Learning how to invest in lithium could be a central investment theme for 2023, and it's a good idea to know how production occurs and where you can use it. In this article, you'll learn how to use lithium in various industries, which companies mine and produce and how to add exposure to this vital mineral to your portfolio (including how to buy lithium stock).

What is Lithium?

While battery production is one of lithium's core uses, it's a versatile mineral in many industries. Lithium belongs to a family of metals known as alkali, which are highly flammable and must be handled and stored with care. On the periodic table, lithium's symbol is "Li," and it has the least density of all elemental metals.

Lithium has many different uses. Lithium-ion is used in the fabrication of rechargeable batteries, making it a crucial commodity for electric vehicles, mobile phones and all kinds of electronics. Lithium also fabricates ceramic glazes and glass, high-temperature lubricants and chemical polymers. The pharmaceutical industry even uses lithium salts in bipolar and antidepressant medications.

Mining companies must extract and refine lithium from the Earth to produce lithium. Miners can extract lithium from hard rock or a more liquid substance called brine. As you might assume, this process taxes the environment, so ESG funds exclude many lithium mining company stocks. Additionally, critics of lithium mining cite water and land contamination as threats to local ecologies. There are also concerns about recycling dead batteries and the intense consumption of resources required in the mining process.

Lithium mining is centralized in a few global locations, most notably the lithium triangle of Argentina, Chile and Bolivia. In addition, China and Australia also have significant operations on lithium deposits. With lithium demand expected to only increase over the next decade, investors should have opportunities to invest in lithium stocks, not just for the production of the mineral but also improvements to the mining and extraction process.

How Lithium Prices Work

Lithium trades less often than other commodities like oil, gold or silver. If you're looking for the price of lithium on your brokerage app or investment tracker, you likely won't have much luck. Unlike metals such as gold, there's no universal consensus on a single lithium price. Lithium mined in South America could vary from the lithium spot price published in Asia. Since prices can differ depending on the market, investing directly in lithium can be tricky (and risky).

Investors who want to invest in lithium mining companies' stocks can trade lithium futures in a few different places. For U.S. investors, the CME Group allows the trading of lithium futures contracts. Contracts are based on the spot price of lithium hydroxide monohydrate in North Asia (China, Japan and South Korea). Commodity pricing information provider Fastmarkets Inc. works with the London Metals Exchange (LME) to maintain the spot price as accurately as possible. However, you should still use caution when trading lithium futures.

Ways to Invest in Lithium

So how to invest in lithium? You can add lithium to your portfolios in different ways, whether through stocks, ETFs or derivatives like options and futures. You'll need to decide the best way to manage risk when investing in lithium company stocks or derivatives. ETFs are the safest way to invest in the sector. Only invest in options or futures contracts if you have experience with derivatives.

Stocks

Stocks with lithium exposure spread across a few different market sectors. Indices tracking lithium stocks often contain miners, electronics manufacturers and materials producers. Some of the more notable companies in the lithium mining field include the North Carolina-based Albemarle Corporation NYSE: ALB, Sociedad Química y Minera de Chile SA NYSE: SQM and Lithium Americas Corporation NYSE: LAC.

If you're looking for lithium exposure, you'll have domestic and international options for their portfolios, although data for miners in China can be challenging.

ETFs

If you don't want to pick stocks for your lithium investments, you can purchase a basket of companies through exchange-traded funds (ETFs). Investors have quite a few options for ETF investments, although the holdings tend to overlap, so pay attention to each fund's expense rates. The three largest lithium ETFs by market cap are the Global X Lithium and Battery Tech ETF NYSEARCA: LIT, the Amplify Lithium and Battery Technology ETF NYSEARCA: BATT and the WisdomTree Battery Value Chain and Innovation Fund BATS: WBAT.

LIT is the largest and most liquid lithium ETF but carries the highest expense rate. ETFs are an ideal investment choice for those seeking lithium industry exposure but don't have the time to research different stocks and monitor them closely.

Futures

Futures contracts are derivatives used to bet on the future price of a commodity, currency, stock or other assets. To trade lithium futures, you'll need access to a futures exchange like CME Group and an understanding of how these derivatives function. Lithium prices are notoriously fickle since a global spot price is difficult to agree on. As a result, futures trading is always risky, even with less volatile commodities like gold or oil. Lithium prices fluctuate wildly, so novice investors likely won't want to dive into futures.

Options

Options are contracts that derive value from an underlying stock or ETF. When you buy an option, you acquire the right to purchase (or sell) a specific security at a previously agreed-upon price. Call options give investors the right to buy, while put options give them the right to sell. All options have a strike price (i.e., the price at which the contract gains intrinsic value) and an expiration date.

Options are far more volatile than common stocks since each option entitles the owner to 100 shares should the strike price be reached. But options can be risky investments since contracts expire worthless if the strike price isn't reached. Trading options based on lithium company stocks is speculative — only seasoned traders should tackle it.

