But what about the industry's potential for investment? Investing in restaurant stocks can be a rewarding experience, providing an opportunity for diversification and potential long-term growth.

However, as with any investment, risks are involved, and it's essential to conduct a thorough analysis before investing your hard-earned money.

Let's look at how to analyze dining stocks, from evaluating a company's financials and market position to assessing growth potential and competitive advantages. If you're a beginner or intermediate investor, our guide will provide the knowledge you need to choose the best restaurant stocks. Let's dive in and discover the tasty potential that restaurant stocks can offer.

Trends in the Restaurant Industry

The restaurant industry constantly evolves, and keeping up with the latest trends can be critical for investors. Let's take a look at seven key trends shaping the industry today. These trends can help identify well-positioned companies to succeed in the future.

Healthier and More Sustainable Menus

The trend toward healthier and more sustainable menu options is not only a reflection of changing consumer preferences but also an opportunity for restaurant industry investors. As more consumers become health-conscious and seek healthier menu options, companies offering these dishes may be well-positioned for growth and profitability.

One way to spot this trend in the restaurant industry is by looking at the menu offerings of different companies. Restaurants focusing on healthier and more sustainable menu options may include dishes that are plant-based, gluten-free or made with locally sourced ingredients. Companies incorporating sustainability practices into their operations, such as reducing food waste or using eco-friendly packaging, may also be aligned with this trend.

Investors may also want to consider the potential market for these menu options. According to our research, nearly two-thirds of consumers say they are more likely to visit a restaurant that offers healthy menu options. In addition, the global plant-based food market should reach $74.2 billion by 2027, indicating significant potential for growth in this industry segment.

The trend toward healthier and more sustainable menu options is a crucial consideration for investors in the restaurant industry. By identifying companies aligned with this trend and having the potential to capture market share in this growing segment, investors can make more informed investment decisions in this sector.

Delivery and Takeout

The restaurant industry's trend toward delivery and takeout has been growing steadily. It has only accelerated with the rise of food delivery services like DoorDash Inc. NYSE: DASH, Grubhub NYSE: GRUB and Uber Eats NYSE: UBER. This trend has become more critical for the restaurant industry as consumers seek more convenience and flexibility in their dining options. In fact, according to a report by the National Restaurant Association, 60% of consumers say they order delivery or takeout at least once a week.

The delivery and takeout trend presents challenges and opportunities from an investor's perspective. On the one hand, restaurants not equipped to handle delivery or takeout may need help to compete in today's market. In contrast, restaurants adapting to this trend can capture additional market share and increase revenue.

Investors can spot this trend by analyzing a company's financial reports and their delivery and takeout sales. Companies that have invested in their delivery and takeout infrastructure, such as developing their own app or partnering with a third-party delivery service, may be well-positioned to take advantage of this trend. Additionally, investors can look for companies with effective delivery and takeout sales growth, indicating they are meeting consumer demand in this area.

The trend toward delivery and takeout is an important consideration for investors in the restaurant industry. By identifying companies that can adapt to this trend and have the potential to capture market share in this growing segment, investors can make more informed investment decisions in this sector.

Ghost Kitchens

Ghost kitchens, virtual kitchens or cloud kitchens are a rapidly growing trend in the restaurant industry. These facilities operate as commercial kitchens where multiple stock restaurants can prepare meals for delivery and takeout without having a traditional dining area. In recent years, the demand for food delivery has increased significantly, and the ghost kitchen concept allows restaurants to meet this demand without the expense of opening a traditional brick-and-mortar location.

For investors, the ghost kitchen trend represents a significant opportunity as it allows restaurants to operate at a lower cost while still meeting the growing demand for delivery and takeout options. Additionally, the concept is highly scalable, allowing restaurants to expand their delivery services without needing a physical storefront, which can be expensive.

To spot this trend, investors can look for news articles and press releases announcing partnerships or collaborations between restaurants and ghost kitchen providers. Investors can also examine the financial reports of restaurant companies to see if there is a shift towards more delivery and takeout sales. As the demand for food delivery continues to increase, ghost kitchens should grow in popularity and become an essential consideration for restaurant industry investors.

