When you believe a stock will rise, you can leverage a trade with stock options. Notably, taking call options is the obvious choice. After all, call options rise when the underlying stock price rises. However, if the stock doesn’t rise but instead falls, the call options can lose value fast with a risk of 100% loss. Additionally, every day you hold the call options, you will value from Theta (time decay).

In a prior article, we reviewed how to use put debit spreads to profit from falling stocks. In this article, we'll review the opposite play of using put credit spreads to profit from rising stocks. It's only fitting that we cover strategies for shorts and longs on both sides of the coin.

What is a Put Credit Spread?

A put credit spread is also called a bull put credit spread, bull put spread or a short put spread. While long puts are associated with falling stocks, short puts are the opposite. Since this is a credit spread, it will provide your maximum gain up front with a credit to your account. It can only go down from there.

A put credit spread is comprised of a higher strike short put and a lower strike long put with the same expirations. Wider spreads between the strike prices equate to larger maximum profits.

For example, an ABC $55/$50 put credit spread is executed in 2 trades: sell short 1 ABC $55 put option and buy long 1 ABC $50 put option.

Example of a Put Credit Spread with INTC

Time for an example using computer and technology sector giant Intel Co. NASDAQ: INTC.

INTC shares have been punished by another weak earnings report and lowered guidance. Shares crumbled towards that $30 support level. INTC has been a falling knife. Taking call options for a bounce may be too risky, especially on a falling knife, no matter how oversold it appears. To minimize the risk, we suggest executing a put credit spread strategy. This will limit our maximum loss potential.

