If you've ever opened a brokerage account, you've likely heard of options trading. Options trading continues to gain popularity since it enables synthetic directional positions where percentage gains and losses can fluctuate in the double and triple digits.

Options let you bet on the direction and magnitude of stock price moves at a fraction of the cost of owning the stock. Trading stock options requires less capital than day trading stocks but can yield similar rewards and also carries significant risk of losses. In this article, we will explore what options are and how options trading provides investors with a powerful tool to leverage stock price movements, generate income, and hedge against market risks.

Introduction to Options Trading

Options trading is similar to trading stocks in that investors buy or sell options to capture profits from price fluctuations. Many platforms that offer stock trading also facilitate options trading. Margin rules apply similarly to the pattern day trader (PDT) designation. However, while you can hold a stock indefinitely, options contracts have expiration dates and can only be held temporarily.

Not all stocks are available for options trading. For example, penny stocks typically don't have options, while blue chip stocks, large-caps and dividend stocks usually do.

Options are a type of derivative contract, meaning their value is derived from the value of an underlying asset. It's important to understand this distinction as you learn to trade options.

When you purchase an options contract, you gain the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before or at expiration. This creates a synthetic long position (for calls) or short position (for puts). Most options contracts do not get exercised, meaning the holder does not proceed to buy or sell the underlying asset. Instead, many options traders close their positions before expiration or let them expire worthless. This aspect attracts speculators and traders who trade options to capture profits from price movements and volatility, rather than acquiring the underlying stock positions.

Options serve many vital roles in the financial markets and can significantly enhance the flexibility of your portfolio. Three key roles they perform are:

- Speculation: Options allow you to speculate on the direction and magnitude of a price move in the underlying stock. By buying call or put options, you can leverage your position to potentially profit from price movements without owning the underlying stock.

- Income Generation: Options can be used to generate income through various strategies. For example, selling covered calls involves writing call options on stocks you already own to earn premium income. More complex strategies like iron condors also allow for income generation by taking advantage of specific market conditions.

- Hedging: Options provide a way to hedge existing positions in your portfolio, acting like an insurance policy. For instance, buying put options can protect against potential declines in the value of stocks you own, offsetting losses if the stock price falls.

Types of Options

There are two types of stock options: calls and puts. Call and put options can be combined for any directional movement or even no movement on the underlying stock. Each option contract represents 100 shares of the underlying stock, meaning one call contract of XYZ is the equivalent of 100 shares of XYZ.

Call options

A call option is a financial contract that gives the contract holder or buyer the right, but not the obligation, to buy a stock at a specified price (strike price) on or before a specified date (expiration date).

Long call options are contracts that benefit from a rising stock price. When you purchase a call option, you expect the underlying stock price to increase. As the stock price rises, the value of the call option typically increases. Traders buy call options to profit from anticipated upward movements in the stock price, making it a bullish strategy.

Example: The ABC Company has a stock price of $30 per share. Amy believes that the stock will rise in the next quarter. She buys a call option with a strike price of $31 per share and pays a $3 premium. Since option contracts generally represent 100 shares, Amy is paying $300 (3 x 100) for the option. This premium is the only money Amy is putting at risk.

If Amy is correct and the stock rises past $31 per share, she can "call" the option, buying the shares at the strike price of $31. If the stock has increased to $38, Amy would make a profit. Her shares would be worth $3,800, yielding a profit of $700, but after subtracting the $300 premium, her net profit is $400. If Amy is incorrect and the stock declines, she would let the option expire worthless, resulting in a $300 loss from the premium.

Put options

A put option is the opposite of a call option. It gives the holder the right to sell the underlying stock at a specified price on or before a specified date. Traders purchase put options when they expect the stock price to decline. This makes put options a bearish strategy.

Example: The stock of the XYZ Company is currently selling at $40 per share. Based on a weak earnings report, John believes the stock will fall in the next quarter. He buys a put option from a seller for $38 a share. The seller charges a $2 premium. Since option contracts are generally for 100 shares, John will be paying $200 (2 x 100) for the option. The premium is the only money John is putting at risk.

If John is correct, and the XYZ company stock drops below $38 per share, he can "put" the option to the seller and receive 100 shares of the company stock for $3,800. If the stock trades at $33 per share, John will have made a $300 profit ($500 - $200 premium). If John is incorrect and the stock increases in price, he can allow the contract to expire worthless. In this case, he is only out of the $200 premium he paid for the contract.