Investors can also look at the success of existing ghost kitchen operators, such as Kitchen United (a startup company) and CloudKitchens, to gauge the potential growth and profitability of this trend. These companies have attracted significant investment from prominent venture capital firms and partnered with major restaurant chains, indicating high interest and confidence in the ghost kitchen model.

There are some potential risks associated with investing in the ghost kitchen trend. One risk is the potential for oversaturation in specific markets as more restaurants and food delivery services adopt this model. This could lead to increased competition and lower profit margins for individual companies. Additionally, there may be regulatory challenges in specific regions or countries regarding the operation of shared kitchen spaces.

The rise of ghost kitchens presents an exciting opportunity for investors in the restaurant industry. Investors can make informed decisions about capitalizing on this trend by examining industry news and financial reports and assessing the potential risks and rewards.

Innovative Technology

The use of innovative technology in the restaurant industry has been a rapidly growing trend in recent years. With the rise of mobile devices and increasing demand for convenience, restaurants have been adopting new technologies to improve their operations and enhance the customer experience. Mobile ordering and payment apps, self-service kiosks and AI-powered chatbots are just a few examples of how technology streamlines ordering, payment and customer service processes.

From an investment standpoint, restaurants adopting innovative technology will likely have a competitive edge. Customers are increasingly looking for quick, convenient and tech-savvy options when dining out or ordering in, and restaurants meeting these demands will likely see increased revenue and customer loyalty. Investors can look at a restaurant's website or mobile app to assess the technology adoption level and the user experience quality.

Investors can also consider companies that provide technology solutions to restaurants, such as point-of-sale systems, payment processing or customer engagement software. These companies will likely see increased demand as restaurants look for ways to integrate technology into their operations.

It's important to note that investing in technology can also be expensive and come with its own set of risks. Companies heavily invested in technology may be vulnerable to security breaches or system malfunctions, which could harm their reputation and financial performance.

Using innovative technology in the restaurant industry presents opportunities and risks for investors. By carefully evaluating a restaurant's technology adoption and considering companies that provide technology solutions to the industry, investors can make informed decisions about how to capitalize on this trend.

Specialization

Specialization is a growing trend in the restaurant industry where restaurants focus on a specific cuisine, dish or ingredient. This approach allows restaurants to create a unique identity and stand out in a crowded market. Specialization attracts customers looking for something different, simplifies operations and reduces costs by allowing for a smaller, more focused menu.

From an investor's perspective, restaurants that specialize in a particular cuisine have the potential to capture a loyal customer base and generate higher profit margins due to their focused menu. Investors should look for signs of successful specialization when analyzing a restaurant company, such as solid customer reviews, high demand and consistent sales growth.

You can spot this trend by observing restaurant menu offerings. If a restaurant focuses on a specific cuisine or menu item, it may be a sign that they follow this trend. Additionally, you can look for restaurant concepts that have successfully carved out a niche in a particular cuisine or menu item and have a loyal customer base. These restaurants may have a competitive advantage in their market and position themselves for long-term success.

Consider the potential risks associated with specialization, such as limited menu options and the need to constantly innovate to keep customers interested.

Social media marketing is an important trend in the restaurant industry, as it provides a cost-effective way for restaurants to promote their brand and connect with customers. By creating engaging content and sharing high-quality images and videos of their food and drinks, restaurants can attract new customers and retain existing ones. Social media platforms like Instagram and Facebook are especially effective for restaurants, as they allow them to showcase their menu items, promotions and events to a broad audience. In addition, social media will enable restaurants to respond quickly to customer inquiries and complaints, creating a more personalized and engaging customer experience.

Investors can spot this trend by looking for restaurants with a solid social media presence and a loyal following. A restaurant's social media pages should have high-quality content, active customer engagement and a consistent branding message. Investors can also look for restaurants using social media to promote unique events or menu items, which can signify a creative and innovative marketing strategy. By investing in restaurants with a solid social media presence, investors can benefit from increased customer engagement and brand awareness.

