Interested in learning more about how to invest in virtual healthcare and telehealth? Read on to learn more about the best telemedicine stocks and how these companies provide value to customers and investors.

Overview of telehealth and telemedicine

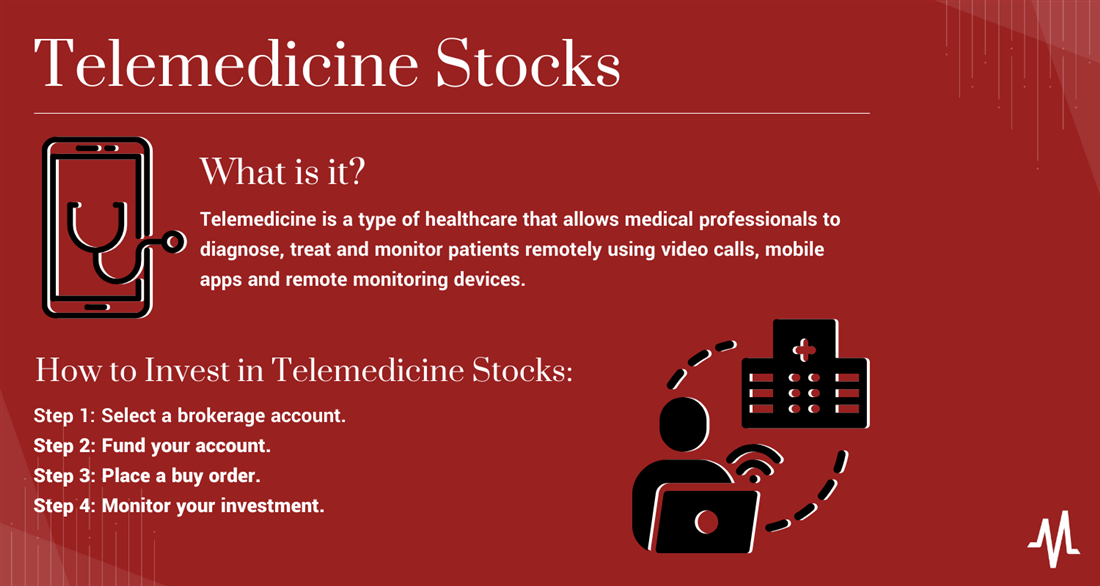

Telemedicine is a type of healthcare that allows medical professionals to diagnose, treat and monitor patients remotely using video calls, mobile apps and remote monitoring devices.

It allows patients to receive medical care from the comfort of their own homes or remote locations, which can be particularly useful for individuals living in rural areas or with disabilities that make mobility more difficult. An example of telemedicine services could include a psychiatrist meeting with a patient and refilling a prescription using video chat services rather than a physical appointment.

Telemedicine services have become increasingly popular recently, particularly due to the COVID-19 pandemic. The highly contagious nature of the pandemic forced medical providers to avoid in-person consultation, directly leading to increases in telemedicine companies' stock prices. Governments around the globe also responded to the infectivity of the virus by relaxing regulations around the use of telemedicine, leading to its expansion.

Why invest in telemedicine?

Investing in telemedicine offers investors unique exposure to the rapidly-changing healthcare sector. Many government regulations that relaxed during COVID-19 are still in place around the globe, meaning telemedicine is likely to be more than a passing phase.

COVID-19 has also shown the importance of telehealth services in remote areas, improving patient-provider relationships through more frequent monitoring and follow-ups. These factors can potentially produce returns for investors with exposure to stocks from MarketBeat's best medical stocks list using telemedicine services.

Key players in the telemedicine industry

To better understand the telemedicine industry, let’s look at a few key players shaping virtual health's future.

- Teladoc Health Inc.: Teladoc Health Inc.NYSE: TDOC is one of the largest and most important players in the telemedicine industry, with a total market capitalization of more than $3 billion in December 2023. Its best-known product is its Better Help remote mental healthcare platform, which became popular during the 2020 COVID-19 pandemic shutdowns. Using Better Help, mental health patients can access more affordable therapy and counseling services.

While Teladoc Health’s cash and equivalents have remained relatively stable through 2020 and beyond, its stock price has fallen by more than 90% from its all-time high value of more than $291 in February 2021.

This correction is likely related to returns to in-person medical and psychiatric care services during this time. However, negative press, including data leaks and the sale of sensitive data, have also contributed to a depressed stock value. While these developments suppressed the value, Teladoc’s acquisition of Livongo Health could present opportunities for investors — especially with the stock's recent EPS of more than $24 per share.

