What are the Dogs of the Dow? This is a simple yet captivating approach to investing in the stock market. Let's take a few minutes to unravel the secrets of the Dogs of the Dow strategy and reveal how it might be your ticket to enhanced portfolio performance.

What is the Dogs of the Dow Strategy?

At its core, the Dogs of the Dow (often shortened to "Dogs Dow Strategy") is an investment strategy designed to harness the power of dividends and blue-chip stocks to boost your returns.

The name "Dogs of the Dow" might sound intriguing, but it simply references the stocks that make up this strategy. What are Dogs of the Dow stocks? These "Dogs" are not underperforming or problematic stocks; they are the highest dividend-yielding stocks among the 30 components of the Dow Jones Industrial Average (DJIA).

Here's how it works: Imagine you're starting your investment journey at the beginning of a new year. The first step in this strategy is to identify the 10 Dow stocks by dividend yield from the DJIA's roster. These 10 stocks become your chosen pack of "Dogs of the Dow." You invest in these stocks and hold onto them for a year, aiming to sell them on the last trading day of that year.

In essence, the Dogs of the Dow strategy is about using the power of dividends and blue-chip stocks to your advantage. It's a straightforward approach that doesn't require constant monitoring or complex maneuvers. Instead, it's a "set it and forget it" strategy that appeals to investors looking to simplify their approach while potentially reaping the benefits of dividend income and stock price appreciation.

Understanding Dogs of the Dow and How They’re Chosen

The Dogs of the Dow strategy hinges on a straightforward yet compelling premise: investing in the ten highest dividend-yielding blue-chip stocks among the 30 components of the Dow Jones Industrial Average (DJIA) each year. This selection process occurs at the end of each calendar year and sets the stage for the year ahead. But how are these Dogs chosen? The selection criteria are based on dividend yield, and the methodology is refreshingly simple. Here's how it works:

- Dividend yield: The first criterion for a stock to be considered a potential Dog of the Dow is its dividend yield. The 10 stocks with the highest dividend yields among the DJIA components as of the last trading day of that year.

- No complex algorithms: Unlike other investment strategies that rely on complex algorithms or extensive analysis, the Dogs of the Dow strategy keeps it straightforward by focusing solely on dividend yields.

- Equal allocation: Once the Dogs are identified, an equal dollar amount goes toward each. This equal-weighting approach ensures that no one stock dominates the portfolio, spreading risk evenly.

- Yearly rebalancing: You then hold the portfolio for the entirety of the upcoming year. This "buy and hold" strategy simplifies the process, making it suitable for those looking for a relatively low-maintenance, long-term approach to investing.

- Annual reiteration: The process repeats at the start of each new year. The stocks that meet the criteria for the highest dividend yields are selected as the "Dogs" for that year, and the portfolio is adjusted accordingly.

This selection process aims to capture the potential benefits of investing in companies with high dividend yields relative to their stock prices. As mentioned earlier, the strategy's underlying assumption is that such companies may be at a stage in their business cycle where their stock prices could grow faster than those with lower dividend yields.

Additionally, because blue-chip companies are known for their stability and consistent dividend policies, the Dogs of the Dow strategy offers a sense of reliability to investors. This simplicity and predictability have contributed to the enduring popularity of this investment approach.

It's important to note that the Dogs of the Dow strategy does not involve extensive research, complex analysis or future predictions performance of specific stocks. Instead, it's a systematic, rule-based approach that aims to provide investors with a way to participate in the potential value offered by high-dividend-yielding blue-chip stocks within the DJIA.

How the Dogs of the Dow Strategy Works

Now that you understand the concept behind the Dogs of the Dow strategy and how the stocks are chosen, let's dig deeper into how this investment strategy works. Understanding the mechanics of the strategy can provide valuable insights for potential investors. The Dogs of the Dow strategy is designed to be accessible and relatively straightforward for investors, particularly those who prefer a hands-on approach but don't want to delve into the intricacies of stock analysis.

The process begins at the stock market's close on the year's last trading day. At this point, investors identify the 10 stocks within the Dow Jones Industrial Average (DJIA) with the highest dividend yields. These stocks are the chosen "Dogs" for the upcoming year. Once the Dogs are identified, investors allocate an equal dollar amount to each of these 10 stocks. This equal-weighting approach ensures that no single stock dominates the portfolio, distributing risk across the selected companies.

