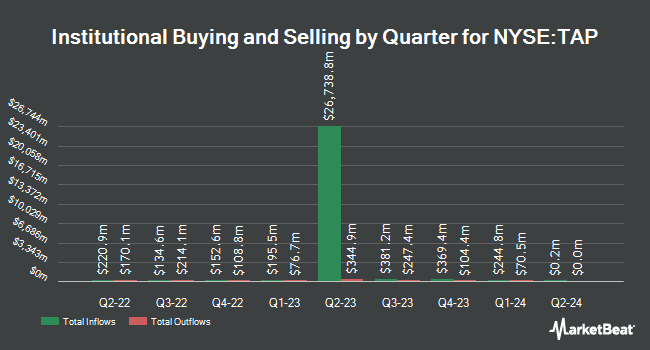

Zurcher Kantonalbank Zurich Cantonalbank lowered its stake in shares of Molson Coors Beverage (NYSE:TAP - Free Report) by 44.6% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 205,037 shares of the company's stock after selling 164,896 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned 0.10% of Molson Coors Beverage worth $11,794,000 as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds have also modified their holdings of the stock. Price T Rowe Associates Inc. MD lifted its stake in Molson Coors Beverage by 22.6% in the first quarter. Price T Rowe Associates Inc. MD now owns 307,393 shares of the company's stock worth $20,673,000 after acquiring an additional 56,584 shares during the last quarter. Janus Henderson Group PLC raised its holdings in shares of Molson Coors Beverage by 144.6% in the 1st quarter. Janus Henderson Group PLC now owns 73,909 shares of the company's stock valued at $4,969,000 after purchasing an additional 43,696 shares in the last quarter. Comerica Bank lifted its position in shares of Molson Coors Beverage by 4.0% during the 1st quarter. Comerica Bank now owns 105,098 shares of the company's stock worth $7,068,000 after purchasing an additional 4,079 shares during the last quarter. Swedbank AB acquired a new position in shares of Molson Coors Beverage during the first quarter worth $6,997,000. Finally, Cetera Investment Advisers increased its holdings in Molson Coors Beverage by 613.8% in the first quarter. Cetera Investment Advisers now owns 44,954 shares of the company's stock valued at $3,023,000 after buying an additional 38,656 shares during the last quarter. 78.46% of the stock is currently owned by institutional investors and hedge funds.

Molson Coors Beverage Stock Performance

TAP traded up $0.81 on Friday, hitting $62.06. 988,154 shares of the company traded hands, compared to its average volume of 2,023,438. Molson Coors Beverage has a 12-month low of $49.19 and a 12-month high of $69.18. The company has a 50 day moving average of $57.43 and a 200-day moving average of $54.55. The company has a quick ratio of 0.74, a current ratio of 0.99 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $12.78 billion, a PE ratio of 13.98, a PEG ratio of 2.40 and a beta of 0.82.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $1.80 EPS for the quarter, topping the consensus estimate of $1.67 by $0.13. The business had revenue of $3.04 billion during the quarter, compared to analysts' expectations of $3.13 billion. Molson Coors Beverage had a return on equity of 9.24% and a net margin of 6.78%. The company's quarterly revenue was down 7.8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.92 earnings per share. Sell-side analysts anticipate that Molson Coors Beverage will post 5.78 earnings per share for the current year.

Molson Coors Beverage Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be paid a dividend of $0.44 per share. The ex-dividend date of this dividend is Friday, December 6th. This represents a $1.76 dividend on an annualized basis and a dividend yield of 2.84%. Molson Coors Beverage's dividend payout ratio (DPR) is 39.64%.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on TAP. Wells Fargo & Company raised Molson Coors Beverage from an "underweight" rating to an "overweight" rating and lifted their price target for the stock from $52.00 to $74.00 in a report on Friday, November 8th. TD Cowen lowered their price target on Molson Coors Beverage from $58.00 to $56.00 and set a "hold" rating for the company in a report on Tuesday, October 8th. UBS Group raised their price objective on shares of Molson Coors Beverage from $55.00 to $58.00 and gave the stock a "neutral" rating in a report on Wednesday, August 7th. Piper Sandler upped their target price on shares of Molson Coors Beverage from $57.00 to $59.00 and gave the company a "neutral" rating in a report on Wednesday, August 7th. Finally, JPMorgan Chase & Co. increased their target price on shares of Molson Coors Beverage from $57.00 to $60.00 and gave the company a "neutral" rating in a research report on Friday, October 18th. Two investment analysts have rated the stock with a sell rating, nine have given a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, Molson Coors Beverage currently has a consensus rating of "Hold" and a consensus price target of $60.00.

Read Our Latest Report on Molson Coors Beverage

Molson Coors Beverage Company Profile

(

Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Featured Articles

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.