Because consumer discretionary stocks often outperform the broader market, you may want to consider adding them to your portfolio. By the end of this article, you'll understand the diverse businesses that make up consumer discretionary and how economic trends and market forces shape this ever-evolving sector.

Overview of the consumer discretionary sector

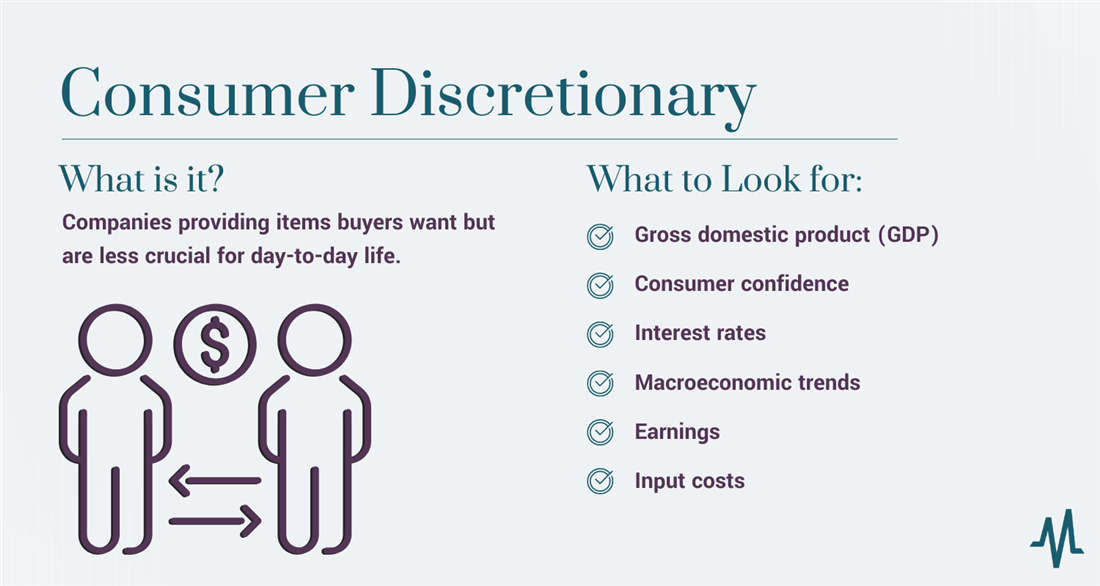

So, what is consumer discretionary? At its core, it refers to the segment of the market that includes non-essential goods and services, those driven by individual desires rather than basic needs. It’s the leisure and luxury purchases you make with your disposable income, encompassing various products ranging from apparel and automobiles to travel and entertainment. Because it thrives on consumer sentiment, this sector is highly responsive to shifts in economic conditions.

Whether scrolling through streaming services, updating your wardrobe with ethically produced clothing or planning your next trip, your choices are unseen forces shaping the consumer discretionary sector's landscape. Imagine that you've decided to set sail on a cruise for your next vacation. Spurred by your decision, the cruise line might invest in new ships, sparking economic activity. Beyond the immediate effect on the company, your choice also has a ripple effect on hospitality by creating demand for accommodations, entertainment by fueling interest in on-board shows and activities and transportation by influencing travel trends and local excursions.

The impact of economic trends

Consumer discretionary spending intricately links to economic indicators like gross domestic product (GDP) growth, employment rates, retail sales, non-farm payrolls, home sales, building construction activity and labor market hours/earning. Collectively, this information serves as a barometer for the economy's overall health, influences consumers' financial well-being and, in turn, shapes their spending habits.

For instance, during robust economic growth and low unemployment periods, consumers often feel more financially secure, leading to increased spending on discretionary goods and services. Conversely, economic downturns and rising unemployment tend to prompt cautious consumer behavior with individuals prioritizing essential needs and cutting back on non-essential wants. If you're afraid of losing your job in a recession, postponing a trip before you stop buying groceries is easy. Understanding this cyclical nature of consumer spending allows analysts and policymakers to gauge the pulse of consumer sentiment, providing valuable insights into broader economic trends. Investors need to be attuned to these cycles, as they impact the performance of companies within the sector.

Market dynamics and key players

The consumer discretionary sector propels a vibrant interplay of market forces that collectively shape its trajectory. Supply and demand directly impact consumer choices and spending patterns based on product availability and pricing. Technological innovations, such as e-commerce platforms and digital entertainment services, continually redefine how consumers access and engage with products and services. Cultural trends and societal shifts contribute to the evolving landscape of what consumers want, prompting companies within the sector to adapt and innovate to meet changing demands.