Unique Dining Experiences

The trend of unique dining experiences has become increasingly popular in recent years as consumers seek new and exciting ways to enjoy food and drink. This trend has led to the emergence of various innovative dining concepts, such as pop-up restaurants, food trucks, themed events and immersive dining experiences.

Investing in this trend can be profitable for investors who can identify unique dining experiences that have the potential to attract a loyal customer base. One way to spot this trend is to look for restaurants offering an experience beyond food and drink. This could include restaurants with an immersive atmosphere or unique decor, offering interactive experiences like cooking classes or tasting events or providing entertainment like live music or performances.

Another way to identify unique dining experiences is to look for restaurants specializing in a particular niche, such as molecular gastronomy or fusion cuisine. These restaurants often offer a unique perspective on traditional dishes and can attract customers looking for a new and exciting culinary experience.

Investors can also look for dining concepts that have gained popularity through social media, as these experiences often go viral and generate buzz around the restaurant. Finally, consider the longevity of the dining experience — is it something that will continue to draw customers over time, or is it just a passing trend? By identifying unique dining experiences that have the potential to attract a loyal customer base and stand the test of time, investors can capitalize on this trend in the restaurant industry.

How to Analyze Restaurant Stocks

Analyzing restaurant stocks can be complex, as the restaurant industry is influenced by many factors, from economic conditions to changing consumer preferences. However, investors who carefully evaluate these factors can make more informed decisions about which restaurant stocks to buy, hold or sell. Let's explore critical factors when analyzing restaurant stocks, including financial metrics, industry trends, competitive positioning and quality. Whether you're a seasoned investor or a beginner, understanding these factors can help you make more confident and profitable investments in the restaurant industry.

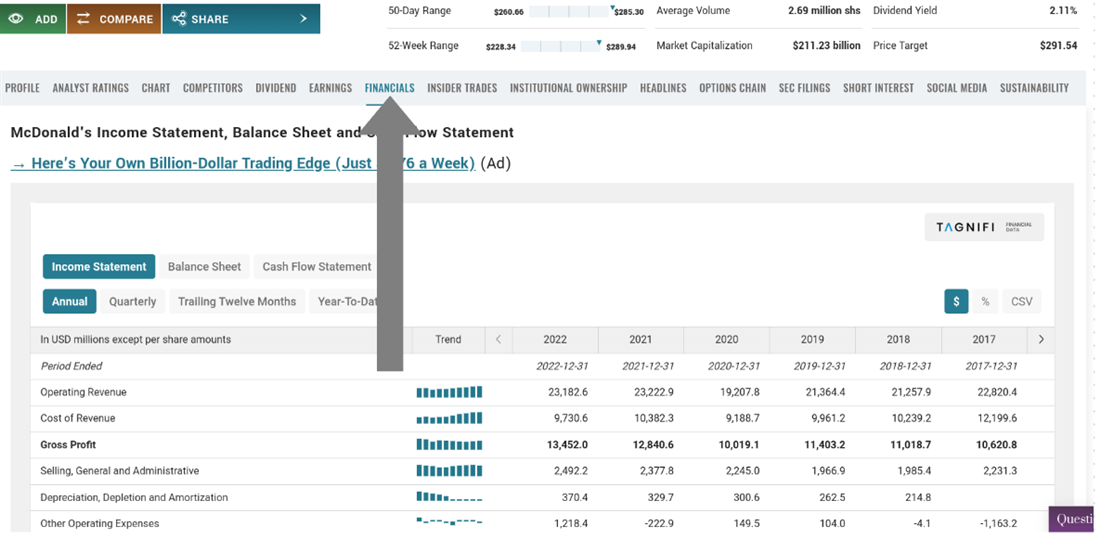

Financial performance is essential when analyzing restaurant stocks as it provides a comprehensive overview of the company's health and profitability. Key metrics include revenue, profit margins, earnings growth and debt levels. Revenue indicates the amount of money the restaurant generates from sales, while profit margins reflect the percentage of revenue left after deducting expenses. Earnings growth refers to the rate at which the company's earnings increase or decrease over time.