How Options Work

An options contract includes three critical pieces of information: the stock symbol, the strike price, and the expiration date.

Options contracts typically expire on the third Friday of every month. However, many stocks also have weekly options contracts, which expire every Friday at the close of trading. Weekly options are usually available for widely traded stocks.

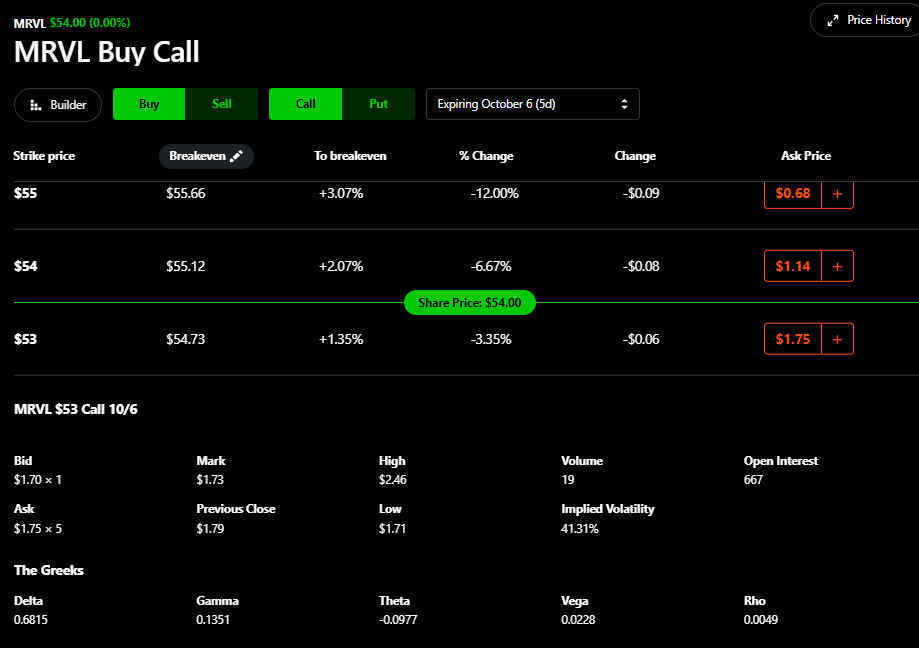

Example: A "MRVL $53 Call 10/6" option is a call option on Marvel Technology Inc. NASDAQ: MRVL with a $53 strike price, expiring on October 6, 2023. If you buy this call option, you expect the MRVL stock price to rise above $53 on or before October 6, 2023.

Suppose the MRVL $53 Call 10/6 trades for $1.73 while MRVL stock is priced at $54.00. The bid price is $1.70, and the ask price is $1.75. The option is a weekly option expiring in five days.

If MRVL is trading at $54 and you buy the $53 call option, it’s already $1 in the money (ITM), meaning the stock trades $1 above the $53 strike price. The option’s intrinsic value is this $1. However, you’ll pay the $1.75 ask price, meaning the extra 75 cents is the premium.

The premium includes the volatility premium and time premium. Delta measures how much the option’s premium changes per $1 move in the underlying stock. For the MRVL call option, the delta is 0.6815, meaning a $1 increase in MRVL’s stock price raises the option’s premium by 68.15 cents. Conversely, if MRVL falls by $1, the option’s premium decreases by 68.15 cents. Theta represents time decay, or how much value the option loses each day as it approaches expiration. In this case, MRVL’s theta is -0.0977, meaning the option’s value falls by 9.77 cents daily.

Buying the MRVL $53 call contract will cost $1.75. With MRVL trading at $54, the call contract has a $1 intrinsic value and a 75-cent premium. Every day you hold the call option, it loses 9.77 cents in value due to time decay. For every $1 increase in MRVL’s stock price, the call option’s value increases by 68.15 cents. The farther away the expiration date, the higher the time premium, making it crucial to capitalize on directional moves quickly to minimize time decay.

