The bull market continues to rise, shrugging off negative news. However, most of those gains can be found in the computer and technology sector powered by the artificial intelligence (AI) revolution. The benchmark indexes are overweighted with the behemoth tech stocks. The top 3 holdings in the Nasdaq 100 index, NVIDIA Co. NASDAQ: NVDA, Microsoft Co. NASDAQ: MSFT and Apple Inc. NASDAQ: AAPL, have nearly a 25% weighting.

This isn't to say the breadth can't expand. Often, when the leaders take a breather, the underperformers can play catchup. If you believe stocks will continue to rise but don't want to chase at these elevated levels, you can use stock options to mitigate some of the risks.

Here are 3 options strategies that you can use to play a stock's uptrend in a rising market.

We’ll use AI chip leader NVDA stock as an example for each of the strategies.

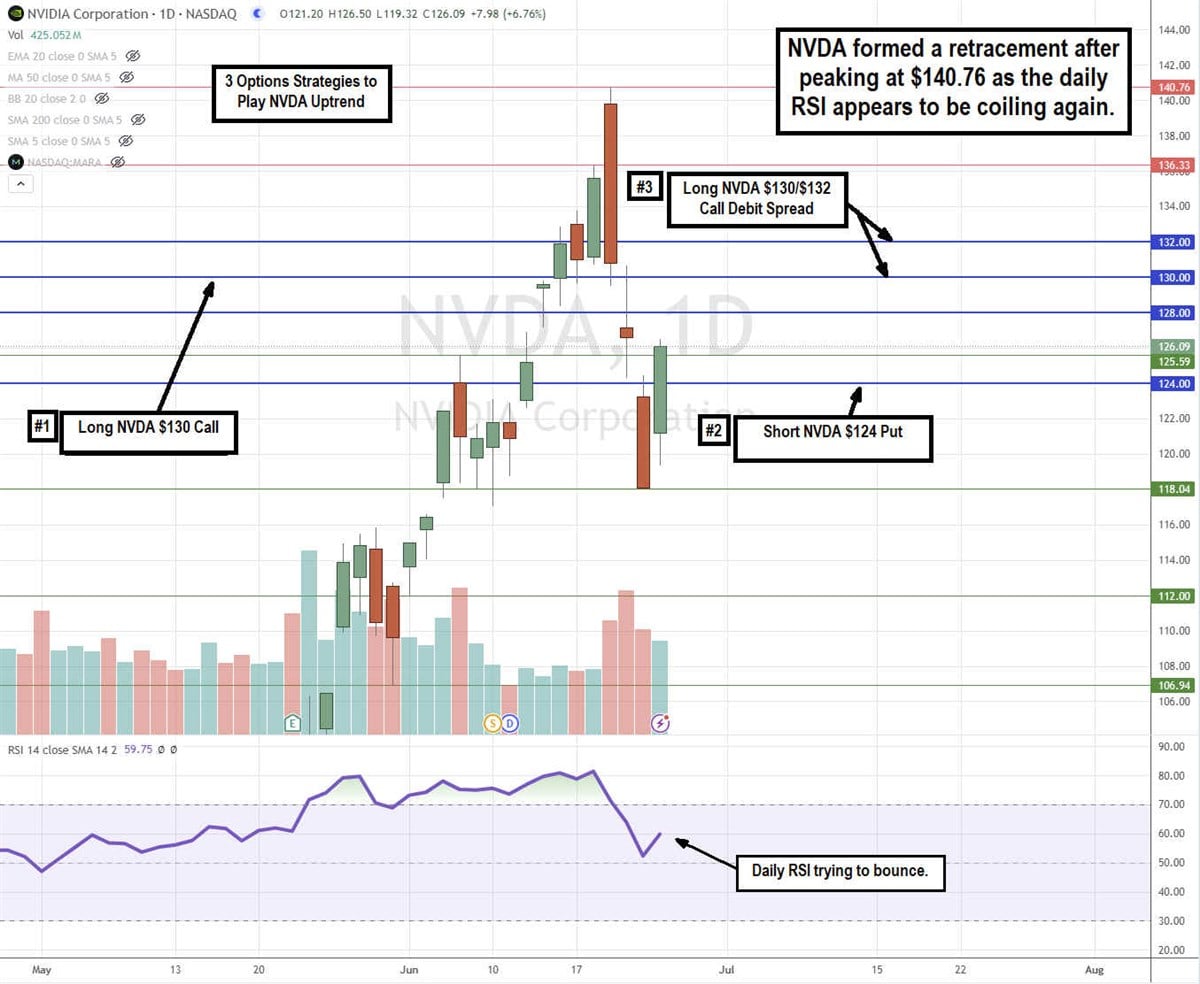

The daily candlestick chart on NVDA surged post-split to a peak at $140.76 before triggering a sharp pullback to $118.04. NVDA staged a rebound as the daily RSI bounced off the 50-band. NVDA is trading around $126.09 on June 25, 2024. The options strategies will use July 12, 2024, expiration, which is 12 days away.

