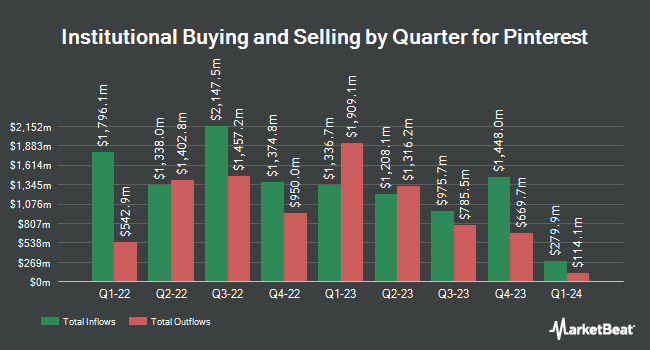

Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in shares of Pinterest, Inc. (NYSE:PINS - Free Report) by 167.7% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 331,899 shares of the company's stock after purchasing an additional 207,917 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank's holdings in Pinterest were worth $9,625,000 as of its most recent SEC filing.

Other hedge funds have also modified their holdings of the company. AlphaQuest LLC grew its stake in Pinterest by 223.7% in the 4th quarter. AlphaQuest LLC now owns 31,706 shares of the company's stock worth $919,000 after acquiring an additional 21,910 shares during the period. Amundi grew its stake in Pinterest by 19.4% in the 4th quarter. Amundi now owns 1,982,783 shares of the company's stock worth $61,209,000 after acquiring an additional 322,560 shares during the period. Machina Capital S.A.S. grew its stake in Pinterest by 132.1% in the 4th quarter. Machina Capital S.A.S. now owns 32,905 shares of the company's stock worth $954,000 after acquiring an additional 18,729 shares during the period. Edgestream Partners L.P. purchased a new stake in Pinterest in the 4th quarter worth approximately $4,965,000. Finally, Candriam S.C.A. grew its stake in Pinterest by 20.5% in the 4th quarter. Candriam S.C.A. now owns 40,557 shares of the company's stock worth $1,176,000 after acquiring an additional 6,887 shares during the period. 88.81% of the stock is owned by hedge funds and other institutional investors.

Pinterest Price Performance

Shares of PINS stock opened at $31.00 on Friday. Pinterest, Inc. has a 12 month low of $27.00 and a 12 month high of $45.19. The firm has a market capitalization of $21.03 billion, a P/E ratio of 11.52, a P/E/G ratio of 1.95 and a beta of 1.02. The company's fifty day moving average price is $34.32 and its two-hundred day moving average price is $32.27.

Pinterest (NYSE:PINS - Get Free Report) last released its earnings results on Thursday, February 6th. The company reported $0.33 earnings per share for the quarter, missing the consensus estimate of $0.63 by ($0.30). Pinterest had a return on equity of 8.10% and a net margin of 51.07%. On average, sell-side analysts anticipate that Pinterest, Inc. will post 0.6 EPS for the current year.

Insider Transactions at Pinterest

In related news, insider Wanjiku Juanita Walcott sold 6,690 shares of the business's stock in a transaction dated Monday, March 10th. The shares were sold at an average price of $32.85, for a total transaction of $219,766.50. Following the completion of the sale, the insider now owns 254,211 shares of the company's stock, valued at $8,350,831.35. This represents a 2.56 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Gokul Rajaram sold 1,150 shares of the business's stock in a transaction dated Wednesday, January 15th. The shares were sold at an average price of $30.43, for a total transaction of $34,994.50. Following the sale, the director now directly owns 30,236 shares of the company's stock, valued at approximately $920,081.48. This represents a 3.66 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 106,879 shares of company stock valued at $3,653,577. Insiders own 7.11% of the company's stock.

Wall Street Analysts Forecast Growth

PINS has been the subject of several recent analyst reports. TD Cowen initiated coverage on shares of Pinterest in a research note on Tuesday, November 26th. They issued a "buy" rating and a $38.00 target price for the company. Wells Fargo & Company lifted their price target on shares of Pinterest from $39.00 to $47.00 and gave the company an "overweight" rating in a report on Friday, February 7th. Monness Crespi & Hardt upgraded shares of Pinterest from a "neutral" rating to a "buy" rating and set a $40.00 price target on the stock in a report on Friday, January 10th. KeyCorp lifted their price target on shares of Pinterest from $37.00 to $46.00 and gave the company an "overweight" rating in a report on Friday, February 7th. Finally, Cantor Fitzgerald lifted their price target on shares of Pinterest from $36.00 to $48.00 and gave the company an "overweight" rating in a report on Friday, February 7th. Eight investment analysts have rated the stock with a hold rating and twenty-two have issued a buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $43.47.

Check Out Our Latest Stock Report on Pinterest

About Pinterest

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Read More

Want to see what other hedge funds are holding PINS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Pinterest, Inc. (NYSE:PINS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.