Earnings season always comes with its share of large stock price moves that exceed 10%. Typically, a stock that beats top and bottom line estimates and raises its forward guidance tends to gap up and vice versa gap down when it lowers its forward guidance. Of course, the market can also be irrational and gap a stock even on an earnings miss and lowered guidance.

Trying to predict the direction and magnitude of a price gap can be futile. However, if you want to take that bet on a large price move in either direction, then you can use stock options to limit your risk. Namely, you may consider an options strategy called a long strangle.

What is a Long Strangle?

A long strangle is a multi-leg options strategy comprised of buying 1 out-of-the-money (OTM) put option and 1 out-of-the-money call option with the same expiration date. These positions or legs are taken simultaneously, usually through a function on your online brokerage app. If your broker doesn't have a strangle trade option, then you can place the trades manually and individually. First, you buy the put option and then buy the call option.

For example, an XYZ $50/$55 long strangle is comprised of a long 1 XYZ $55 put option and a long 1 XYZ $50 call option.

When to Consider a Long Strangle Trade

You can use a long strangle when you feel a stock will make a large move on an event or catalyst. These can be scheduled events like earnings reports, FDA advisory panel votes, product launches or legal verdicts. Determining the direction or magnitude of the price move can be unpredictable, but if you are certain the price move will be outsized by at least 10%, then you can take a measured risk with a long strangle trade.

Example of a Long Strangle on RBLX

Time for an example: a computer and technology sector, video game and platform developer Roblox Co. NYSE: RBLX.

RBLX has a history of making large price moves on its earnings report. The stock has traded in a range between $47.11 and $32.81 in its past 2 earnings reports. Predicting which way RBLX will go upon its earnings release is fruitless. The daily relative strength index (RSI) is rising to the 64-band.

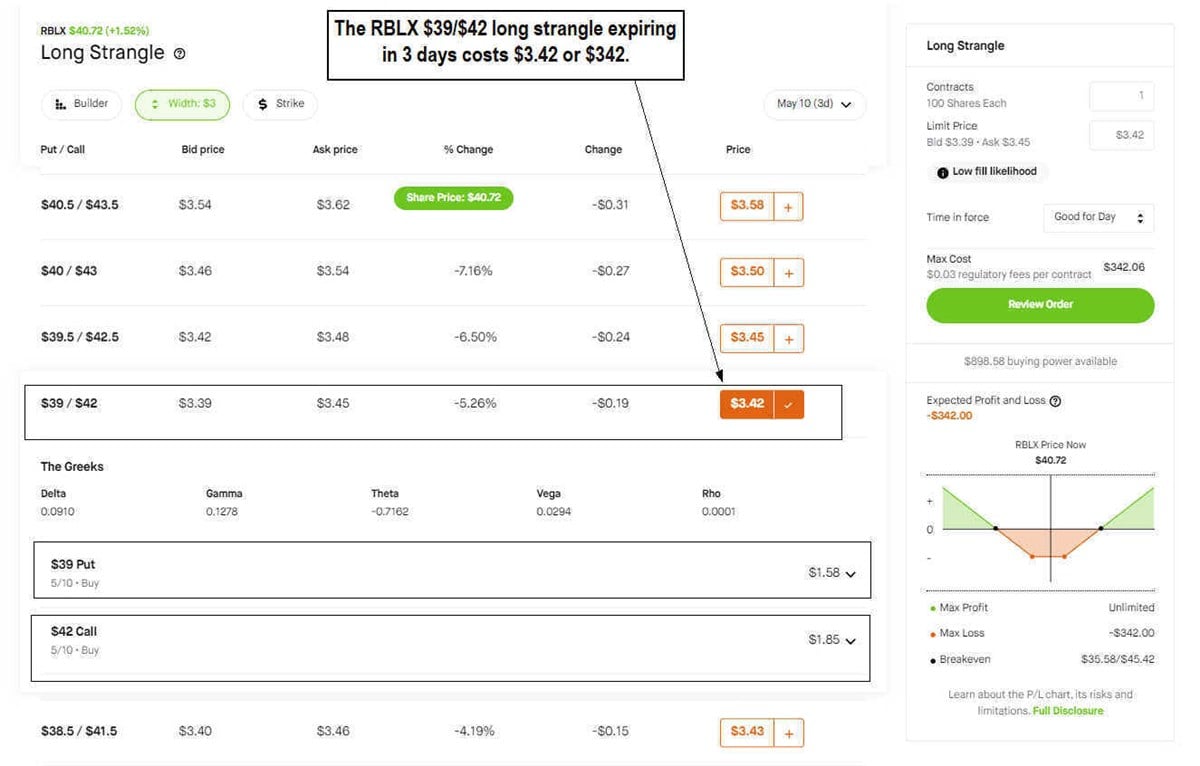

If we consider a $3 spread for a long OTM strangle, we can use the $39 to $42 range or the $39 put and $42 call. The cost of both legs needs to be added to the strike prices to calculate the breakeven levels.

Executing the Trade

RBLX is currently trading at $40.72. If we look up the RBLX $39/$42 long strangle expiring May 10, 2024, we see the $39 put is priced at $1.58, and the $42 call is priced a $1.85. The total for the 2 positions is $3.42, the cost of the trade or debit.

To execute the trade, you just click a button that will simultaneously perform both trades at the $3.42 price. If your online broker can't place one-click long strangle trades, then you'll have to manually buy the $39 put option for $1.58 and buy the $42 call option for $1.85.

The Potential Outcomes

Upon expiration, there are 3 potential outcomes.

RBLX can close at two breakeven price levels: $35.58 and $45.42. The cost of the strangle trade is $3.42. We subtract and add the cost of the trade to each option strike price to derive the breakeven price, respectively. The $39 put minus $3.42 is $35.58. The $42 call option plus $3.42 is $45.42.

The maximum loss is $342. This is the total cost for the trade. This occurs if RBLX closes between $42.00 and $39.00.

The maximum profit is technically unlimited. However, we can use the prior trading range from $32.00 to $48.00. If RBLX rises to $48.00, the profit is $257 and continues to grow as it moves higher. If RBLX falls to $32.00, the profit is $357.00, and that continues to grow as it falls further.

It’s Still a Gamble, But Measured.

The title of this article starts with "How to Bet on a Large Stock Price Move…" The key word is "Bet." Any way you slice it, a long strangle is a bet. Some people call it a gamble, while others consider it speculation since your maximum loss is contained in the cost of the trade. Long strangles are an attempt to predict a large price move, which makes them a gamble but a measured one.

Before you consider Roblox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roblox wasn't on the list.

While Roblox currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.