- Hims & Hers Health Inc.: More commonly known simply as “Hims,” Hims & Hers Health Inc.NYSE: HIMS is another successful telehealth start-up that has entered mainstream online healthcare. Hims is known for its online platform that offers a range of products and services related to men's and women's health. The company aims to provide more accessible and affordable healthcare solutions, offering products that support everything from mental health to skincare. Its virtual platform allows users to connect with health professionals to discuss prescription options without needing an in-person visit.

Like Teladoc Health, Hims initially saw a major boost in share value during the pandemic, as stocks offering medical services virtually saw an inflated boom. Today, analysts rank Hims as a "moderate buy," which can present new opportunities for growth investors when combined with its sub-$10 share price.

- Doximity Inc.: Doximity Inc. NASDAQ: DOCS is a unique telehealth and healthcare technology company that operates as a professional network for physicians. Founded in 2010, Doximity has created a platform that connects medical professionals, allowing them to collaborate, share medical knowledge and communicate securely. Enhanced encryption and messaging permissions limit patient information to relevant parties. For example, the platform may allow a renal expert to send test results to a patient's primary care physician without leaving a phone message.

In December 2023, Doximity had a total market capitalization of about $4.6 billion, making it one of the largest telemedicine networks to receive HIPAA approval. However, the company recently released earnings and saw a P/E ratio of more than 42, indicating that the price of each share could be overvalued at almost $25.

Technological innovations shaping telemedicine

Evaluating and keeping up with how technology is changing in the telemedicine sphere is crucial for healthcare investors. Patient information has always been considered sensitive data, with the federal Health Insurance Portability and Accountability Act (HIPAA) establishing clear boundaries on who can access patient health information without the patient's immediate consent.

These laws were introduced in 1996, meaning that the vocabulary in the bill does not cover virtual communications, especially those between healthcare professionals. Additionally, the rise of online crime and illegal data collection and sale present ongoing concerns to companies that offer telemedicine services. Those companies that can leverage the latest tech to provide more convenience to customers while adhering to privacy laws and keeping data safe are likely to see growth in valuation.

Some of the most cutting-edge trends investors see in the telemedicine sphere as 2024 approaches include the following.

- Artificial intelligence (AI): While AI has been making waves with companies like ChatGPT, its also being used to revolutionize the telemedicine industry by providing optimized treatment plans and improving diagnostics accuracy. AI-powered algorithms analyze vast datasets to identify patterns and trends, helping the machinery in the early detection of diseases that the human eye could miss. Telemedicine platforms also integrate AI-driven chatbots to engage patients and streamline data collection, allowing medical professionals to focus on more complex care needs.

- Internet of Things (IoT): The IoT plays a pivotal role in telemedicine by connecting medical devices and wearables, enabling continuous remote monitoring of patients. These interconnected devices, which may include smart wearables and sensors, collect real-time health data and transmit it securely to healthcare providers. This monitoring is particularly valuable for patients with chronic conditions, allowing healthcare professionals to intervene promptly if any anomalies are detected. This also helps the physician avoid more frequent check-ins in person, which can help them devote more time to patients showing care needs in their data sets.

- Virtual reality: You may have played a video game that involved virtual reality (VR) — but what if the same technology could be leveraged to provide patients with a more immersive consultation? In telehealth consultations, VR can simulate physical examination settings, offering a more interactive and detailed experience. VR is also utilized for therapeutic purposes, such as pain management and rehabilitation.

For example, VR technology has been introduced in the field of exposure therapy for treating anxiety-related disorders, such as phobias and post-traumatic stress disorder. VR allows therapists to create controlled, immersive environments that simulate the situations or stimuli that trigger anxiety in patients without their being any real threat. For instance, a therapist might use VR to recreate scenarios like flying in an airplane or being in a large group of people. Patients can then engage with these virtual environments in a gradual and controlled manner, allowing them to confront and manage their fears in a therapeutic setting.

Balancing the use of technology with HIPAA compliance and data security is an ongoing challenge for telemedicine companies and one that you should investigate as an investor before purchasing shares.

How to invest in telemedicine stocks

Now that you understand how telehealth stocks work, you can begin considering your investment options. The following are the basic steps you'll go through when investing in some of the best telehealth and top-rated biotech stocks on MarketBeat.

Step 1: Select a brokerage account.

