When you want to make a bet on a stock price move, you can use stock options for a fraction of the cost of owning the stock. However, if the stock doesn’t move far enough and fast enough in your direction, you could suffer a 100% loss on a directional trade. Options spreads enable you to gain from underlying stock price movements economically and limit your downside risk. While you don’t get unlimited upside gains, your losses will be cheaper than if you had only played a directional option.

Options spreads are also cheaper than directional options, meaning you can play more spreads at a fraction of the cost. Options spreads are a popular strategy and can be used to generate income.

The 2 Types of Options Spreads

There are two types of spreads: debit and credit. Debit means you pay upfront for the trade, and credit means you get paid your maximum gain upfront. Both types of spread can be played for an upside move, or downside move on the underlying stock. In these examples, we'll stick with bullish spreads seeking a rise in the stock price.

Debit spreads are a multi-leg strategy, meaning each spread trade comprises two options positions for the same stock with the same expiration dates. Most brokerage platforms have preset functions to create spread trades. However, if yours doesn't, you'll have to execute each leg of the spread manually.

A call debit spread consists of buying one long call option and selling one short call option at a higher strike price.

For example, you could buy one ABC call option at $55 and sell one ABC call option at $60, both expiring on the same date.

A put credit spread consists of selling one put option and buying another put option with a lower strike price.

For example, you could sell one ABC put option at $60 and buy one ABC put option at $55, both expiring on the same date. Since you get paid upfront, this is often considered an income strategy.

When to Use a Debit Spread or a Call Spread

While both a debit spread and a call spread seek the same result, profiting from a rise in the stock price, there are differences between the two that can favor one over the other.

Debit spreads can be favored when selecting an option expiration that is over 60 days away. This is due to the Theta (time decay) being less significant. Theta is not on your side when you have a debit spread, as it erodes the value of your position daily. Debit spreads are also ideal when implied volatility (IV) is low and may start rising. Low IV helps keep the option premiums relatively cheap. Since you can get the position cheaper, there tends to be more upside.

Credit spreads are favorable when your expiration is less than 60 days away. As options expiration nears, especially in the last week, Theta will erode quicker. Credit spreads benefit from time decay, enabling you to keep more of the premium credit you received upfront. Credit spreads are also indicated when IV is relatively high and starts to fall. This enables you to receive the highest premium credit upfront.

Example of Options Spreads on UBER

Let’s see an example of a debit spread and credit spread on a computer and technology sector stock, rideshare, and delivery platform operator Uber Technologies Inc. NYSE: UBER. Uber shares have been selling off due to missed Q1 2024 EPS guidance. However, the company still experienced double-digit growth across almost all metrics, from revenues to bookings to active users.

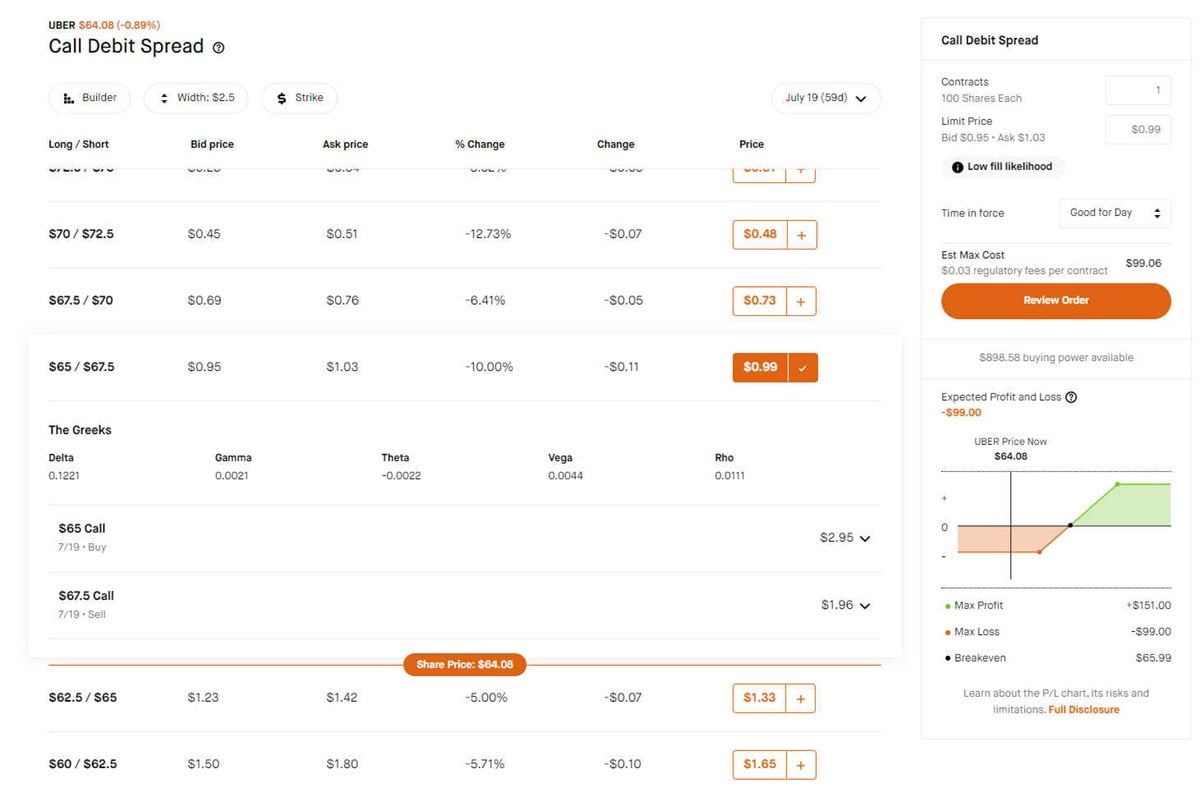

Let's assume we're bullish about UBER shares rallying after an extended selling period, which drove its relative strength index (RSI) toward the oversold 30-band level. We also assume we're expecting UBER to rally above $67.50 by the July 19, 2024, expiration, which is 59 days away. Let's see what the option spread choices are.