If you own 100 shares of MRVL, you can write (sell) the $53 covered call at the bid price of $1.70. If MRVL stays above $53 by Friday’s close, your shares will be sold at $53 each, and you keep the premium. If the call options expire out of the money (OTM), you keep both your shares and the $1.70 premium.

Trading Options

Options can be traded similarly to stocks. When you buy an option, you open a long position. Selling the option you hold closes the long position, and this applies to both calls and puts.

You can also sell options without owning the underlying asset. Selling an option on a stock you own is called writing a covered call, which opens a short position. To close the position, you either buy back the option or let it expire. This strategy can generate income from the premiums.

Example: If you own 100 shares of XYZ trading at $35, you can write a covered call with a $37 strike price and collect a $2 premium. If the stock price exceeds $37, you sell your shares at the strike price. If the stock stays below $37 at expiration, you keep both your shares and the premium.

Exercising an option means using your right to buy (call) or sell (put) the underlying stock at the strike price. For example, if you have a $33 call on XYZ and the stock is trading at $37, you can exercise the call and buy the stock at $33.

Basic Options Trading Strategies

Let's take a look at some foundational strategies for trading options, utilizing call and put options.

Long Call and Long Put Strategies

These are basic directional trades. Buying a call option indicates you expect the stock to rise above the strike price before expiration. Conversely, buying a put option means you expect the stock to fall below the strike price.

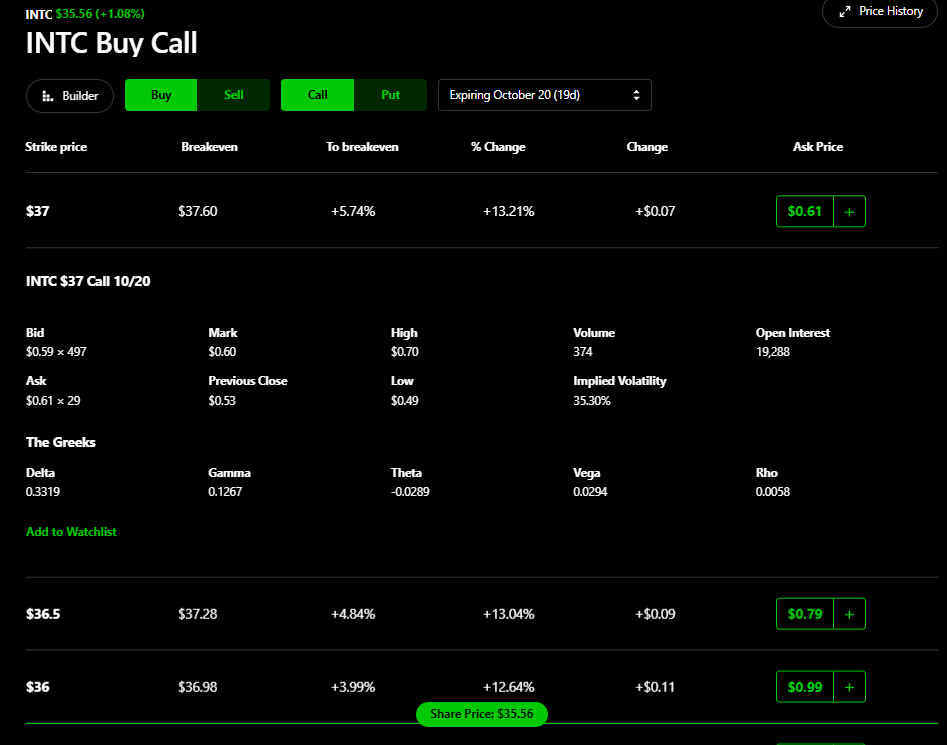

Example: An INTC $37 Call, expiring on October 20, 2023, costs 61 cents to buy on the ask, while INTC is trading at $35.56. Its intrinsic value is worthless since it trades $1.44 out of the money. The 61-cent cost for the option is based on volatility and a time premium for 19 days. You have 19 days for INTC to make a move before the option expires worthless. The value of the option can spike if INTC surges $1 today. Based on the delta, if INTC stock rises $1.00 to $36.56 today, the option will increase in value by 33 cents, giving me a 50% profit in one day even as it trades below the strike price and is intrinsically worthless.

Covered Call and Protective Put Strategies

These strategies involve selling call options on owned stocks to generate income (covered calls) and buying put options to protect against potential losses (protective puts).

