While many semiconductors stocks have been huge winners over the last decade, the sector has been rife with volatility from both economic and geopolitical sources. In this article, you'll learn how to invest in semiconductors, how the industry works and where this sector will go.

Basics of the Semiconductor Industry

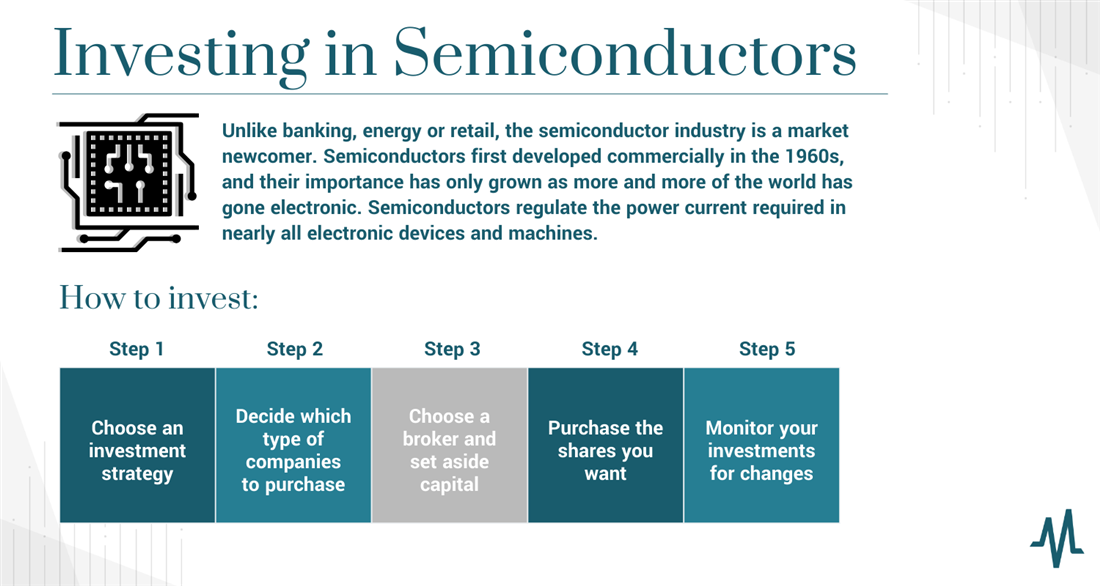

Unlike banking, energy or retail, the semiconductor industry is a market newcomer. Semiconductors first developed commercially in the 1960s, and their importance has only grown as more and more of the world has gone electronic. Semiconductors regulate the power current required in nearly all electronic devices and machines. You can find semiconductors in various household items, such as computers, phones, gaming consoles, printers and TVs. The industry is now so large it even has a lobbying group — the Semiconductor Industry Association (SIA).

You can break semiconductor companies into two main areas: designers and fabricators. A few firms, known as integrated device manufacturers (IDMs), are involved in design and fabrication. Still, these are mostly the largest companies in the sector, like Analog Devices Inc. NASDAQ: ADI, Intel Corp. NASDAQ: INTC and ON Semiconductor Corp NASDAQ: ON. Despite the growth, the semiconductor industry is relatively consolidated, and fabrication plants for the most complex parts reside only in the United States, Taiwan and South Korea.

Trends Driving the Semiconductor Industry

Investing in semiconductors is a viable strategy moving forward, thanks to advances in computer technology. However, the sector still hasn't fully recovered from the COVID-19 pandemic and supply chain issues remain. According to Deloitte, the tech sector bear market hit the industry hard, knocking nearly $1 trillion off the total market cap of the top 10 chip producers.

How to invest in semiconductor shortages? The answer might be to stick with the largest companies with the easiest time producing materials. IDMs that design and manufacture their chips can keep up with demand and maintain profit margins in the face of rising costs.

