The aerospace sector has been red hot in 2023. While it was an epicenter sector during the pandemic, positive normalization has finally come to fruition as the travel boom sent airlines into hyperdrive, looking to grow and modernize their fleets. The Boeing Co. NYSE: BA shares have risen to 52-week highs on the accelerating demand for planes. The demand for aircraft has also sent shares of manufacturers, component makers and leasers rocketing higher. Here are two surging aerospace stocks with the potential to reach even higher altitudes.

Spirit is one of the world's largest makers of aerostructures and aircraft components. They make everything from fuselages, flaps, struts and stabilizers to fully functional and tested wind systems. They operate in three segments: Commercial, Defense & Space and Aftermarket. While revenues are climbing from the demand for aircraft as well as defense products and services primarily with the U.S. government, profits are still deep in the red. The company has had its share of issues, ranging from its debt to a capital raise through a $200 secondary offering and the abrupt departure of its President and COO. However, shares are surging to 52-week highs on the very bullish sentiment of its reorganization plan.

Strong top and improving bottom line

Spirit reported a loss of $1.42 per share in Q4 2023. It still beat consensus analyst expectations for a loss of $1.54 by 12 cents. Revenues surged 12.7% to $1.44 billion, falling short of the $1.46 billion consensus analyst estimates.

Revenue by segment

The Commercial segment revenues rose 10% YoY to $1.1 billion due to higher production across most programs. Defense & Space revenues rose 27% YoY to $205.7 million primarily due to increased activity on development programs and the KC-46 Tanker program. Aftermarket segment revenues rose 21% YoY to 96.8 million due to higher spare parts sales.

Deliveries increased to 332 chipsets, up from 316 chipsets in the year-ago period, which includes 83 Boeing 737 chipsets compared to 69 in the year-ago period. Spirit's backlog was nearly $42.2 billion, which includes all the work packages on all commercial platforms in the Boeing and Airbus backlog.

Interim CEO comments

Spirit appointed Pat Shanahan as interim President and CEO. Shanahan commented, "Our priority is to strengthen Spirit financially. Signing the memorandum of agreement with Boeing was an important step forward. In parallel, the Spirit team is focused on meeting our customer commitments, improving operational performance and commercial conversations with Airbus."

Full-year 2023 outlook

Cash used in operations for the full year 2023 is expected to be between $150 million and $200 million. The full-year free cash flow is expected to be between $275 million and $325 million, reflecting lower projected Boeing 737 deliveries of 345 to 350 units for the year.

Spirit AeroSystems analyst ratings and price targets are at MarketBeat. Spirit AeroSystem's peer and competitor stocks can be found with the MarketBeat stock screener.