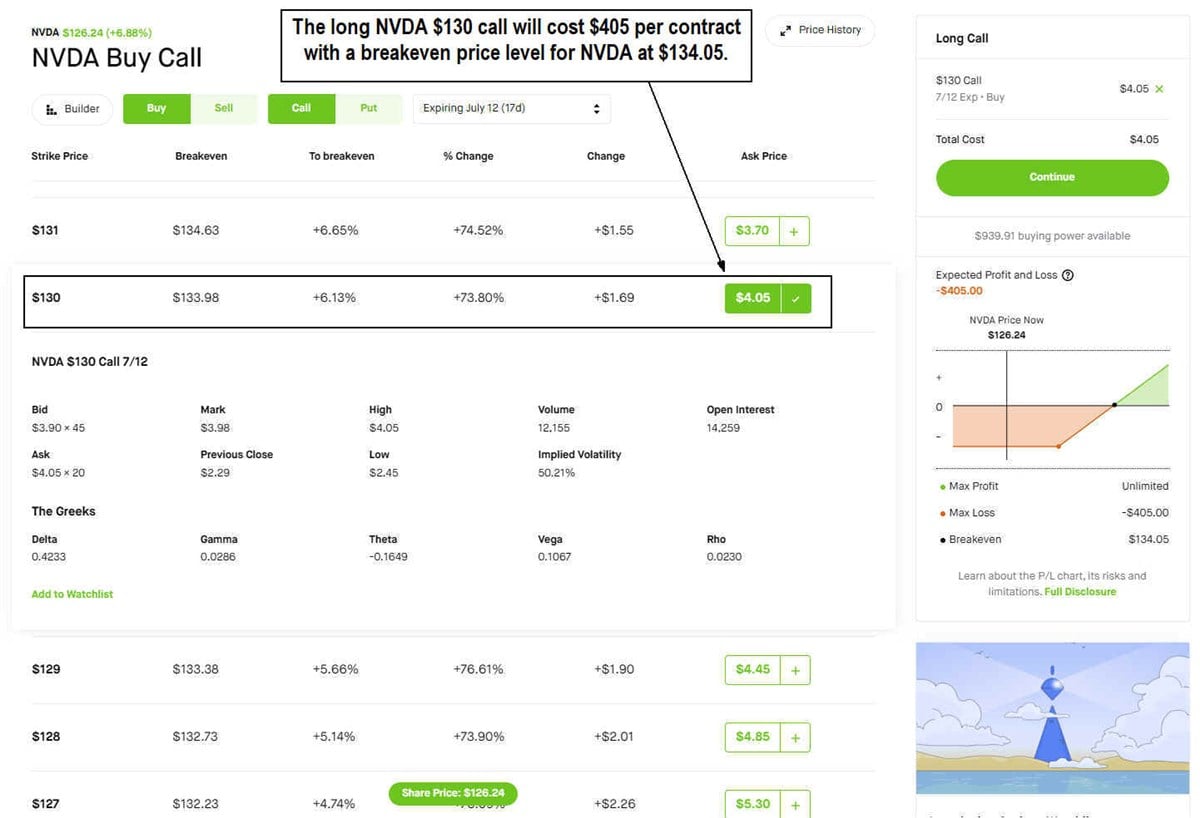

Strategy #1: Buy a Long Call Option

The simplest strategy is to buy a call option. You have to pick a strike price and an expiration date. If you want to have some intrinsic value, then you could pay more for an in-the-money (ITM) call option. If you are feeling extra bullish, you can buy an out-of-the-money (OTM) option for a cheaper price. Keep in mind that any long option, call or puts, suffers from Theta (time) decay. The longer you hold the option, the more time decay erodes the value. Theta speeds up in the final week before expiration.

