc. (NYSE:AVTR - Free Report) by 20.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 433,213 shares of the company's stock after purchasing an additional 73,633 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank owned 0.06% of Avantor worth $11,207,000 at the end of the most recent reporting period.

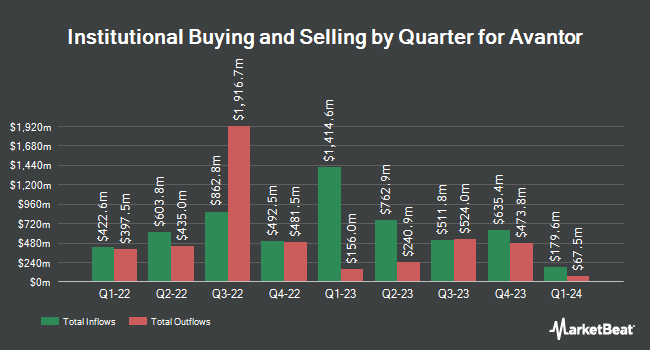

Other large investors have also recently bought and sold shares of the company. Swedbank AB acquired a new stake in shares of Avantor in the first quarter worth $2,707,000. Sound Shore Management Inc. CT bought a new stake in shares of Avantor during the second quarter valued at approximately $76,412,000. Seven Eight Capital LP acquired a new position in shares of Avantor in the second quarter valued at $642,000. New York State Teachers Retirement System acquired a new stake in Avantor during the third quarter worth $8,473,000. Finally, Allspring Global Investments Holdings LLC increased its holdings in Avantor by 35.1% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 1,157,855 shares of the company's stock valued at $24,547,000 after buying an additional 300,579 shares during the period. 95.08% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on the stock. Wells Fargo & Company decreased their target price on shares of Avantor from $30.00 to $28.00 and set an "overweight" rating on the stock in a research report on Monday, October 28th. Royal Bank of Canada reiterated an "outperform" rating and issued a $34.00 price objective on shares of Avantor in a research note on Thursday, September 26th. Robert W. Baird decreased their price target on Avantor from $27.00 to $26.00 and set an "outperform" rating on the stock in a research note on Monday, October 28th. Barclays dropped their price objective on Avantor from $28.00 to $25.00 and set an "overweight" rating for the company in a research note on Friday, October 25th. Finally, UBS Group cut their price objective on Avantor from $30.00 to $29.00 and set a "buy" rating for the company in a report on Tuesday, October 8th. Three equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $27.57.

Get Our Latest Stock Report on Avantor

Insider Activity at Avantor

In other Avantor news, CAO Steven W. Eck sold 3,525 shares of the company's stock in a transaction that occurred on Thursday, September 5th. The stock was sold at an average price of $25.06, for a total transaction of $88,336.50. Following the completion of the transaction, the chief accounting officer now owns 29,544 shares of the company's stock, valued at $740,372.64. This represents a 10.66 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 1.50% of the stock is owned by corporate insiders.

Avantor Trading Up 0.1 %

NYSE AVTR traded up $0.02 during trading on Friday, reaching $21.06. 3,337,532 shares of the stock traded hands, compared to its average volume of 6,860,813. Avantor, Inc. has a fifty-two week low of $19.59 and a fifty-two week high of $28.00. The company has a quick ratio of 1.06, a current ratio of 1.54 and a debt-to-equity ratio of 0.84. The firm has a market cap of $14.33 billion, a price-to-earnings ratio of 45.78, a price-to-earnings-growth ratio of 2.55 and a beta of 1.35. The stock's 50-day moving average price is $23.28 and its 200 day moving average price is $23.72.

Avantor Profile

(

Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

Featured Stories

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.