Debt levels help evaluate the company's leverage and financial risk. You may also be interested in the company's price targets and analyst ratings. A healthy financial performance is critical to the long-term success of a restaurant and its ability to weather any industry challenges. The "financials" tab of the MarketBeat website is a great place to start evaluating financial performance.

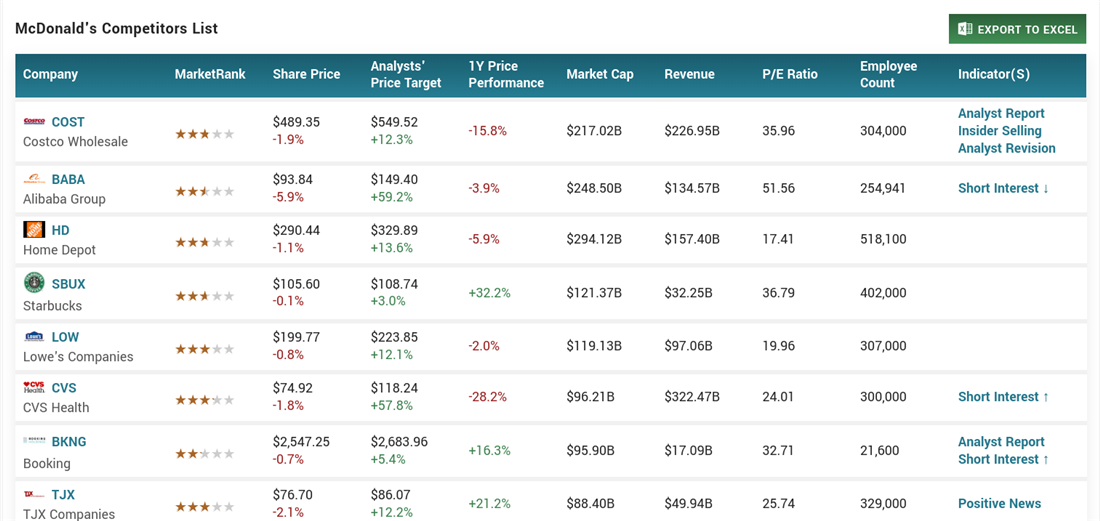

Market Share

Market share is essential when evaluating restaurant stocks, as it indicates the company's position in the market and how it compares to its competitors. A company with a large market share is typically viewed as a leader in the industry and may have a competitive advantage over smaller players. Understanding market share trends and dynamics can help investors identify growth opportunities and assess the competitive landscape.

Menu innovation is essential to attract and retain customers in the restaurant industry, which constantly evolves to meet changing consumer preferences and trends. Analyzing a company's ability to introduce new menu items, adapt to dietary restrictions and incorporate sustainable practices can provide insights into its potential for growth and customer loyalty.

Expansion Plans

Expansion plans are critical when analyzing restaurant stocks, as they indicate the company's growth potential. Evaluating a company's expansion plans, including the number of locations it plans to open and the financing required, can provide insights into its prospects.

Customer Experience

Customer experience is essential when investing in restaurant stocks, as it can significantly impact the company's revenue and profitability. Factors such as the quality of service, menu offerings and ambiance can influence customer satisfaction and loyalty. Investing in restaurants that consistently provide a high-quality customer experience can lead to long-term success.

Brand Reputation

Brand reputation is key when analyzing restaurant stocks, as it can significantly influence consumer behavior. A strong brand reputation can drive customer loyalty and positive word-of-mouth, while a negative image can harm the company's reputation and bottom line. A strong brand reputation can also lead to a more inflation-resistant restaurant stock because consumers prefer to stick to brands they know when faced with economic challenges.

Competition

Competition is critical when investing in restaurant stocks, as it can impact the company's ability to attract customers and generate revenue. Analyzing the competitive landscape and understanding how a company differentiates itself from its competitors can provide insights into its long-term prospects. MarketBeat's site has a "competitors" tab that helps break down every company's competition.

Regulatory Environment

The regulatory environment is important when evaluating restaurant stocks, as government regulations can significantly impact the industry's profitability and operations. Factors such as minimum wage laws, food safety regulations and environmental regulations can affect a company's bottom line and ability to operate.

