Embarking on an investment journey? Why not start with something you're passionate about? Whether you are a parent or just young at heart, investing in toy stocks can offer a delightful and potentially profitable venture. Keep reading to learn more about the world of publicly traded toy companies. By the end of this article, you'll be well-equipped to make savvy investment choices in prominent U.S. toy brands.

An Overview of the Toy Industry

The toy industry encompasses a broad range of products such as board games, video games, collectibles, and puzzles. Leading retailers include companies like Walmart Inc. NYSE: WMT and Target Co. NYSE: TGT who are pivotal in the distribution of toys across the nation.

In this sector, you'll find firms focused on video games like Electronic Arts Inc. NASDAQ: EA and Take-Two Interactive Software Inc. NASDAQ: TTWO, as well as classic toy manufacturers such as Mattel Inc. NASDAQ: MAT and Hasbro Inc. NASDAQ: HAS. Innovators like Funko Inc. NASDAQ: FNKO and giants like Walt Disney Company NYSE: DIS also significantly shape this market.

The collective market capitalization of these companies surpasses $600 billion, showcasing their substantial presence in the investment landscape.

Why Invest in Toy Stocks?

Toy stocks can function as long-term investments or as part of a seasonal trading strategy. These stocks may experience price fluctuations in response to new product launches and cyclical sales patterns, presenting opportunities for profit.

Engaging with types of stocks that pique your interest can simplify the process of monitoring market changes, making well-known toy retailers appealing for sustained investment. Accessible brands like Mattel and Hasbro, with their smaller market caps, are listed among MarketBeat's best low-priced stocks. Larger retail chains extend their product offerings beyond toys, providing a cushion against the risks of investing in single toy firms.

How to Gain Exposure to the Toy Industry

Companies in this sector can be involved in the manufacturing, distributing, or marketing of toys and the materials that make them. Investing in multiple areas of the wide-reaching toy market can provide you with more extensive market exposure. Let's take a look at four ways you can access the toy industry.

1. Traditional Toy Manufacturers

Decades-old toy companies continue to produce beloved items like dolls, action figures, and board games, aiming to foster creativity and social skills among children.

2. Video Game Developers

The video game sector is one of the most dynamic segments of the toy market, continuing to evolve and innovate as consumer tastes change. This massive audience, combined with the advent of digital-only game downloads, has caused an explosion in video game companies entering the market.

3. Electronic Toy Developers

These companies blend traditional toys with cutting-edge technology, enhancing their interactive appeal. These toys often include educational gadgets as well as dolls, and action figures electronically enhanced with sensors, lights, and sounds.

4. Toy Retail Giants

Major retailers such as Amazon.com Inc. NASDAQ: AMZN and Costco Wholesale Corporation NASDAQ: COST not only offer an extensive array of toys but also provide added services like assembly and delivery. If you want even more diversification, consider a major retail ETF such as SPDR S & P Retail ETF NYSE: XRT.

How to Invest in Toy Stocks

Once your brokerage account is up and running, follow the below guide to make an investment in the toy market.

Step 1: Compare Stocks

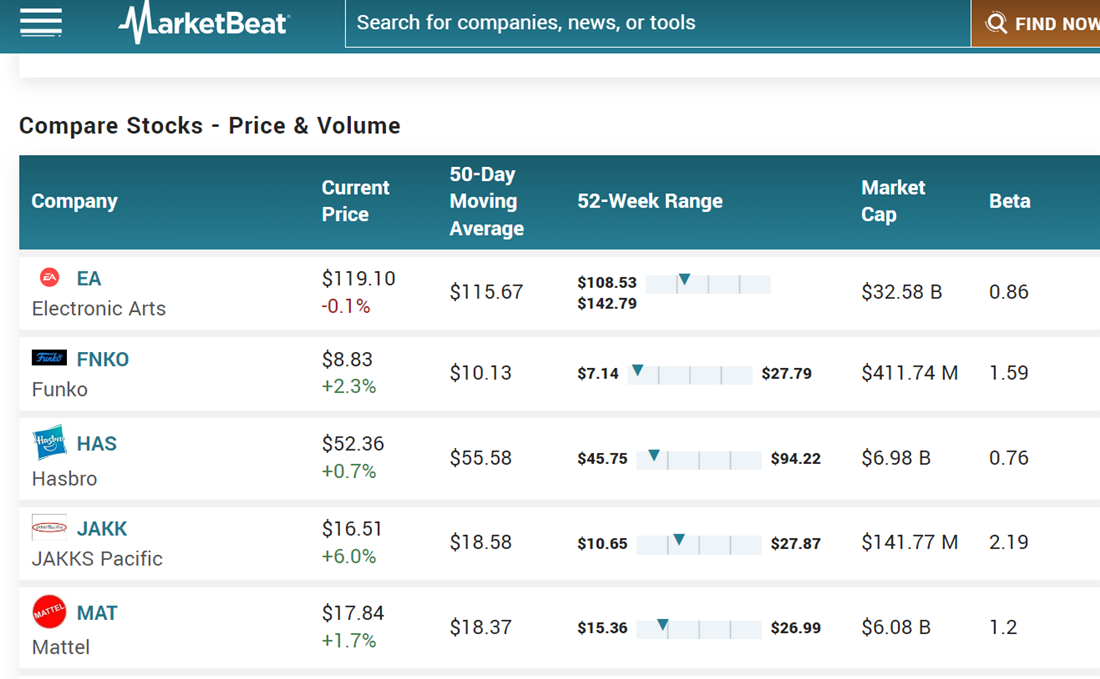

Begin by comparing stocks, focusing on solid financials, insider holdings, and MarketRank to pinpoint promising investments.

Step 2: Execute an Order

Once you have chosen a stock, place a buy order through your brokerage account. Many investors use limit or market orders while learning the ropes of the market.

- Market order: A market order is an order to buy or sell a security right away. It does not guarantee the execution price but does guarantee that it will be executed.

- Limit order: A limit order means you’ll buy or sell a security at a specific price or better.

Step 3: Monitor Your Investment

Keep up-to-date with your stock's performance and company earnings reports, as well as the toy industry's competitive and regulatory landscape. Utilize the tools available through your brokerage accont to help you, and consider enabling automatic dividend reinvestments for stocks that offer dividends.

Pros and Cons of Toy Stocks

Investing in toy stocks brings the potential of seasonal gains and diversification but also includes risks like long-term price fluctuations and supply chain disruptions. Employ tools such as the MarketBeat dividend calculator to gauge expected returns.

The Future of Toy Stock Investments

Anticipate further integration of technology in traditional toys and expansion into digital spaces through streaming services and virtual reality. As we already see, toys are now being marketed by influencers and through popular social media channels. The way the industry shifts into the digital age through modeling toys after popular media is rapidly expanding and will likely only continue the trend of merging physical and digital goods.

FAQs

Let's take a look at some frequently asked questions about toy stocks.

Which toy company is the most profitable?

Although many toy companies are profitable, large retailers such as Walmart and Target typically achieve higher returns due to their vast distribution networks.

Who are the leading toy manufacturers?

Key players include Hasbro, Mattel, and Disney, renowned for their extensive and popular product ranges.

Who are the major players in the toy industry?

In addition to traditional manufacturers, prominent forces in the toy industry include video game developers and large retail distributors.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.