Example: If you owned INTC stock at $35 and expected it to move higher, you could also write a covered call at $38 to collect a premium and the potential to get assigned the stock at $38 for a $3 profit in addition to the premium. Selling the call when you own the shares is called writing a covered call. However, if you sell the call without owning the stock, it's called a naked position. A naked position can backfire hard if INTC's price surges through $38 since you can sell the shares at $38 even if you have to buy it at $40. Only investors or traders with options level 4 permissions can take naked calls or puts. Even then, it's a risky trade only seasoned pros should consider doing.

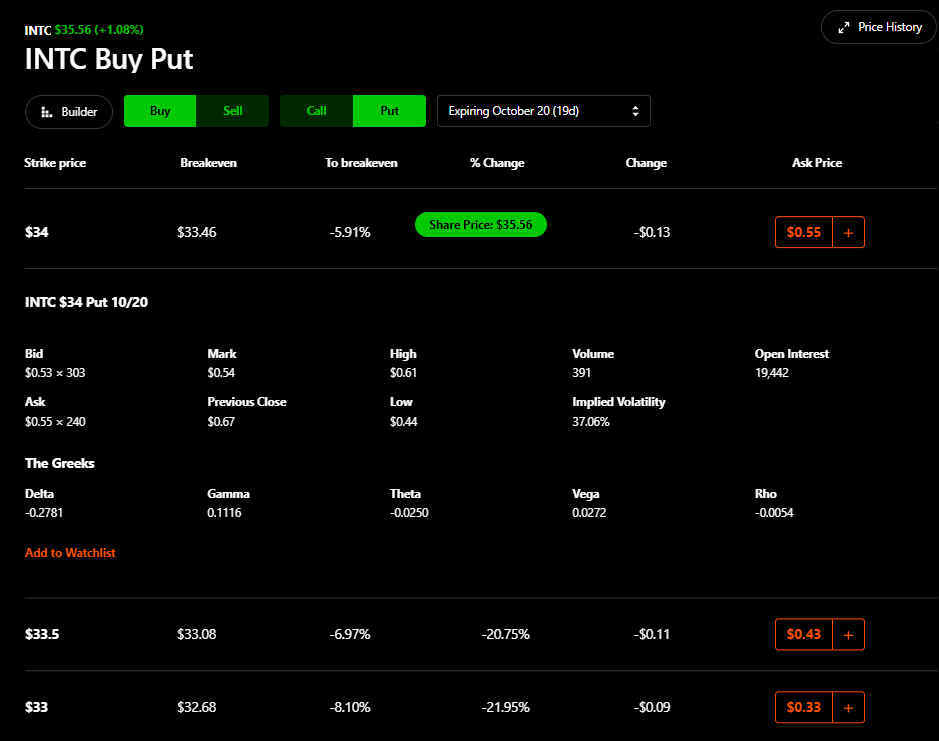

If you expect the price of INTC to drop, you can look at the INTC $34 Put contract expiring in 19 days on October 20, 2023. You would buy the put for two reasons: speculation or protection.

In terms of speculation, you may not want to risk shorting INTC stock and have it squeeze on you indefinitely. In this case, you can limit your loss potential to the 55-cent cost to buy the put contract for speculation, expecting the stock to drop under $34 per share. In this example, one contract will cost me $55 when INTC trades at $35.56 and $1.56 out of the money. If INTC stock collapses $1 today, the put contract will rise by 27.8 cents based on the delta. Every day you hold the put contract, you lose 2.5 cents a day in options value based on the theta. You would need INTC to fall to $33.08 or lose 6.97% to break even on the contract. You need INTC to fall as fast as possible in the quickest amount of time to exit by selling and closing the put position to make a profit.

For protection, if you owned 100 shares of INTC at $35 heading into an earnings report and you want to protect yourself, you can buy the same INTC $34 Put for insurance. If the INTC stock price falls to $33, your stock would fall $2, but your option would be worth $1, which offsets half of the losses. If you want more protection, you could buy the INTC for $35, but it would cost more.

Advanced Options Trading Strategies

Experienced traders may opt to partake in some advanced options trading strategies, such as various types of spreads, straddle, strangle, or collar.