We can take a UBER $65/$67.50 call debit spread for 99 cents. This spread consists of a long $65 call option for $2.95 and a short $67.50 call option for $1.96, leaving a debit cost of 99 cents.

The maximum profit of $150 occurs if UBER closes at or above $67.50 on expiration.

The breakeven occurs if UBER closes at $66.00.

The maximum loss of $100 occurs if UBER closes at $65.00 or below.

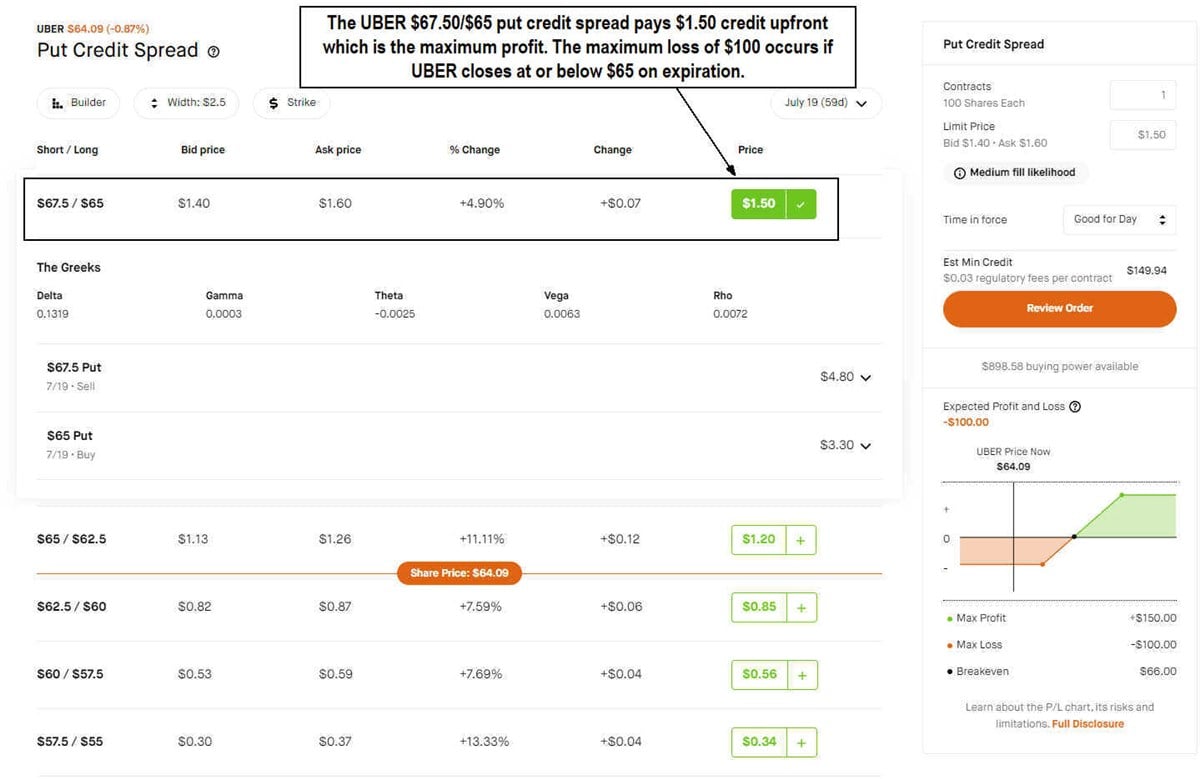

We can take an Uber $67.50/$65 put credit spread for a $1.50 credit paid to us upfront. This is comprised of a short $67.5 put option for $4.80 and a long $65 put option for $3.30, leaving a credit of $1.50 paid to us.

The maximum profit of $150 occurs if UBER closes at or above $67.50 on expiration. This was the $1.50 credit that was paid upfront to us.

The breakeven occurs if UBER closes at $66.00

The maximum loss of $100 occurs if UBER closes at $65.00 or below.

Outcomes Identical, But Not Quite

While the outcomes are identical regarding maximum profits and maximum losses on expiration, the difference can’t be seen as clearly on the surface. In our examples, the IV on UBER had fallen significantly than the day following its earnings release. Use the 50% rule with IV. If IV is above 50%, it's considered high and favors a credit spread. Suppose IV is below 50%. Then it's considered low and favors a debit spread.

In our examples, the IV had fallen to 31%. While the expirations were not quite 60 days out, the low IV favors the call debit spread, making the position cheaper to enter. The IV was much higher on the day following its earnings release, and a credit spread would have been favored based on higher premiums. However, a higher strike price would have also put the trade deeper into the red. In other words, don’t forget to do your technical analysis, and don’t always go by just the IV.

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report