Shortages, lack of materials and increasing costs are certainly trends to be aware of when investing in semiconductor stocks. However, the industry has some tailwinds in addition to headwinds. Advances in artificial intelligence, cloud computing, virtual reality and the metaverse should all boost semiconductor sales. Remote work should also help semiconductor companies as reliable technology becomes paramount to the daily workday.

Types of Semiconductor Investments

Want to know more about how to invest in semiconductor companies? Let's get into the types of securities you can use for semiconductor investing. You can find all kinds of semiconductor equity exposure on public markets, starting with some of the world's largest and most successful tech companies.

Semiconductor Stocks

You'll have many options if you're looking for a semiconductor stock. For example, you can invest in large domestic firms like Texas Instruments Inc. NASDAQ: TXN or international manufacturers like Samsung Electronics Co. Ltd OTC: SSNLF. But for this example, let's use one of the popular MATANA stocks — NVIDIA Corp. NASDAQ: NVDA.

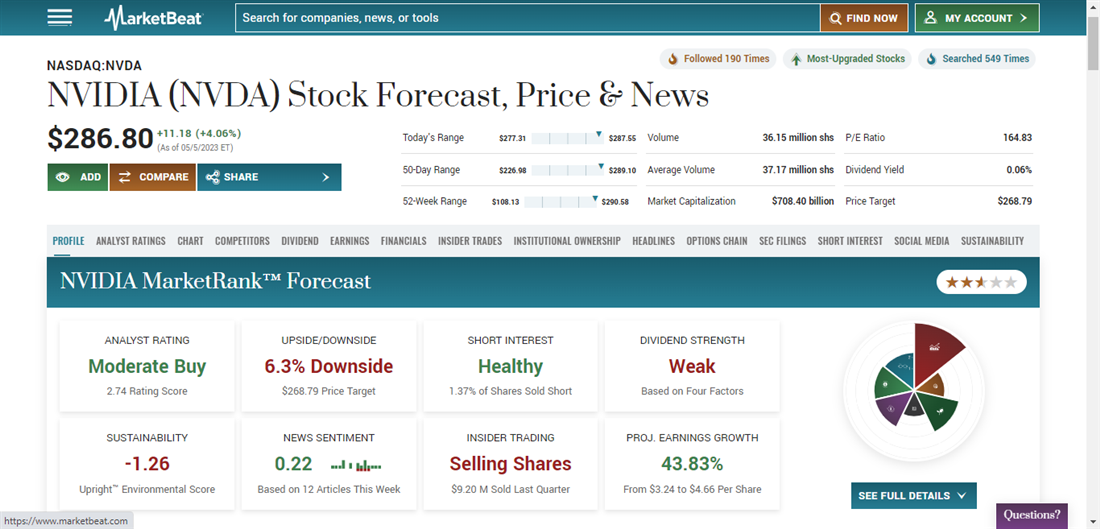

NVIDIA is one of the largest semiconductor manufacturers in the United States, focusing on gaming, artificial intelligence and graphics. It doesn't pay much of a dividend, and insiders have been selling shares, but less than 2% of the float is short and projected earnings growth is over 43%.

