In last week’s stock options article, we reviewed the pros and cons of debit spreads. When you believe a stock is going higher but want to limit your downside risk and are willing to cap upside gains to spend less on the trade, then a call debit spread can be a viable choice. In the same vein, you could also consider a credit spread. This is similar to a debit spread but also very different in the mechanics. In this article, we’ll review the pros and cons of a put credit spread strategy.

What is a Put Credit Spread?

A put credit spread is also called a bull put spread or a put spread. A put credit spread strategy can be used when you believe a stock will rise. Just like a debit spread, it limits your downside risk while capping your upside gains. A major difference is that it pays you the maximum gain in the form of credit upfront and utilizes the put option instead of call options.

A put credit spread is a multi-leg trade in which you sell/short 1 higher strike in-the-money (ITM) put and buy a lower strike out-of-the-money (OTM) put.

For example, Sell 1 ABC Put at a $50 strike price and Buy 1 ABC Put at a $45 strike price. This should net you a credit, which is paid to you upfront. A credit spread takes advantage of time decay (Theta), which is your friend. This is opposite to a debit spread, where the Theta is the value you lose every day holding the position.

Example of a Put Credit Spread with INTC

Using a familiar example with computer and technology sector behemoth Intel Co. NASDAQ: INTC.

INTC's daily candlestick chart isn't very pretty. It has been falling from the $41.48 level to $35.91 in the past 11 days. The daily relative strength index (RSI) is oversold at the 30-band.

Executing the Trade

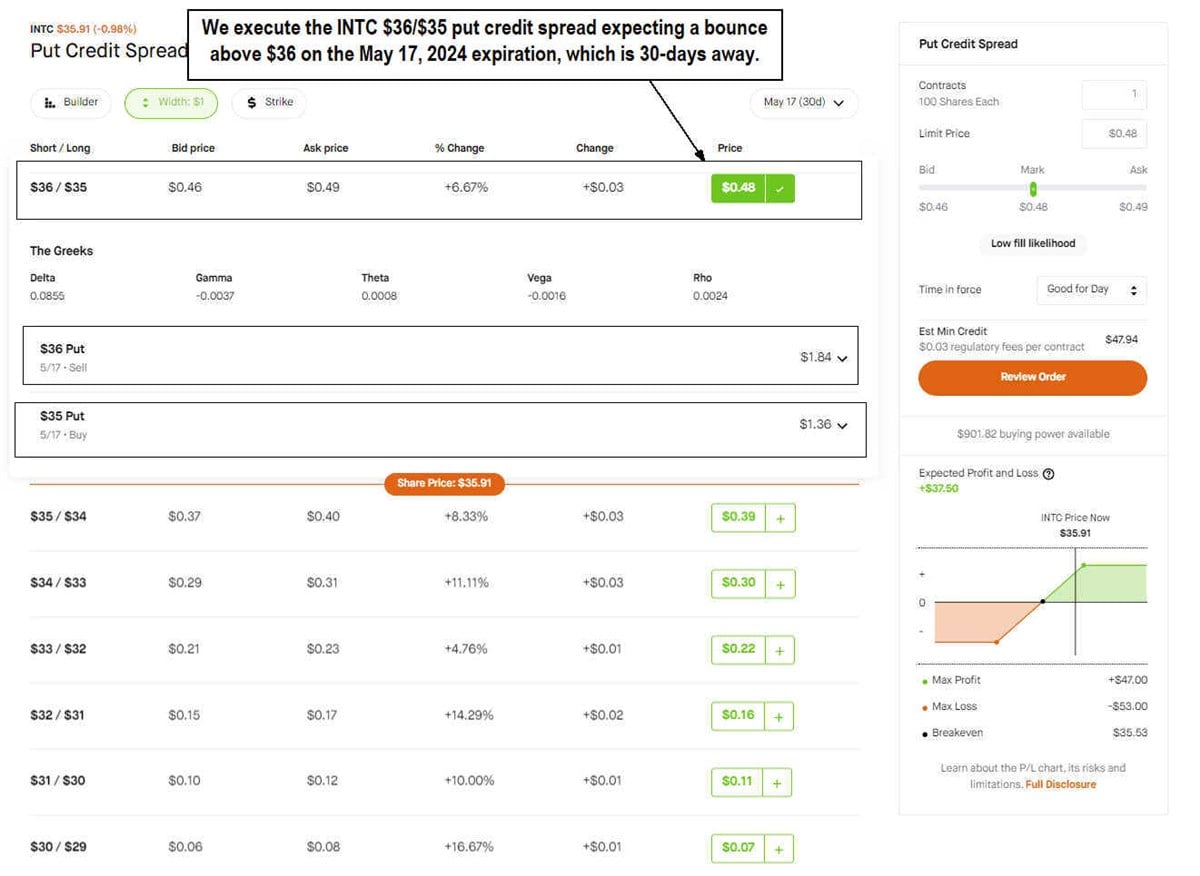

Let’s assume we are semi-bullish and expect INTC to bounce back up, especially after such an extreme sell-off. INTC stock is currently trading at $35.91. Let's assume INTC will rally back up through $36, which is only 9 cents away by May 17, 2024. The expiration, which is 30 days away, provides a beefy time premium.

To put on the trade, we select the INTC $36/$35 put credit spread for 48 cents. This is comprised of selling/shorting the $36 OTM put at $1.84 and buying the $35 put at $1.36. We receive a credit from the short put and use it to pay for the long put. This leaves a remaining credit of 48 cents, which is paid to us. This is the maximum gain on the trade paid upfront.