The portfolio of Dogs is then held for the entirety of the following year.

This means that investors commit to holding these stocks for a full calendar year, regardless of market fluctuations or developments. As the new year begins, the process repeats. Investors review the current DJIA components to identify the 10 stocks with the highest dividend yields. These newly selected stocks become the Dogs for that year, and the portfolio is adjusted accordingly.

While the Dogs of the Dow strategy should be relatively low maintenance, it's not entirely hands-off. Investors should keep an eye on their portfolio throughout the year, monitoring the performance of each Dog. This periodic check ensures the portfolio remains aligned with the strategy's principles. Importantly, investors should have a predefined exit strategy in place. This could involve selling the Dogs at the end of the year, as per the strategy, or when specific price targets are reached.

The underlying idea behind the Dogs of the Dow strategy is rooted in several key assumptions:

- Blue-chip stability: Blue-chip companies, represented within the DJIA, are typically known for their stability, financial strength and consistent dividend policies. They are considered reliable investments.

- Dividend yields: The strategy assumes that companies with high dividend yields relative to their stock prices may be at a point in their business cycle where their stock prices could grow faster than those with lower dividend yields.

- Contrarian approach: Focusing on stocks with high dividend yields, the Dogs of the Dow strategy takes a contrarian stance. It leans towards stocks that may be undervalued due to their relatively high yields.

- Long-term focus: The strategy's simplicity and long-term nature appeal to investors looking for a relatively passive approach to investing in blue-chip stocks.

How the Dogs of the Dow Change

The composition of the Dogs of the Dow changes annually, and here's why. The process begins at the stock market's close on December 31 each year. Investors select the 10 stocks within the Dow Jones Industrial Average (DJIA) with the highest dividend yields as the Dogs for the upcoming year. This selection is based solely on dividend yield, aiming to identify high-yielding blue-chip stocks.

As the new year begins, the portfolio is reevaluated. The process repeats, and investors identify the 10 DJIA stocks with the highest dividend yields for the current year. These new selections become the Dogs for that year, and the portfolio is adjusted accordingly. This annual rebalancing allows the strategy to focus on the highest-yielding stocks yearly.

To gain a clearer perspective on the practical application of the Dogs of the Dow investment strategy, let's take a closer look at two crucial snapshots in time: the Dogs of the Dow for the years 2022 and 2023.

By comparing these two data sets, we can observe how the strategy's annual adjustment keeps it aligned with the ever-changing landscape of the stock market, reflecting the core principle of targeting high-yield, blue-chip stocks.

The 2022 Dogs of the Dow

In 2022, the average yield for the selected Dogs of the Dow stocks stood at 3.77%. This figure represents the collective dividend yield of these stocks, showcasing their appeal to income-focused investors seeking dividends as a source of returns.

The 2023 Dogs of the Dow

Remember that these were chosen on the first trading day of 2023. This means they are “the official dogs of the Dow.” However, changes in the market mean that the live list of top Dogs changes frequently. If you are using the official Dogs of the Dow stock list, these frequent changes do not affect you because the strategy dictates you hold these stocks until the end of the calendar year. However, if you use the live list to adjust your portfolio actively, keeping track of this information is essential to the success of your strategy.

Analyzing the average yields of the Dogs of the Dow for 2022 and 2023 provides valuable insights into the Dogs of the Dow strategy performance. In 2022 the average yield was 3.77%, while in 2023, it increased to 4.67%. Tracking the Dogs of the Dow strategy over time offers investors valuable insights into its consistency, adaptability, risk management and income-generation potential. Consistent performance reflects a focus on high dividends, while changes in the portfolio year to year show adaptability to market shifts. Comparing its performance to the broader market helps assess its sensitivity to economic cycles and provides a stable track record that appeals to risk-averse investors.

Additionally, observing its long-term potential and diversification benefits aids in aligning the strategy with individual investment goals.