Executing the Trade

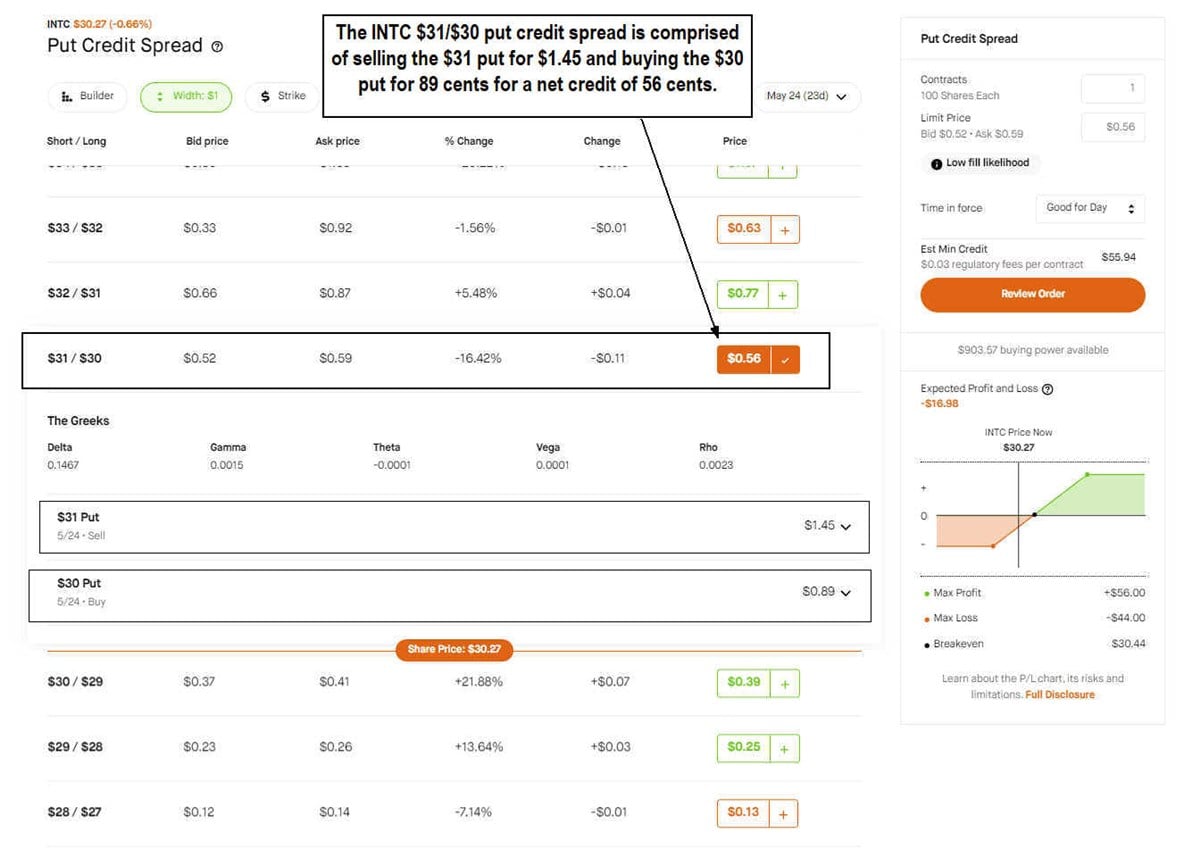

INTC is trading at $30.27. We chose the May 24, 2024, expiration date which is 23 days away. We can select the INTC $31/$30 put credit spread for 56 cents. Remember, the wider the spread between the strike prices, the more maximum profit potential. Of course, the probabilities also drop proportionately. Your online broker will likely have the ability to select a put credit spread trade, which will automatically perform both legs (short $31 put and long $30 put) simultaneously. If not, then you’ll have to execute them manually.

The 56-cent price is the difference between the short sell of $31 put for $1.45 and the long $30 put for 89 cents. The $1.45 would be credited to your account, and then the 89 cents would be debited back out, leaving you with a 56-cent or $56 maximum profit credit in your account to start.