If you still need to get a brokerage account, you'll need to open one before you can start buying and selling items from Marketbeat's best medical stocks list. Consider factors like account minimums, trading tools and market availability when selecting a broker to work with. MarketBeat's list of the top brokers can be a great place to start your research if this is your first time opening a trading account.

Step 2: Fund your account.

After submitting your personal information, your broker will approve and open your account. You'll usually link and confirm your funding method before accessing full account functionality. Depending on the broker you're working with, you can fund your account using a direct bank transfer, wire transfer or debit card.

Step 3: Place a buy order.

Once your account is open and funded, you can begin exploring stock options on the markets your broker offers. In later sections, we'll cover a few of the top telemedicine stock players, but you may also want to explore the best pharmaceutical stocks on MarketBeat before investing.

After selecting a company to invest in, search for its telehealth stock symbol using your brokerage account and place a buy order. Novice investors may want to use their brokerage account's limit order functionality to lock in their telehealth stock price paid per share when the order closes.

Step 4: Monitor your investment.

If your broker can close the order according to your instructions, you'll see the shares in your account. Be sure to keep an eye on the value of your investments and how they're changing to reach your financial goals.

Top telehealth and telemedicine stocks to buy

Now that you have a functional account, it's time to explore the best telehealth and telemedicine stock options available in major markets.

Teladoc Health Inc.

Teladoc Health Inc. NYSE: TDOC provides telemedicine services, including virtual visits with doctors and specialists, mental health counseling and chronic condition management. Its platform connects patients with licensed healthcare providers through phone, video or mobile app, allowing patients to receive medical care from the comfort of their own home.

Teladoc Health has experienced significant growth in recent years, and its services are now available to patients in over 175 countries. In 2020, the company announced plans to merge with Livongo Health, a leading provider of digital health management solutions for chronic conditions. The merger completed in 2020, creating a combined company that provides virtual care, remote monitoring and personalized health management services.

Hims & Hers Health Inc.

Hims & Hers Health Inc. NYSE: HIMS is a telemedicine company that offers virtual consultations and prescriptions for various health and wellness issues, ranging from erectile dysfunction to acne. Patients can sign up for the service online and complete a medical questionnaire. They get matched with a licensed healthcare provider who can diagnose and prescribe medications if necessary.

Hims & Hers was founded as a direct-to-consumer telemedicine company. Investors looking for native options may want to consider Hims & Hers. In May 2023, the company showcased a total market capitalization of more than $2.5 billion.

CVS Health Co.

CVS Health Co. NYSE: CVS is best known as a drugstore and pharmacy service provider — you might even pick up your prescriptions in person at this giant. However, it has also made multiple strides in its telemedicine services since 2020. The company's telehealth services, offered through its subsidiary, MinuteClinic, provide virtual consultations and in-person care for primary, urgent and specialty care services.

In addition to its telehealth services, CVS Health has invested in digital health and remote patient monitoring. The company's HealthHUB locations offer various health and wellness services, including virtual consultations with healthcare providers, chronic condition management, and remote patient monitoring. The HealthHUBs provide patients with personalized care that is convenient, accessible and affordable. If you're an investor looking for a blue-chip potential stock purchase, CVS could be a stronger choice.

UnitedHealth Group

Another major name in healthcare, UnitedHealth Group NYSE: UNH has been investigating how to add telemedicine to the list of benefits its policyholders enjoy. UnitedHealthcare now offers various telemedicine services to its members, including virtual consultations with doctors and remote monitoring for patients with chronic conditions.

In addition to offering telemedicine services to its members, UnitedHealthcare has also launched its telemedicine platform called "24/7 Virtual Visits." Virtual Visits allow members to connect with healthcare providers for virtual consultations through a HIPAA-compliant mobile app or website. The platform provides convenient and safe healthcare access, even in areas where UnitedHealth does not operate.

GoodRx Holdings Inc.

GoodRx Holdings Inc. NASDAQ: GDRX is a tech-forward company that helps consumers compare drug prices and save money. GoodRx's team partners with pharmaceutical and health insurance providers to offer lower rates on prescription medications. GoodRx is not a telemedicine company, but its platform can be seen as complementary to telemedicine services, as both aim to provide consumers with greater access to affordable health services.

Doximity Inc.