Example of the Dogs of the Dow Strategy

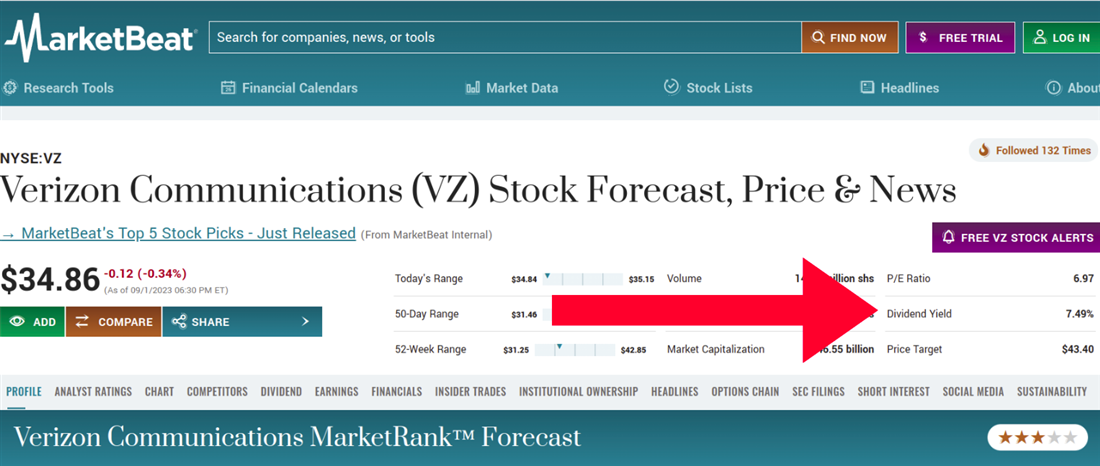

Looking at an example of the Dogs of the Dow strategy means analyzing the Dogs of the Dow at any given time, and several critical factors come into play. First and foremost, you would focus on the dividend yields of the selected stocks, ranging from 7.49% for Verizon’s dividend yield to 2.72% for JP Morgan Chase’s dividend yield. High dividend yields are a primary criterion for inclusion in the Dogs of the Dow, so assessing whether each stock meets this requirement is essential. Finding this information is easy to do on MarketBeat. Search for each company and find the "dividend yield" at the top of each profile page on the right-hand side.

Simultaneously, you would closely monitor the price trends of these stocks throughout the year. It is crucial to examine whether they experienced significant price appreciation, indicating strong capital gains, or remained relatively stable.

Another critical aspect of the analysis involves comparing the Dogs' performance to the broader market, represented by the DJIA. Did the Dogs collectively outperform or underperform the DJIA during the year? For instance, if the DJIA had a robust year, did the Dogs manage to keep pace or even surpass it? Industry sector analysis plays a vital role as well. You'd examine whether the Dogs are diversified across various sectors or concentrated in specific industries. This can provide insights into sector-specific performance trends influencing the strategy's returns.

Historical data would be referenced to compare the 2023 Dogs' performance with those from previous years. Have certain stocks consistently performed over time, while others have shown more variability? Assessing the risk associated with each Dog is also essential. Volatility in stock prices can significantly impact overall returns. For example, Amgen may have a lower yield but offer a less volatile investment than a higher-yield, more volatile stock.

Moreover, you'd consider how well the Dogs of the Dow portfolio achieves diversification. Does it provide exposure to a variety of industries and risk profiles, or is it heavily skewed toward certain types of stocks? Lastly, evaluating how effective the Dogs of the Dow strategy is at generating income through dividends is crucial. Investors following this strategy typically seek a reliable income stream, so you would assess whether the chosen stocks delivered on this front.

By closely examining these factors and comparing the performance of the 2023 Dogs of the Dow to historical data and market benchmarks, you can understand how this investment strategy performs and make informed decisions about its suitability for your portfolio. To execute this strategy, you would divide your investment capital equally in ten ways if you utilize the standard Dogs of the Dow strategy. Then, you would use your brokerage account to invest equally in all ten companies. However, if you are using the live list to invest, you would decide how many top Dogs you want to invest in, for instance, fifteen. Then, you would divide your money equally and invest in the top fifteen Dogs.

ETFs and Mutual Funds that Track the Dogs of the Dow

Investors looking to follow the Dogs of the Dow strategy have several options, including Dogs of Dow ETF and Dogs of the Dow mutual fund investments designed to track the strategy. These investment vehicles offer a more diversified and convenient strategy implementation. One such option is the ALPS Sector Dividend Dogs ETF (NYSEARCA: SDOG). This ETF tracks an index composed of the five highest-yielding securities in each of the 11 Global Industry Classification Standard (GICS) sectors. While it doesn't precisely mirror the traditional Dogs of the Dow strategy, this more advanced version of the strategy employs a similar concept of focusing on high-yield dividend stocks.