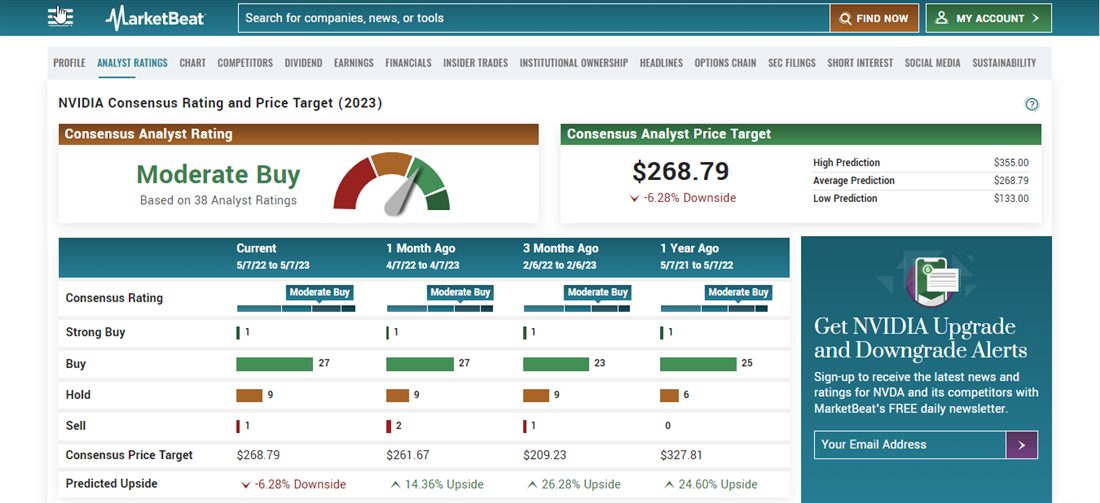

NVIDIA analyst ratings currently list the stock as a moderate consensus buy, although the current trend projects that short-term upside could be limited. The average price target is $268.79, which would drop more than 6% from the current price.

The NVIDIA stock chart has been one of the prettiest in the tech sector in 2023. Despite high inflation, supply chain headaches and political tensions in Taiwan, NVIDIA has gained more than 96% to start the year, massively outpacing the broader market. While many tech stocks remain well below their all-time highs, NVIDIA's stock is quickly approaching the $329 all-time high set in November 2021.

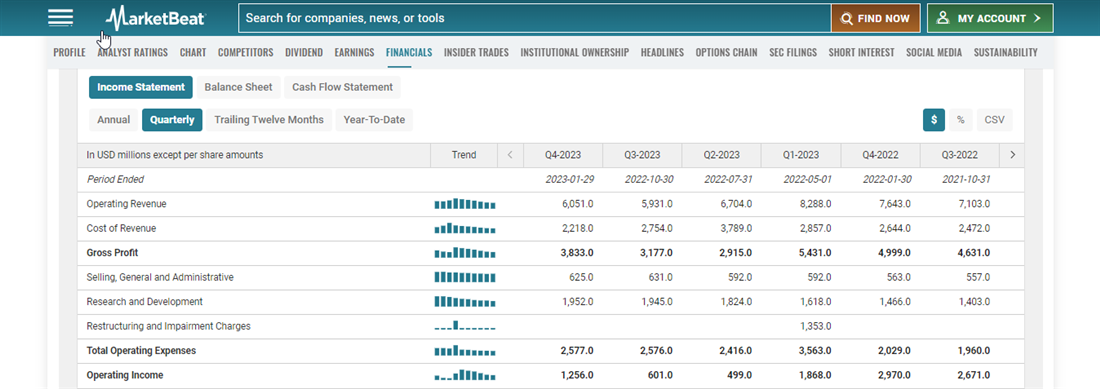

Along with the majority of tech stocks, NVIDIA's financials took a hit in 2022, especially in Q3, when gross profits dropped more than 40%. But Q4 and Q1 in 2023 saw profits rebound, and analysts projected more growth throughout the year.

Along with the majority of tech stocks, NVIDIA's financials took a hit in 2022, especially in Q3, when gross profits dropped more than 40%. But Q4 and Q1 in 2023 saw profits rebound, and analysts projected more growth throughout the year.