Technological Innovation

Technological innovation is essential in the restaurant industry, as it can significantly impact a company's operations and customer experience. Companies that leverage technology to enhance efficiency, offer online ordering and improve the customer experience may have a competitive advantage over those that do not.

Management Team

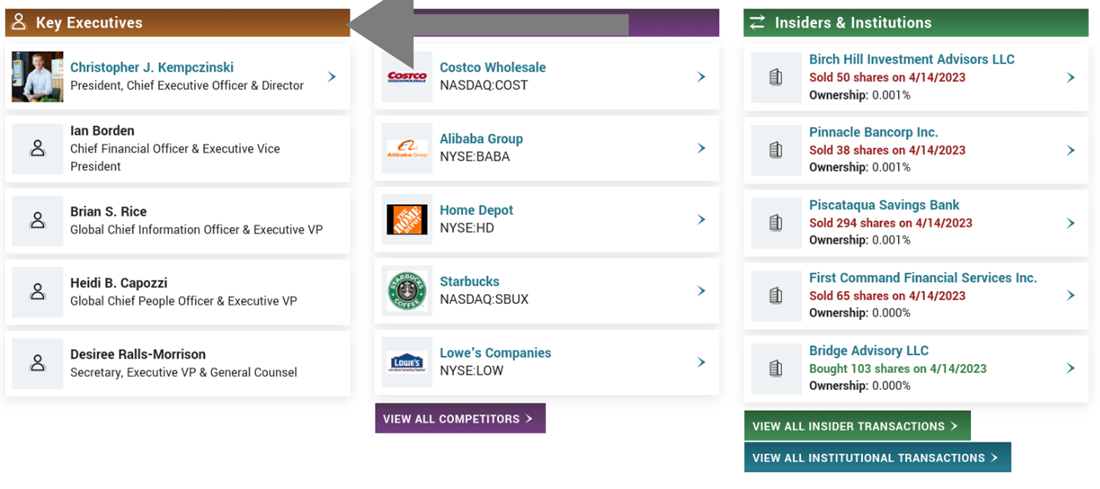

The management team is critical when analyzing restaurant stocks, as it can significantly impact the company's long-term prospects. Evaluating the leadership team's track record of success in the restaurant industry, strategic vision and ability to adapt to changing industry trends can provide insights into the company's potential for growth and profitability. You can find information about key executives near the bottom of each MarketBeat profile page.

How to Choose the Best Restaurant Stocks

Choosing the best restaurant stocks can be daunting, but you have to consider several key factors when making investment decisions. The first step is to research the company's financial performance, including revenue, profit margins, stock ranking, dividends, earnings growth and debt levels. Look for companies with a solid financial track record and a history of consistent growth.

Next, analyze the company's market share and position in the industry. Look for companies with a competitive advantage, whether through innovative menu offerings, a strong brand reputation or superior customer service. Consider how the company is adapting to changing consumer preferences and trends in the industry, such as a shift towards healthier or more sustainable menu options.

Another essential factor to consider is the company's expansion plans. Evaluate the company's strategy for opening new restaurant locations and how it intends to finance that growth. Look for companies with a strong balance sheet and a proven ability to generate cash flow.

Assess the quality of the customer experience, including factors such as service, menu offerings and ambiance. Consider the company's brand reputation and how consumers perceive it. A strong brand reputation can be a powerful driver of customer loyalty and repeat business.

Analyze the competitive landscape and how the company differentiates itself from its competitors. Look for companies with unique value propositions and strong competitive advantages. Consider the impact of government regulations on the company, such as minimum wage laws or food safety regulations.

Finally, evaluate the leadership team and their track record of success in the restaurant industry. Look for companies with a strong management team aligned with shareholder interests and a clear strategy for driving growth and creating value for investors.

Pros and Cons of Investing in Restaurant Stocks

Now that we have reviewed some strategies behind investing in restaurant stocks let's discuss the pros and cons of investing in the industry. As with any investment, there are advantages and disadvantages to consider. By examining the potential benefits and drawbacks, investors can make a more informed decision about whether investing in restaurant stocks aligns with their investment goals and risk tolerance.