A long call option rises in value as the underlying stock price rises. The NVDA $130 call option costs $4.05. This means NVDA would have to rise to $134.05 on expiration to break even. With a -0.16 Theta, the option loses 16 cents daily in value as it currently has no intrinsic value since its OTM. Of course, you don't have to hold the option until expiration. The goal of a call option is to get the largest upside in the shortest time. With a 0.42 Delta, each $1 move in the stock should result in a 42-cent move in the option.

The maximum loss is $405 if NVDA fails to close above $134.05 on expiration. The maximum profits are unlimited.

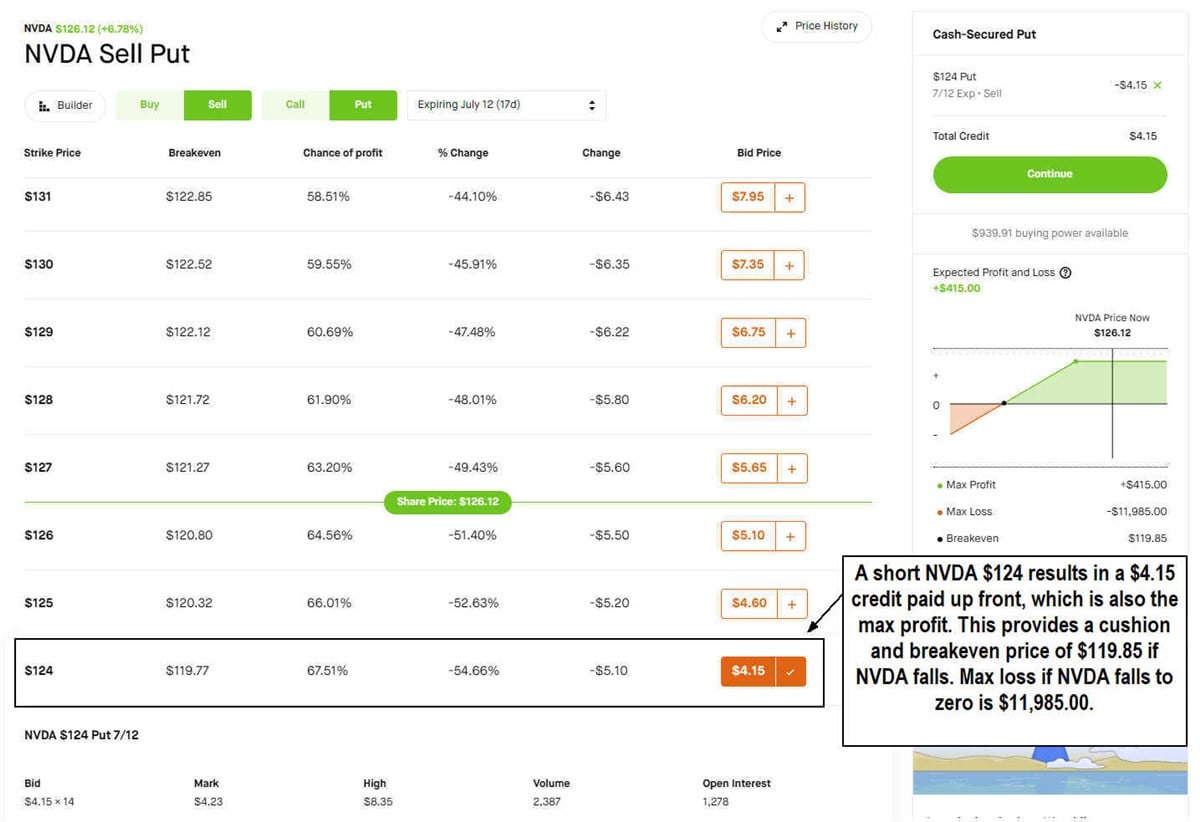

Strategy #2: Sell/Short a Put Option

This is normally called a naked put. However, it's always prudent to make it a cash-secured put. This means you have the capital to pay for the stock at the strike price if you happen to get assigned shares. Executing a cash-secured short put will result in a credit paid upfront. That is your maximum profit upfront. It can only go down from here.

A short put option falls in value as the underlying stock price rises in value. They have an inverse or negative correlation. The NVDA $124 put will pay a $4.15 premium, resulting in a $415 credit per contract. That is the maximum profit paid upfront. If NVDA continues to rise and hold above $124 upon expiration, you'll keep the whole credit. If NVDA falls, there is a $4.15 buffer to the breakeven price of $119.85. If NVDA falls any lower, that is when you will start losing money all the way to a maximum loss of $11,985 if NVDA stock falls to zero.