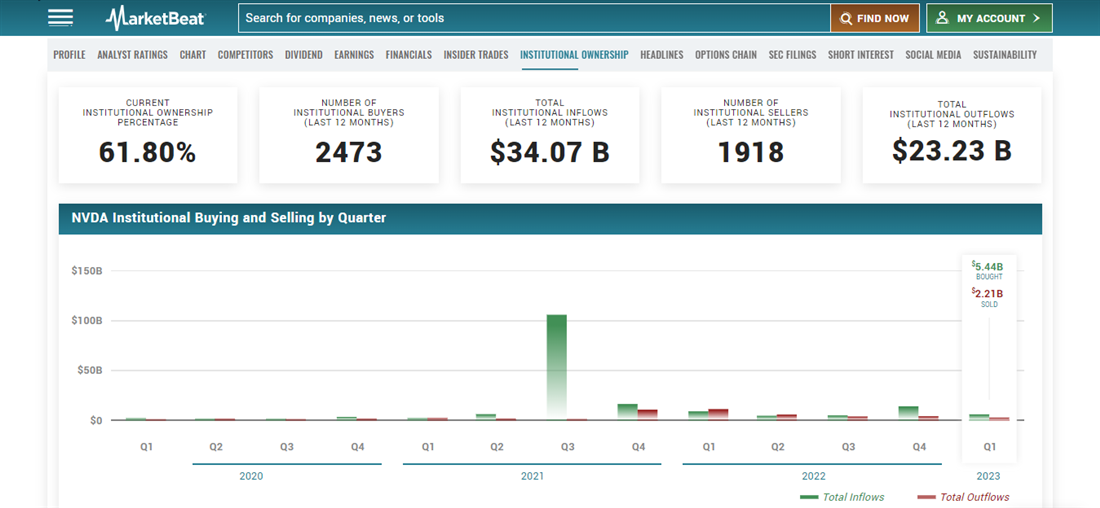

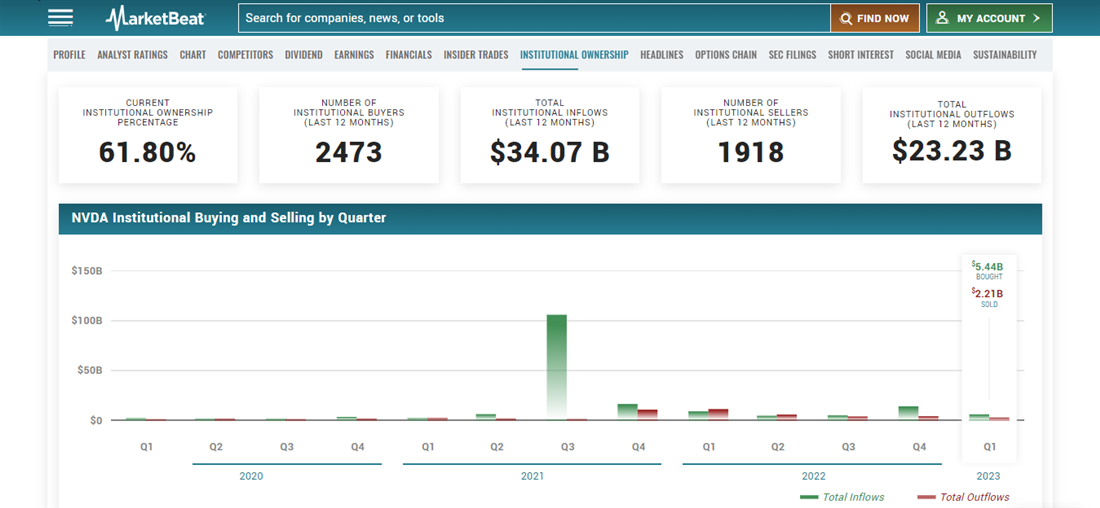

NVIDIA's institutional ownership numbers have also grown in the last three quarters following an early 2022 departure. NVIDIA's most recent quarter saw more than $5.4 billion in inflows compared to just $2.2 billion in outflows. In the last 12 months, NVIDIA's stock has seen nearly $11 billion in net inflows from institutions.

NVIDIA's institutional ownership numbers have also grown in the last three quarters following an early 2022 departure. NVIDIA's most recent quarter saw more than $5.4 billion in inflows compared to just $2.2 billion in outflows. In the last 12 months, NVIDIA's stock has seen nearly $11 billion in net inflows from institutions.