Large, well-known brands profoundly influence the sector both as trendsetters and game-changers. These companies reflect and actively shape consumer desires, steering the direction of the broader industry. For example, Amazon’s dominance in e-commerce has revolutionized retail and set new standards for convenience, impacting how consumers make choices across various product categories. As a powerhouse in the entertainment industry, Disney has shaped consumer discretionary spending through its diverse offerings (from theme parks to streaming services), influencing how individuals allocate their leisure budgets. And Tesla's innovation in electric vehicles is transforming the automotive industry and sparking shifts in consumer preferences.

Types of consumer discretionary companies

The consumer discretionary sector encompasses various types of companies, each catering to specific consumer desires, including restaurants and travel companies, household furniture, leisure-related items, hotels and casinos and general retail. Examples of consumer discretionary stocks include:

Investing in consumer discretionary stocks

Consumer discretionary stocks offer the potential for high returns driven by cyclical growth. Businesses within this sector will also benefit because a flourishing economy often correlates with increased discretionary spending.

Companies in this sector are often at the forefront of innovation, especially in technology and lifestyle products, presenting opportunities for investors to capitalize on emerging trends. However, the sector is also susceptible to economic downturns and shifting consumer preferences, presenting inherent risks. Diversifying across sub-industries, thorough research on individual companies, and staying attuned to economic indicators are key strategies to navigate these dynamics. Additionally, monitoring global trends, such as e-commerce growth and sustainability, can guide investment decisions.

In the past few years, we have seen technological advancements, changing consumer preferences and global events shape the consumer discretionary sector. The rise of e-commerce has been substantial with companies investing in robust online platforms and omnichannel strategies seeing increased investor interest. Augmented reality (AR) and artificial intelligence (AI) have revolutionized the retail experience. Companies leveraging these technologies to enhance customer engagement and personalize shopping experiences have become appealing to investors. The COVID-19 pandemic further accelerated this trend, emphasizing the importance of digital presence for retail and entertainment companies.

COVID-19 also created a shift towards spending more time at home — for both work and relaxation time. This has fueled demand for home improvement and technology-related products and businesses involved in home office equipment, home entertainment and renovation supplies have experienced increased investor interest. In addition, the surge in popularity of streaming platforms has transformed the media landscape. Companies investing in original content creation and adapting to changing viewer habits have seen significant investor interest.

Predicting trends for the consumer discretionary sector

If you know where to look — economic indicators like consumer spending, the unemployment rate, interest rates and personal savings rates — it is not too difficult to predict where trends for the consumer discretionary sector may go.

GDP

GDP consists of four main areas: consumer spending, business spending, government spending and net exports. It is a crucial indicator, influencing consumer confidence and spending within the discretionary sector. In the third quarter of 2023, personal consumption accounted for nearly 68% of the U.S. GDP.

Consumer confidence

High consumer confidence typically leads to increased spending, while low confidence can result in cautious consumer behavior. Each month, the global nonprofit think tank Conference Board conducts The Consumer Confidence Survey, which gives insight into “consumer attitudes, buying intentions, vacation plans and consumer expectations for inflation, stock prices, and interest rates.” Investors closely monitor these reports since consumer confidence affects spending: positive data typically boost the consumer discretionary sector, but lower numbers often drag it down.

Interest rates

Interest rates play a dual role, influencing consumer borrowing costs and investment returns. Low interest rates may encourage consumer borrowing and spending, benefiting the discretionary sector. But when interest rates are high, it will eventually affect consumer spending, and purchases of non-essential and luxury goods will typically decrease.

Globalization and consumer discretionary

Globalization has increased market reach and influenced product diversity in the consumer discretionary sector. Increased interconnectedness allows buyers to access a broader range of goods and services worldwide. International trade agreements and cultural influences can also significantly impact consumer choices. Although companies may benefit from expanded markets, they will also face the challenge of adapting to varied cultural expectations. They must strike a balance between global appeal and localized strategies to stay competitive in the evolving global marketplace.

Global trends will help shape the future of the consumer discretionary sector. Take the accelerated rise of e-commerce, for example, whose success was driven by technological advancements and changing consumer preferences for convenient online shopping experiences. Sustainability and ethical consumerism are gaining momentum, compelling companies to adopt environmentally conscious practices and offer ethically sourced products. In addition, the global emphasis on health and wellness influences choices in fitness, nutrition and leisure activities, steering investments towards companies aligning with these lifestyle trends. These trends transcend borders, compelling companies within the sector to innovate, adapt, and align offerings with evolving global sentiments.