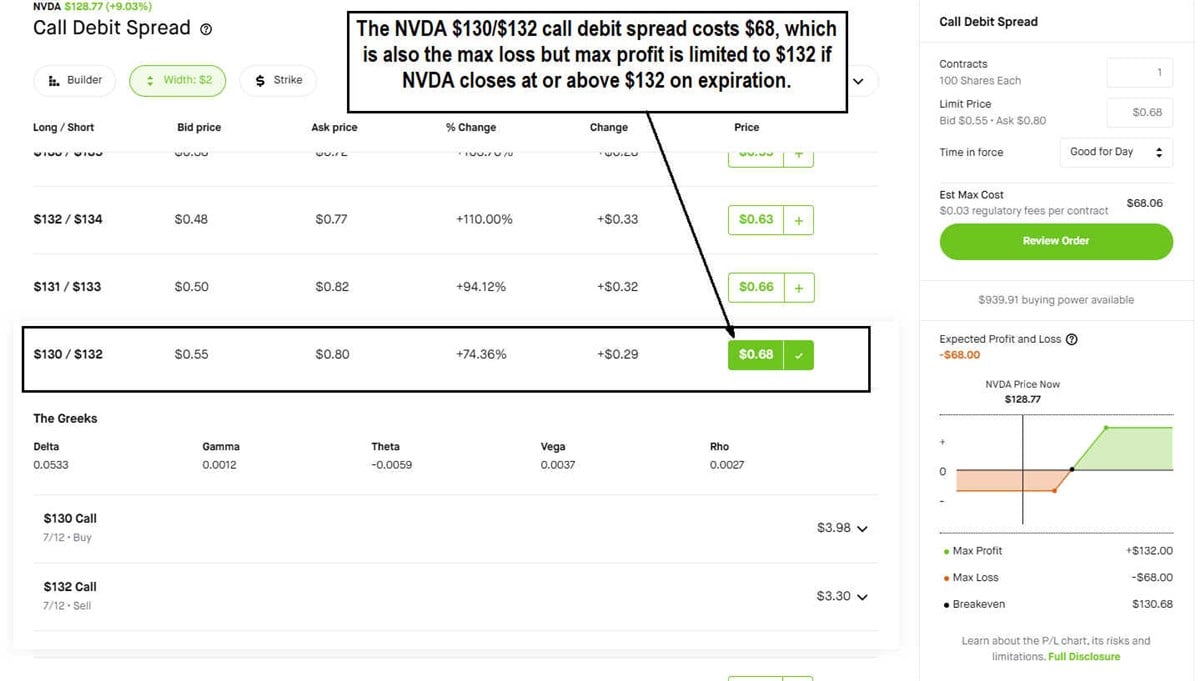

Strategy #3: Buy a Long Call Debit Spread

A long call debit spread is also referred to as a bull call debit spread or a long call spread. This is a multi-leg strategy comprised of a long-call option and a sell/short-call option at a higher strike price. It's basically a combination of Strategy #1, Long Call and Short Call option at a higher price than the Long Call. Most brokers have a function to execute a call debit spread in a single transaction, in which the platform executes the 2 trades automatically.

A call debit spread helps finance the long call, making the trade cheaper. However, the upside is limited, and the downside is also capped. This means rather than paying $4.15 for a long NVDA $130 call like Strategy #1 and risk losing $415 if NVDA fails to close above $134.15 on expiration, you can risk $68 with a call debit spread.

The call debit spread is formed by selling an NVDA $132 call for $3.30 credit. This results in a debit or cost of $68. The maximum profit of $132 occurs if NVDA rises to $132 or higher on expiration. The breakeven level is $130.38 on NVDA. The maximum loss is the $68 cost of the trade. While the upside is limited, your downside is also limited and much less than the full cost of the call option.

Determine Your Risk Comfort Level and Apply the Strategy That Fits

Each of these strategies comes with various levels of risk. The long call strategy has the potential for a full loss on the trade of $4.15 if NVDA can't close above $134.15 on expiration. While this seems like the riskiest trade, losing 100% of your investment, the short put strategy has the "potential" to lose $11,985 if NVDA drops to zero (which is highly unlikely).

However, the potential to lose more money than you put into the trade makes it the riskiest strategy of the 3. The call debt spread strategy has the least risk but that comes at the cost of limiting maximum profit. Use the strategy that fits your risk tolerance best. Remember that you can always close out your options position before expiration or roll your positions to give the trade more time to play out.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.