Semiconductor ETFs

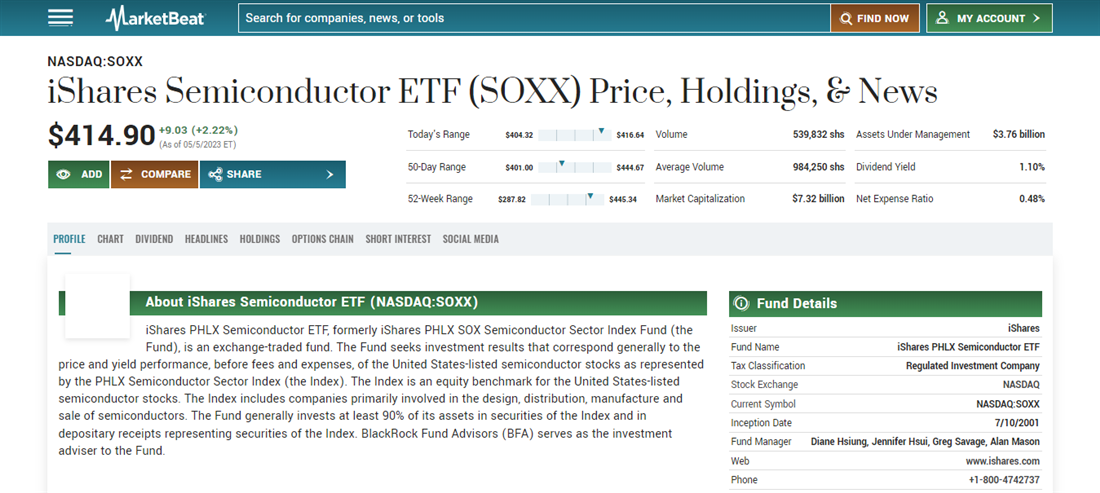

Now that we've evaluated a semiconductor stock, what about a semiconductor ETF? Investors who don't want to pick stocks can buy into the sector at-large through a few different ETFs. Some semiconductor ETFs, like the Direxion Daily Semiconductor Bull 3X Shares NYSE: SOXL, are leveraged or inverse, which may suit more aggressive traders. But most investors will likely prefer broad exposure through affordable (and unleveraged) products like the iShares Semiconductor ETF NASDAQ: SOXX.

The iShares Semiconductor ETF offers broad exposure to the industry through an index of U.S.-based equities. Like most thematic ETFs, the expense rate is higher than your typical index fund, but the ETF has plenty of liquidity and a market cap north of $7 billion. It even pays a small dividend!

The broader semiconductor space has yet to echo NVIDIA's recent success. The SOXX stock chart shows a barely visible gain over the last 12 months, while NVDA stock has risen over 50%. Despite some individual names' outperformance, supply shortages and cost inflation have kept the overall sector down.

SOXX's holdings include 70 top semiconductor companies, mostly based in the United States but with a handful of international firms. You'll recognize many top holdings as notable companies like NVIDIA, Texas Instruments and Advanced Micro Devices. SOXX works best for investors who want to focus on US manufacturers and avoid sticky geopolitical situations in Asia.

How to Find Undervalued Semiconductor Investments

Investing in semiconductors usually means diving deep into the tech sector, which isn't typically synonymous with undervalued. If you compare valuation metrics like P/E ratios or price-to-book value from the semiconductor industry to other sectors, you likely won't find anything a value investor would consider cheap.

If you want to find undervalued semiconductor stocks, you'll need to compare them to their peers in the industry. For example, NVIDIA's stock has a P/E Ratio over 160, which is usually enough to give any value investor heart palpitations. However, Advanced Micro Devices Inc. NASDAQ: AMD has a P/E ratio of 390, more than double NVIDIA's rate. Tech stocks usually look expensive, so don't compare apples and oranges in your analysis.

How to Invest in Semiconductors

Ready to learn more about this fast-paced sector? Here’s a simple 5-step guide on how to invest in semiconductors:

Step 1: Choose an investment strategy.