The Potential Outcome

Upon expiration, there are 3 potential outcomes.

The breakeven price on the trade is $36.50 for INTC.

The maximum loss is the $53, which is the credit and fees paid to you when you executed the trade if INTC closes below the $35 strike price.

The maximum gain is the $48 credit you received upon executing the trade if INTC closes above the $36.00 strike price.

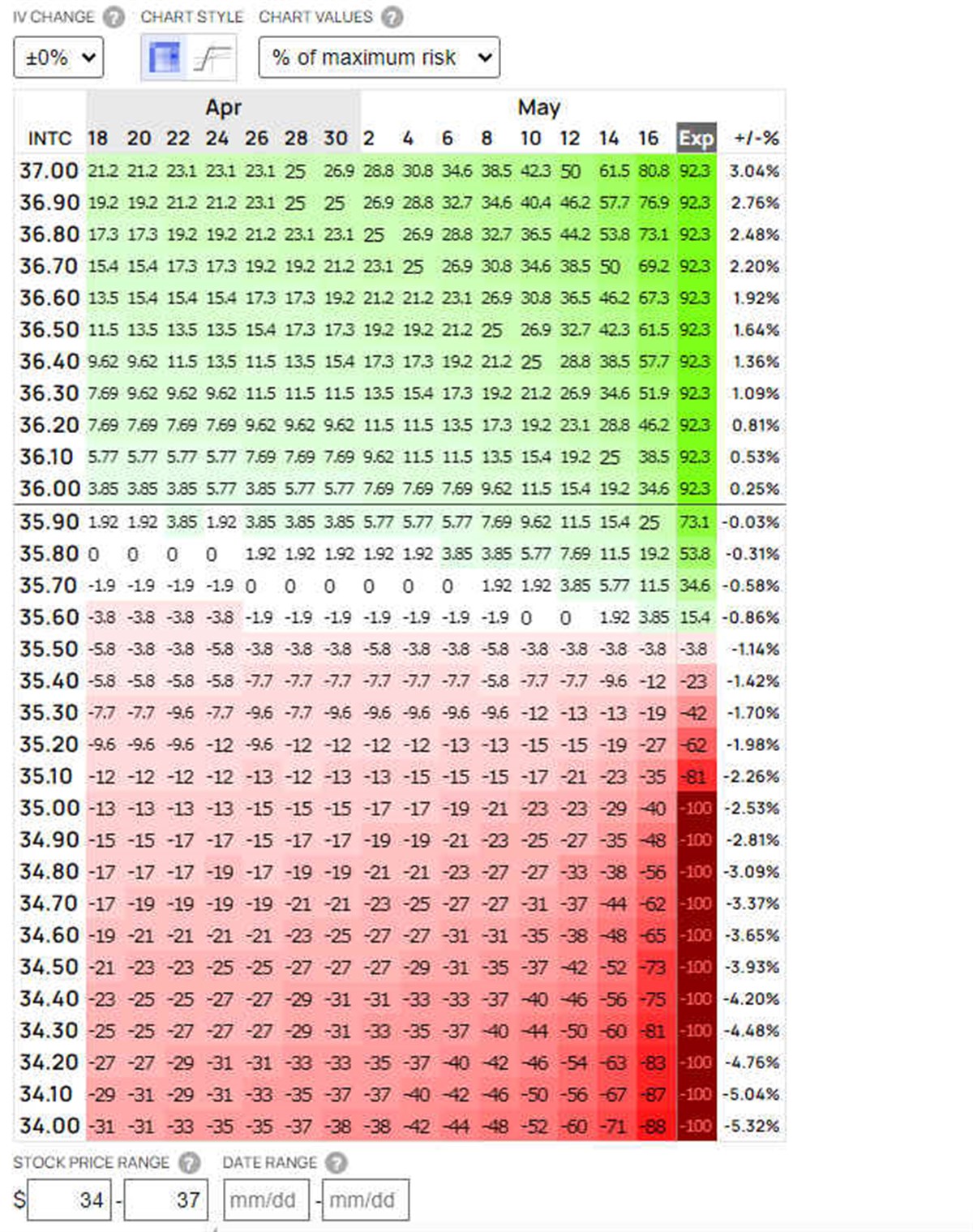

Of course, you aren’t obligated to hold the position through expiration, but remember that theta is on your side. This means you make more money for holding longer versus a debit spread where every day you hold suffers from time decay.

The Pros and Cons of Credit Spreads

Here are the potential benefits and pitfalls of trading credit spreads.

The pros are:

- Get paid upfront with a credit. Selling an ITM put option provides you with a credit that is used to pay for the OTM put option, leaving you with a maximum profit premium paid upfront.

- Benefit from high implied volatility (IV). When IV is high, then you can benefit from it by being a net seller of premium to receive a credit.

- Quantifies and minimizes your downside risk. Both your upside and downside risk are measured and limited in this strategy.

The cons are:

- The maximum profit potential is capped and is less than the maximum profit. In exchange for receiving a credit paid upfront, you will be making a little less than your maximum loss.

- The maximum loss is still 100% of the investment. If the stock falls under the lower put strike price, then you lose the whole credit and fees, which is slightly more than your max profit.

Scratch the Itch

Put credit spreads are ideal during periods of high volatility, driving up IV. Options tend to be "expensive" during these periods. This allows net sellers to take advantage of lofty premiums and receive credits. If IV is still high, you can also roll forward the trade to continue collecting premiums. Keep in mind that Theta erodes faster a week out from expiration.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.