Pros

Investing in the restaurant industry can be an attractive opportunity for many investors due to the potential for high returns and the industry's resilience to economic downturns. While risks are certainly involved, there are also several advantages to investing in restaurant stocks.

Let's take a moment to explore some pros of investing in the restaurant industry in more detail.

- Resilience: Restaurants have historically shown to be relatively resilient in economic downturns, with people still wanting to dine out and socialize, albeit at lower prices. Even during the COVID-19 pandemic, while many restaurants struggled, some could pivot to takeout, delivery and outdoor dining.

- Growth potential: The restaurant industry is projected to grow with an expected CAGR of 4.1% between 2021 and 2026. This growth is driven by changing consumer preferences, increasing meals eaten outside the home and a growing global population.

- Diversification: Investing in the restaurant industry can diversify a portfolio, as it is a distinct sector from other industries such as technology or healthcare.

- Opportunities for differentiation: While the restaurant industry can be competitive, there are opportunities for companies to differentiate themselves through menu innovation, unique dining experiences and sustainable practices, among other factors.

- Potential for high returns: Some restaurant stocks have the potential for high returns if the company performs well, with some companies experiencing growth of over 100% in recent years.

Cons

While there are many potential benefits to investing in the restaurant industry, there are also several risks and drawbacks. Let's examine some of the cons of investing in restaurant stocks to inform you before making investment decisions.

- Economic downturns: When the economy is downturned, people often cut back on nonessential spendings, such as dining out, which can hurt the restaurant industry. In times of recession, restaurants may experience lower revenues and profit margins. However, some restaurants defy recession concerns and investing in those during lean times may be an option.

- Intense competition: The restaurant industry is highly competitive, with many consumer options. To succeed, a restaurant must differentiate itself from competitors and offer a unique experience or product. This can be challenging, and many restaurants fail due to intense competition.

- Changing consumer preferences: Consumer trends and preferences heavily influence the restaurant industry, which can be challenging to predict and adapt to. For example, a restaurant may invest heavily in a particular cuisine or menu item only to find that consumer preferences have shifted to something else.

- Labor costs: Labor costs can be significant for restaurants, particularly in areas with high minimum wage rates. Additionally, restaurants may need help with staffing and retention, impacting the quality of service and overall customer experience.

- Fluctuating food costs: The cost of food can be unpredictable, with prices fluctuating due to weather, supply and demand and global events. Restaurants must be able to manage these costs to maintain profitability.

- Seasonal fluctuations: Many restaurants experience seasonal fluctuations in business, with peak times during certain holidays or tourist seasons. This can lead to inconsistent revenue streams and require restaurants to manage inventory and staffing accordingly.

Choose the Best Restaurant Stocks

Investing in restaurant stocks can be lucrative for investors who carefully consider the factors involved. By examining a company's financial performance, market share, menu innovation, expansion plans, customer experience, brand reputation, competition, regulatory environment, technological innovation and management team, investors can decide which restaurant stocks will likely perform well.

Of course, as with any investment, there are risks to consider, such as the impact of economic downturns, changing consumer preferences and regulatory changes. For those willing to take on these risks, investing in restaurant stocks can provide a tasty addition to a well-rounded investment portfolio. Savor the flavor of the restaurant industry and invest wisely!

FAQs

Do you still have questions about investing in restaurant stocks? We've compiled answers to some of investors' most common questions and concerns. We've covered you with expert insights and tips for making informed investment decisions in the dynamic and ever-evolving restaurant industry.

What is the best restaurant stock to buy?

There is no one best restaurant stock that you can buy. Determining the best restaurant stock requires careful financial performance analysis, market share, expansion plans, customer experience and regulatory environment. Conduct thorough research and seek professional advice before making investment decisions.

What are some good food stocks?

Many good food stocks are available for investors, ranging from large multinational companies to small regional players. Some factors to consider when looking for good food stocks include financial performance, market share, product innovation and growth potential. Review MarketBeat's list of top NYSE stocks for investment ideas to get you started.

Are there any publicly traded restaurants?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...