A persistent concern of telemedicine is HIPAA compliance and patient information confidentiality. Medical professionals increasingly demand secure software to share sensitive patient information and collaborate with other care providers. Doximity Inc. NASDAQ: DOCS is an online messaging service provider that provides medical professionals with enhanced security when transmitting and storing patient data. It provides secure messaging, electronic faxing and video chat services.

Pros and cons of investing in telemedicine

Before continuing to explore telemedicine investing options and the best pharmaceutical stocks on MarketBeat, consider both the pros and cons of investing in this healthcare realm.

Pros

Telemedicine is a rapidly growing market that should continue to expand in the coming years, offering opportunities for investors.

- New developments and market expansion: While COVID-19 proved the power of telemedicine, the cost-saving benefits and improved convenience for consumers may compound demand for these services from health insurance and care providers.

- Increased access to healthcare: Telemedicine can be used to improve access to healthcare services for patients who live in remote areas. It may offer future expansion potential for companies heavily invested in remote care services, especially when combined with relaxed regulations.

- Improved patient-provider relationships: The convenience of telemedicine services can make it easier for patients and service providers to connect and review test results, feedback and more. It may lead to improved patient health service outcomes and stronger investor returns.

Cons

While the convenience of modern technology is a major benefit to both patients and care providers, it comes with security and confidentiality compliance challenges.

- Regulatory changes: The use of telemedicine in the future is still up in the air, as privacy advocacy groups look to roll back leniency in laws introduced during COVID-19. For example, multiple states have reduced the ability of telemedicine service providers to extend new prescriptions, which was previously allowed when in-person visits were suspended during the pandemic. New restrictions or reductions in virtual medicine service availability will almost guarantee reductions in telemedicine stock values.

- Privacy and security concerns: Telemedicine involves transmitting sensitive patient information, and there are concerns about the security of electronic medical records and the potential for data breaches. Poor cybersecurity could lead to a costly lawsuit for publicly traded companies, resulting in investor loss.

- Technical problems: Telemedicine relies on technology, and technical issues such as connectivity problems or software glitches can disrupt the delivery of care and potentially impact patient outcomes. This may be a particularly persistent problem in rural areas, where telemedicine is most needed.

Future of telemedicine and investment strategies

As the population of the United States continues to age, telemedicine presents significant opportunities for healthcare service providers to make the patient-provider connection more accessible than ever before. Telemedicine should expand its scope beyond traditional virtual consultations to include a broader range of healthcare services, particularly to assist seniors with mobility issues. This includes combined remote patient monitoring and digital therapeutics, which offer a more comprehensive and holistic approach to healthcare delivery.

Telemedicine should extend beyond traditional healthcare settings to unconventional places such as workplaces, schools and even in-home care. For example, colleges and universities have been introducing virtual telehealth options for students, offering more convenience with a busy schedule. This broader reach can also facilitate early intervention, increased use of preventive care and increased access to medical services for individuals facing geographical or logistical barriers.

As an investor, it’s important to recognize and plan for the risks of investing in telemedicine. As a developing field, regulatory changes are likely to impact share prices — and while smaller companies focused entirely on telemedicine services might serve as great growth stocks, they may also show more volatility. Use these stocks to complement a fully diversified portfolio, and remember that major healthcare ETFs will also provide exposure to telehealth stocks without shouldering as much risk.

Investing in the future of telemedicine

When considering the future of telemedicine and its potential, keep the healthcare industry's regulatory structure in mind. While technology has infiltrated every area of our daily life, ranging from dating to completing work tasks, telemedicine, by definition, requires sharing patient health information over a virtual communication network.

Telemedicine can leave investors liable for losses in a major data breach or client information loss. Be sure to review security protocols before making a major investment in a telemedicine-focused company.

FAQs

Ready to learn more about the best pharmaceutical stocks in 2023? The following are some last-minute questions that you might have about telehealth stocks.

What is the best telehealth stock to buy?

The best telehealth stock to buy might vary depending on your investment goals. For example, if you're looking for a native telemedicine stock, Hims & Hers Health could be a great option. If you're a long-term investor looking for blue-chip, established investment options, CVS could be a better choice.

Is telemedicine a good investment?

Investing in telemedicine can be a good idea for some investors, especially those interested in growth. Telemedicine may remain an important component of the world's healthcare infrastructure, leading to rising stock prices. However, it's important to know that no investment opportunity offers guaranteed returns, especially when investing in a single company's shares of stock.

What is the biggest telemedicine company?

Teladoc Health is currently the largest telemedicine-focused company, with a total market capitalization of over $4 billion.

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.