Your first step is always laying out your investment strategy. What types of assets do you plan on purchasing, stocks or ETFs? How long do you plan on keeping these positions open? And what kinds of negative news or price declines would cause you to exit the position early? Ensure you can answer these questions before investing capital into semiconductor stocks.

Step 2: Decide which type of semiconductor companies to purchase.

If you want to buy semiconductor stocks, what types of companies do you want to own? Are you interested in designers, manufacturers or IDMs that can do both? Large-cap or small-cap companies? What type of international exposure are you comfortable with? Semiconductor stocks vary in many ways, and investors will have different preferences for exposure.

Step 3: Choose a broker and set aside capital for your investments.

Now you'll need to pick a broker to open an account with and fund your account with capital. If you want to trade international semiconductor stocks, select a broker with access to foreign shares. Many non-US semiconductor stocks trade off major exchanges like the NYSE and NASDAQ, which is something to consider when choosing a brokerage account. Next, set aside a portion of your portfolio for semiconductor investments. This is a volatile sector, so don't put more capital at risk than you feel comfortable with.

Step 4: Purchase the shares you want.

Once you've got your account funded and portfolio planned out, you can buy your preferred semiconductor stocks. Some investors prefer to buy their shares all at once, while others like to dollar-cost average into a position over time. Both styles have their merits, so choose whichever one fits your goals and risk tolerance.

Step 5: Monitor your investments for news and trend changes.

Unfortunately, semiconductor stocks aren't "set it and forget it" types of investments. You'll need to stay on top of current events, especially any news about China and Taiwan. The sector is also extremely volatile, which makes cutting losers and adding to winners easy to think about but tough to do. Semiconductor investing isn't for those with weak stomachs.

Risks of Investing in Semiconductors

There are risks of investing in semiconductors, including risks include:

- Supply shortages: The pandemic wreaked havoc on semiconductor supply chains, and many companies are still recovering from disruptions. Lead times for certain products are still clocking in at over 52 weeks in some areas.

- Rising prices: Current supplies are dwindling, and new chips are becoming more expensive to fabricate due to rising component costs. Only some companies can minimize these costs or pass them on to customers.

- Geopolitical instability: Taiwan is a large hub for semiconductor manufacturing, but the rivalry between China and Taiwan (and the United States by proxy) is something to monitor in the coming years. Warren Buffett recently said he's more comfortable investing in Japan than Taiwan due to this political rivalry.

Future of Investing in Semiconductors

Winners and losers will undoubtedly emerge, but this sector's long-term outlook can make investors irrationally exuberant. According to the Journal of Engineering Science and Technology Review, total semiconductor sales are expected to exceed $700 billion by 2027. AI, cloud computers, metaverse apps and other technological advances can only help expand the market for faster chips and more efficient systems.

However, semiconductor stocks are always volatile, and the industry rapidly changes. Additionally, geopolitical concerns between China and Taiwan could add to the short-term unpredictability of this sector. We're going to need semiconductors. That fact isn't in doubt.

But where do we get them from?

That answer is a little more hazy.

Semiconductor Stocks: Expect Volatility Along the Way

Semiconductors play a huge role in our everyday lives, and there's no sign of change anytime soon. These chips don't just power computers and video game consoles anymore.

Phones, watches and even cars require semiconductors, some of which are getting increasingly more intricate. But political tensions overseas could disrupt a volatile industry, and supply shortages remain a constant focus. Despite the hype, investors looking to get into semiconductor stocks must still perform their due diligence.

FAQs

Here are a few frequently asked questions about investing in semiconductors:

Are semiconductors a good investment?

Semiconductor stocks are volatile but had terrific results following the COVID-19 crash in 2020. However, semiconductors were hit hard in 2022 and suffered losses greater than the S&P 500. Growth prospects are strong, but investors in this space must be able to handle the ups and downs.

How do you invest in semiconductor stocks?

You can invest in individual semiconductor stocks like NVIDIA, AMD or Intel. Or you can buy semiconductor ETFs, which purchase a basket of companies in the sector based on certain themes like market cap or region.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...