The Potential Outcome

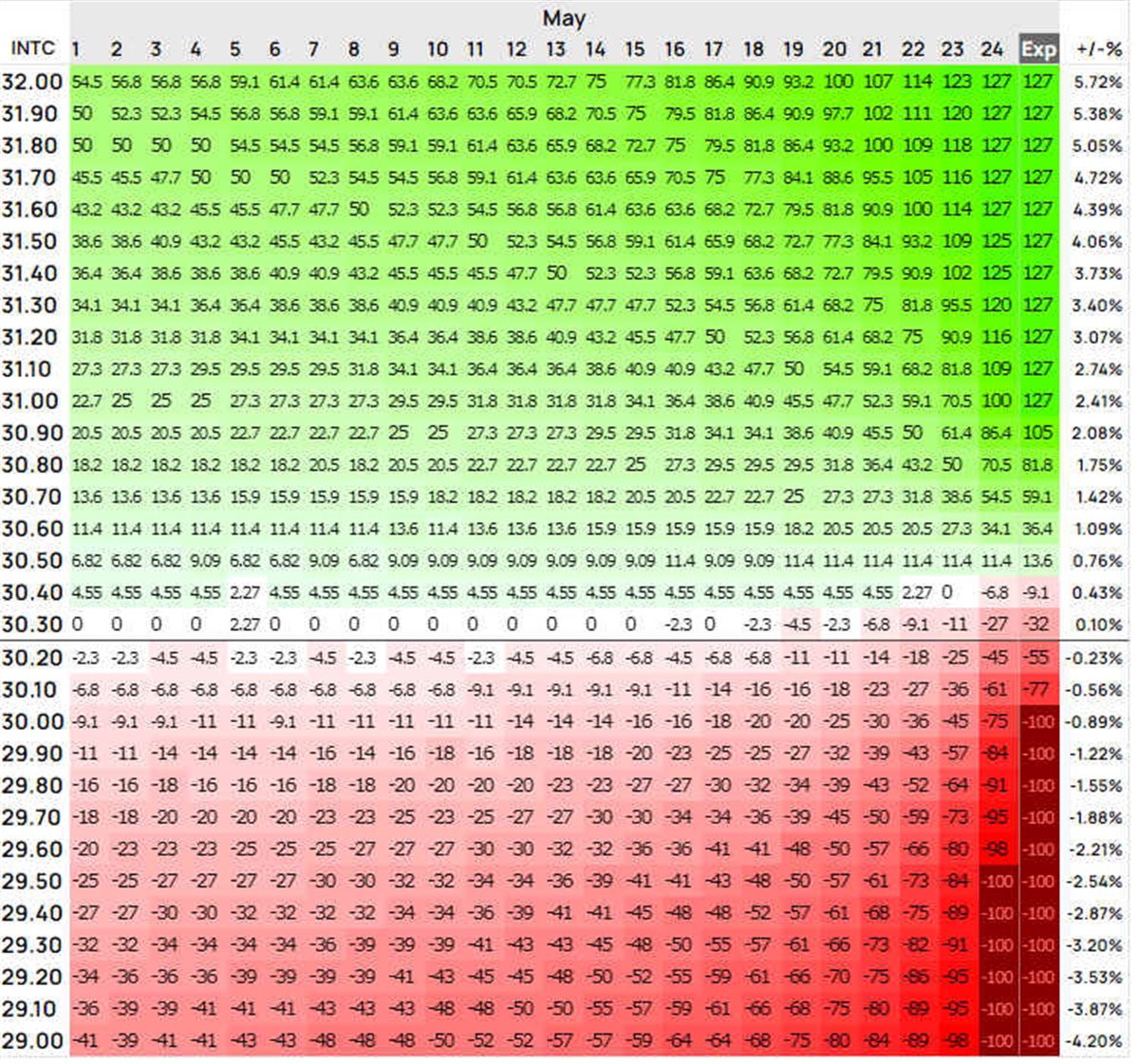

Upon expiration, there are 3 potential outcomes.

The breakeven price on the trade is $30.44. This is derived from the $1.00 spread between the strike prices minus the $56 credit.

The maximum loss is $44 if INTC closes at or below the $30 strike price of the long put.

The maximum gain is $48 if INTC closes at or below the $31 short put strike price. If the number sounds familiar, it’s because that’s the credit amount that we received went we put on the trade.

While there are 24 days until expiration, we are free to close out the trade anytime. Remember, Theta is our friend. The longer we hold the position, the more we gain daily from time decay working in our favor.

The Pros and Cons of Put Credit Spreads

Here are the potential benefits and pitfalls of trading put credit spreads.

The pros are:

- Maximum loss is capped. Like any spread trade, the max loss is capped by taking the opposite side of the trade (IE, long INTC $30 put) in the event the trade moves against you. It's especially important when you're selling short options.

- Enables you to take riskier trades for a measured gain or loss. Catching a falling knife can be a painful and costly endeavor. By using a put credit spread, we have limited our losses in case we're dead wrong on the direction, and INTC continues to sink lower.

- Cheaper than taking a long call option. If we were to take a $31 call option expiring on May 24, 2024, it would cost us a debit of 71 cents or $71.

- Get paid a credit upfront. A credit spread enables you to receive the maximum profit up front in the form of a credit. It can only go downhill from there, but it's nice to be up in the account.

The cons are:

- The maximum profit and loss are capped, as is the maximum gain. You'll see this when you execute the trade since it gets credited to your account. You can't make any more money unless you remove the long put option leg. However, this takes away your hedge.

- The maximum loss is still 100% of the investment. If INTC falls under $30, then your maximum loss is triggered at 44 cents or $44. While it's still a 100% loss, it's much smaller than a directional long $31 call trade.

Free to Be a Knife Catcher.

While it’s often shunned to catch falling knives, reversals are most profitable when you can catch them near the lows. You can minimize your exposure by using a bull put credit spread instead of going all in on long calls. If you need more time for the trade to play out, then you can also roll forward the trade to buy more time.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.