Navigating risks and opportunities

Investing in the consumer discretionary sector comes with its share of potential risks. When the economy hits a rough patch, we tend to tighten our belts, directly affecting companies selling non-essential goods and services. It's like a domino effect – economic downturns lead to lower consumer confidence, reducing spending on vacations, fancy gadgets or dining out. Another challenge is the ever-changing tastes of consumers. What's hot today might be out of fashion tomorrow, and companies must keep up or risk falling behind. The sector is highly competitive, so companies are under constant pressure to stay innovative, which can be costly. Plus, unexpected events like supply chain disruptions, global crises or regulatory changes can throw a wrench into the works.

So, while growth potential is there, you must keep a watchful eye and be ready to adapt to the twists and turns that come with the territory. Here are some strategies to help you navigate the consumer discretionary sector more effectively:

- Diversification: Spread your investments across various sub-industries within consumer discretionary, such as retail, entertainment, and luxury goods, to minimize risk associated with specific sectors.

- Stay informed about trends: Keeping on top of consumer tendencies, technological advancements and cultural shifts helps you to identify opportunities and potential risks.

- Long-term perspective: Given the cyclical nature of consumer discretionary stocks, you should extend your investment horizon to ride out short-term market fluctuations and benefit from the sector's growth over time.

- Thorough research: Assess a company's financial health, competitive positioning, management effectiveness and growth prospects to make informed investment decisions.

- Monitor economic indicators: GDP growth, employment rates and consumer confidence provide insights into the overall economic health and potential shifts in consumer spending patterns.

- Consider global trends: Factor in international influences on consumer discretionary. Companies with a strong global presence may also offer additional diversification benefits and exposure to emerging markets.

- Assess brand strength: Companies that resonate with consumers tend to weather economic downturns more effectively and recover quickly during upturns.

- Watch for innovation: Businesses that incorporate innovative practices may have a competitive edge, particularly in technology and sustainability.

- Risk management: Setting stop-loss orders and diversifying investments will help mitigate potential losses during market downturns or unexpected events.

- Earnings season analysis: Read these reports as they provide valuable insights into financial performance and can impact stock prices.

- Be cautious during economic downturns: Exercise caution when consumer discretionary spending typically contracts, assess the financial stability of companies in your portfolio and consider defensive strategies.

How to invest in consumer discretionary

Investing in the consumer discretionary sector can be approached many ways, each catering to different risk appetites and investment preferences. Here are some investment approaches to consider.

Individual stock selection

This involves conducting in-depth research on individual companies and choosing stocks based on financial health, market positioning, growth potential, dividend payments, global exposure, economic cycle alignment, social responsibility, themes or portfolio diversification.

Exchange-traded funds (ETFs)

These funds track consumer discretionary indices and offer diversified exposure to the sector, reducing individual stock risk while capturing the overall performance of the market segment.

Sector-specific mutual funds

You can outsource this section of your portfolio to professional fund managers who will actively manage these consumer discretionary funds and make investment decisions based on their analysis of market conditions.

Options trading

More advanced investors can utilize options trading to leverage or protect investment positions to generate income or manage risk.

Consumer discretionary keeps the economy buzzing

While the consumer discretionary definition is the goods and services that individuals purchase based on their preferences and desires rather than out of necessity, it’s more than just a market sector; it's a dynamic force shaping and responding to our evolving preferences. It reflects our society’s choices and desires and the ebb and flow of our economic landscape.

When consumers are optimistic, these stocks tend to perform well. But when consumers are worried, these stock prices tend to fall. Understanding the cyclical nature of consumer spending and its potential risks and rewards will help you choose your portfolio's right investments and strategies.

FAQs

Here are some frequently asked questions about investing in Consumer Discretionary stocks.

What is meant by consumer discretionary?

Consumer discretionary includes companies providing items that buyers want but aren't necessary in the same way that groceries, personal hygiene or healthcare products are required.

Consumer discretionary includes home electronics, restaurants, travel companies and even automakers.

What is discretionary vs. staples?

You can think of consumer discretionary goods as something people want, such as restaurant meals or vacations. However, when consumers pinch pennies in a weak economy, they continue spending on necessary consumer staples, such as food and household cleaning supplies.

Is McDonald's a consumer discretionary stock?

McDonald's is a perfect example of a consumer discretionary stock. Its earnings grow more slowly when consumers are concerned about inflation or a possible recession. In a booming economy, its earnings tend to grow faster.

Before you consider (EXA), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and (EXA) wasn't on the list.

While (EXA) currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.