Spreads

Spread strategies specifically involve multiple options of the same type (calls or puts) with different strike prices or expiration dates. Spreads can lower the cost basis and provide a more controlled risk environment.

There are two types of spreads:

- Vertical Spreads: Buying (open long) and selling (open short) options contracts with the same expirations but different strike prices.

- Horizontal Spreads: Buying and selling options with the same strike prices but different expiration dates.

Here are some widely used spread strategies:

- Bull Call: Buying a call option with a lower strike price (ITM) and selling a call option with a higher strike price (OTM), this strategy profits from a rise in the underlying stock price with lower cost and risk, achieving maximum profit if the stock exceeds the higher strike price. This spread lowers the breakeven price, the net premium paid, and limits maximum losses.

- Bull Put: Buying a put option with a higher strike price and selling a put option with a lower strike price, this strategy profits from a rise in the stock price, achieving maximum profit if the stock stays above the lower strike price. This spread lowers the breakeven price, the net premium paid, and limits maximum losses.

- Iron Condor: Combines two vertical spreads - a bull put spread and a bear call spread - this strategy profits from low volatility, aiming to capture premium income from the spreads' price range.

- Butterfly: Buying and selling multiple call or put options with different strike prices but the same expiration date, this strategy profits from low volatility and small price movements in the underlying asset.

- Calendar (Time Spread): Buying and selling options with the same strike price but different expiration dates, this strategy profits from changes in volatility and time decay differences between the near-term and long-term options.

- Diagonal: Combining elements of a calendar spread and a vertical spread, this strategy involves buying and selling options with different strike prices and expiration dates, aiming to profit from both time decay and directional price movements.

Straddle

Buying both a call and a put option with the same strike price and expiration date, this strategy profits from significant price movements in either direction.

Strangle

Similar to a straddle, a strangle involves buying a call and a put option with different strike prices. It is typically cheaper than a straddle and profits from substantial price movements in either direction.

Collar

Holding a long position in a stock while simultaneously buying a protective put and selling a covered call, this strategy limits both potential gains and losses, providing a balance between risk and reward.

Risk Management in Options Trading

Effective risk management involves planning trades in advance, adhering to stop-loss orders, and using strategies like spreads to minimize potential losses and define risk-reward parameters. Traders should be aware of liquidity and bid-ask spreads to ensure stop-loss orders are effective, avoiding wide spreads that can trigger unintended losses. By managing risk prudently, traders can protect their investments while taking advantage of opportunities in the options market.

Tips for Successful Options Trading

Follow these tips to enhance your chances of success in options trading and better manage the risks involved.

- Understand the basics of options trading, including terminology, types of options (calls and puts), and various strategies.

- Stay updated with market news, trends, and economic indicators that can affect options prices.

- Begin with basic strategies like buying calls and puts before moving to more complex ones like spreads, straddles, and condors.

- Use paper trading (simulated trading) to practice and gain confidence without risking real money.

- Define your trading goals, risk tolerance, and strategy.

- Manage your risk by using stop-loss orders, diversifying your trades, and never investing more than you can afford to lose.

- Employ strategies like bull call spreads, bear put spreads, and iron condors to limit losses and define potential gains.

- Trade options with high liquidity and volume to ensure tight bid-ask spreads and minimize slippage.

- Avoid options with wide spreads, as they can lead to unexpected losses and difficulty in executing trades.

- Understand how implied volatility affects options pricing and use it to gauge market sentiment and predict potential price movements.

- Factor time decay when planning your trades, especially for long positions.

- Avoid emotional trading decisions and stick to your trading plan and strategies, especially entry and exit points.

- Don’t chase losses; accept small losses as part of the trading process.

- Keep learning about new strategies and market developments.

- Analyze your trades to understand what worked and what didn’t so you can adapt your strategies based on market conditions and personal experiences.

Navigating the Complexities of Options Trading

Options trading offers a versatile tool for investors to leverage stock price movements, generate income, and hedge against risks. By understanding the fundamental concepts and strategies, traders can effectively navigate the complexities of options trading. However, the significant risks involved necessitate a disciplined approach, including thorough planning, effective risk management, and continuous learning. Employing both basic and advanced strategies can help traders capitalize on market opportunities while managing potential losses.

Before you consider Onsemi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onsemi wasn't on the list.

While Onsemi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report