Another ETF to consider is the Invesco Dow Jones Industrial Average Dividend ETF (NYSEARCA: DJD). This ETF aims to replicate the performance of the Dow Jones U.S. Select Dividend Index, which includes companies with a consistent history of paying dividends. While not explicitly focused on the Dogs of the Dow, it encompasses dividend-yielding stocks, making it a relevant choice for income-seeking investors.

There is the Hartford Dividend and Growth Fund (HDGIX) for those preferring mutual funds. This mutual fund focuses on blue-chip companies known for their dividend payments and capital appreciation potential. It includes most of the stocks commonly found in the Dogs of the Dow strategy.

Investors can choose between these ETFs and mutual funds to gain exposure to dividend-yielding stocks that align with the Dogs of the Dow strategy. It's essential to research each option thoroughly, considering factors such as fees, historical performance and specific stock holdings, to determine which best suits your investment goals and risk tolerance. These investment vehicles provide a convenient way to implement the Dogs of the Dow strategy while benefiting from professional portfolio management and diversification.

Does the Dogs of the Dow Strategy Work?

The Dogs of the Dow strategy has a noteworthy track record that closely mirrors the performance of the Dow Jones Industrial Average (DJIA) over the years. However, its effectiveness can vary depending on the specific time frame and market conditions, with a notable advantage in markets emphasizing value investing principles. The strategy's mechanics are straightforward yet potent. When a DJIA stock experiences a short-term event causing its share price to dip, it can ascend the Dogs list if it maintains a stable dividend yield. Often, these temporary price fluctuations prove to be just that—temporary. Over the year, such stocks can rebound, potentially outperforming the broader market—a key principle of this strategy.

What sets this strategy apart is the availability of real-time data and live lists, providing investors with greater flexibility. While the traditional approach involves selecting and investing in these stocks at the start of the year, a live list enables active investors to modify their portfolio on any trading day. This adaptability empowers investors to seize market opportunities as they arise.

Additionally, with the advent of real-time data and live lists, investors now have greater flexibility in executing the Dogs of the Dow strategy. While the traditional approach involves selecting and investing in these stocks at the start of the year, a live list enables investors to initiate the strategy on any trading day. This adaptability allows investors to capitalize on market opportunities as they arise, making the Dogs of the Dow strategy more dynamic and responsive to ever-changing market dynamics.

By monitoring the live list and identifying a stock entering the Dogs list due to a recent price decline, you might choose to invest in Dow stocks mid-year to capture potential dividend income. Suppose one of your Dogs significantly outperforms the others, and its dividend yield drops below that of other DJIA components. In that case, you can replace it with a higher-yielding stock from the live list.

One notable Dogs of the Dow asset is the ELEMENTS Dogs of the Dow Linked to the Dow Jones High Yield Select 10 Total Return Index (NYSEARCA: DOD). This asset had a long-standing presence in the market from November 7, 2007, until April 12, 2023. Analyzing its historical data can offer valuable insights into the Dogs of the Dow strategy's performance over time.

Unexpected market events or economic conditions might create opportunities. You can adapt your strategy by staying updated with the live list and monitoring dividend announcements. MarketBeat's live list of the Dogs of the Dow offers real-time information on the top dividend-yielding DJIA stocks, enabling you to adjust your portfolio in response to evolving market dynamics. This dynamic approach allows investors to capitalize on opportunities and respond to changing conditions, making the Dogs of the Dow strategy more adaptable and responsive to the market.

Fetching Returns with the Dogs of the Dow

The Dogs of the Dow strategy presents investors with a straightforward yet effective method for capitalizing on the income-generating potential of blue-chip stocks. By honing in on dividends and selecting the highest yielders from the Dow Jones Industrial Average, this strategy offers an accessible approach that doesn't require complex analysis or constant monitoring. Its historical performance often closely aligns with that of the broader market, making it an appealing option, particularly during periods of value-focused investing.

The advent of real-time data and live lists has further enhanced the Dogs of the Dow strategy's appeal. Unlike the traditional approach, which typically kicks off on January 1, active investors now have the flexibility to implement this strategy on any trading day, allowing them to adapt swiftly to changing market dynamics and seize opportunities as they arise.