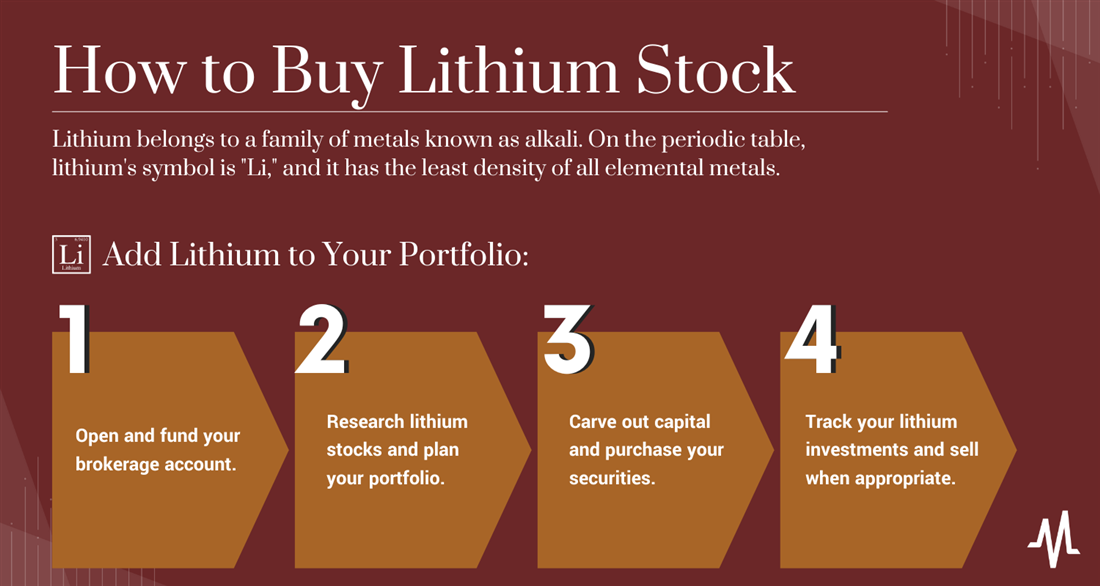

How to Add Lithium Stocks to Your Portfolio

Follow this simple guide for crafting your lithium-infused portfolio. Some lithium companies' stocks trade over the counter on the OTC markets, so make sure your broker has these shares available before planning your portfolio construction.

Step 1: Open and fund your brokerage account.

To build a portfolio of lithium stocks, you'll first need some capital and a broker. Most prominent lithium companies have stocks located on major brokers, but certain international firms trade through American Depository Receipts (ADRs) or on the OTC markets.

Research your brokerage options and use the platform that best suits your investing goals. For example, if you're looking to speculate through options or futures contracts, you'll likely need a different broker than an investor who wants to invest in common stocks and ETFs.

Step 2: Research lithium stocks and plan your portfolio.

Once you've established and funded a brokerage account, you'll need to research stock and plan a portfolio. Lithium companies may have a place in a diversified portfolio, but it's a volatile sector, and you want to avoid any specific industry absorbing too much of your capital.

How you build a portfolio depends on your goals and risk tolerance. For instance, are you looking for investment opportunities in a specific field or product, such as EV charging companies? Do you want a handful of potential winners or broad exposure through an ETF? And what about domestic vs. international companies? Once you've chosen a path, plan a portfolio with securities that can guide you.

Step 3: Carve out some capital and purchase your securities.

An investment plan is a must-have for anyone buying stocks, even if your goal is simple speculation. Select a percentage of your capital and use it to buy your preferred securities, whether you choose stocks, ETFs or derivatives like options and futures. Your investment plan should contain your goals and rules about when to buy and sell. Prudent planning removes the urge to trade impulsively; emotional investing can cause you to lose money. Technical analysis is often helpful when searching for ideal entry and exit points in your stock investments.

Step 4: Track your lithium investments and sell when appropriate.

Many fortunes have been made by simply sitting back and letting compound interest work, but lithium investments are based on a volatile commodity and require more stringent monitoring. Volatile stocks like lithium companies' stock could crash into your investment parameters quicker than anticipated, so abide by the buy and sell rules developed in your investment plan. Following the procedure will allow you to cut losing stocks quickly or add to your winners.

Lithium Demand is Robust, but Risk Management is Key to Investment

Lithium is one of the world's most coveted metals thanks to its versatility in rechargeable batteries, industrial processes and pharmaceutical development. Plus, with electric vehicle usage on the rise and governments pushing for more renewable energy, lithium should be a popular investment theme well into the next decade.

But despite the ramp-up in usage and value, lithium remains a volatile and controversial mineral for investments. Lithium mining is a dirty and expensive process, outstripping the environmental hazards of fracking.

Lithium price volatility can be extreme and different regions may report different spot prices. Investments in lithium producers today could pay off in the future, but investors need to manage risk and expectations, especially in the near term.

FAQs

Still trying to decide about buying lithium stocks? Here are a few frequently asked questions about lithium investments. Always perform ample due diligence when investing in an unfamiliar field, industry or commodity.

How do I buy lithium shares?

You can buy shares of lithium mining, battery producers or even pharmaceutical firm companies. Investors can also trade lithium futures contracts on exchanges like CME Group or the London Metals Exchange. The type of security you buy should reflect your risk tolerance, research and asset allocation.

Is it worth investing in lithium?

Lithium is a valuable mineral with plenty of practical uses. Investments in lithium mining companies and ETFs could prove profitable, but the price is prone to volatile fluctuations and the extraction process is expensive and time-consuming. Therefore, determine the risk and reward potential of any security influenced by the price of lithium.

What are some tips on investing in lithium?

To invest in lithium, you'll need to evaluate your risk tolerance first. Determine how much volatility you can tolerate and build a portfolio based on these parameters before you buy lithium stock. Next, since it's a volatile commodity, be careful not to devote too much capital to lithium investments. Finally, follow a rules-based buying and selling system, so emotions don't cloud your judgment.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...