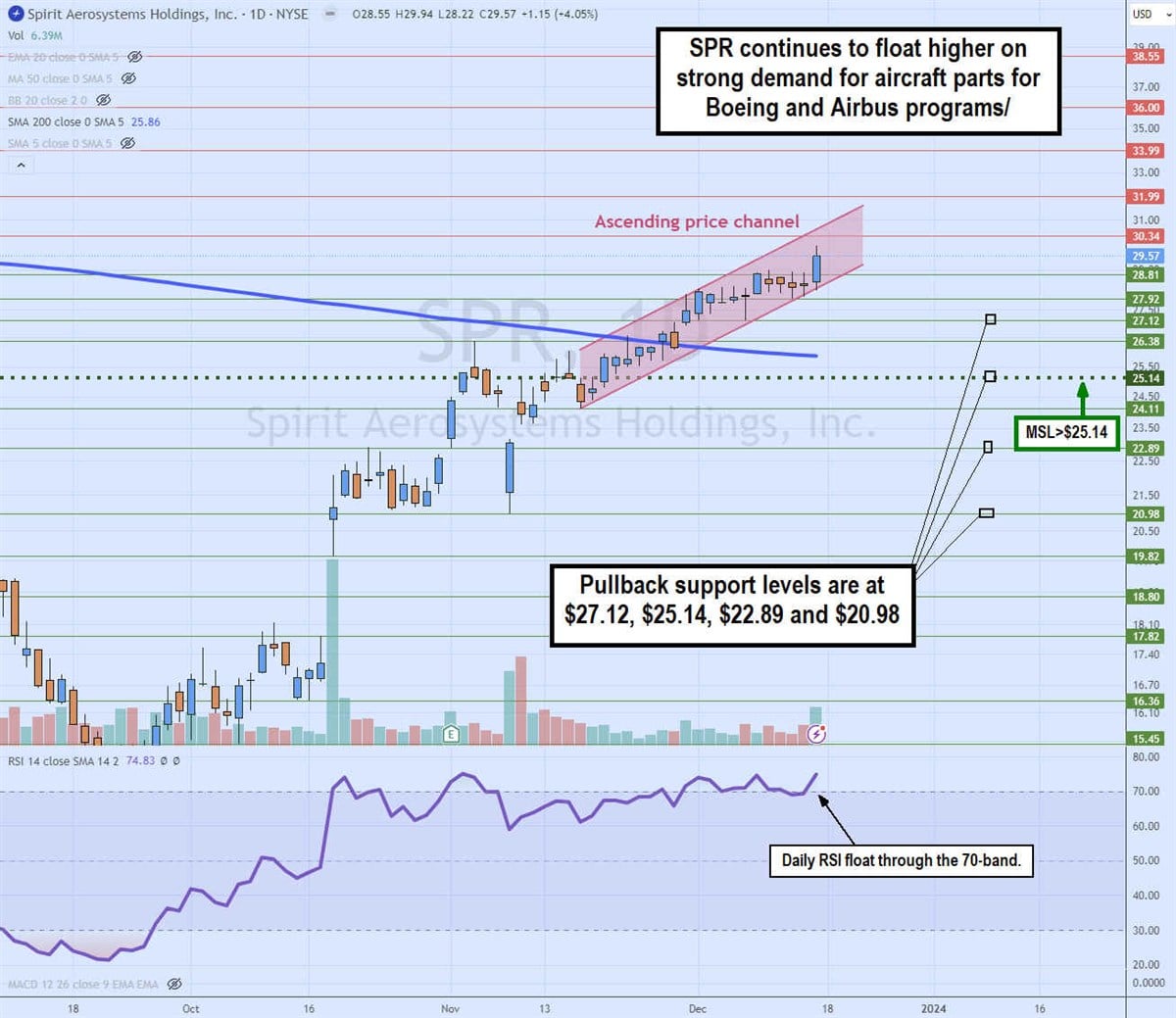

Daily ascending price channel

The candlestick chart on SPR illustrates an ascending price channel comprised of higher highs and higher lows. The channel commenced at $24.11 as the daily market structure low (MSL) breakout formed on the $25.14 trigger. Shares continued to grind higher through the daily 200-period moving average resistance, which has now become a support at $25.86. The daily relative strength index (RSI) has steadily been climbing through the 70-band as SPR floats higher. The pullback support levels are at $27.12, $25.14, $22.89 and $20.98.

FTAI leases and sells its commercial aircraft, which mainly consist of Boeing 737s and Airbus A320s, to airlines and leasing companies worldwide. It also has several joint ventures that manufacture aftermarket components and repair jet engines for resale. The company competes with large aircraft leasing companies like Air Lease Co. NYSE: AL and AerCap Holdings N.V. NYSE: AER.

Quick Turn full ownership acquired

FTAI acquired full ownership in Quick Turn Engine Center after buying out the remaining 50% stake from Unical Aviation Inc. This continues to support the growing pipeline of CFM56 engine maintenance with its additional capacity. It also enables tighter integration and delivery of The Module Factory products and services. The Module Factory is a commercial engine maintenance center housed in a 500,000-square-foot facility in Montreal, Canada, owned and operated by FTAI Aviation in collaboration with Lockheed Martin Co. NYSE: LM.

Top and bottom line miss

FTAI reported a profit of 33 cents per share in Q3 2023, missing consensus analyst estimates by 9 cents. Revenues surged 26.3% to $291.1 million, falling short of analyst estimates of $299.85 million.

Acquired 10 more aircraft and 23 engines

Aerospace Products revenue rose to $107.1 million, generating an adjusted EBITA of $40.6 million at a 38% margin. The company closed on its purchase of 23 engines and 10 aircraft at "attractive prices," which will contribute to further Leasing EBITDA. The company sold 41 modules to 11 unique customers, which included two new and nine repeat customers. The company declared a 30 cents per share cash dividend.

FTAI Aviation CEO Joseph Adams commented, "Based on a strong backlog and an expanding customer base, we are looking for $200 million to $250 million of Aerospace Products EBITDA in 2024, up from $98 million year-to-date 2023 and $70 million in 2022. Overall, we therefore expect annual aviation EBITDA for 2024 to be between $675 million and $725 million, not including Corporate and Other."

FTAI Aviation analyst ratings and price targets are at MarketBeat.

Daily bull flag breakout

The daily candlestick chart on FTAI illustrates a bull flag breakout. This triggered the daily MSL breakout at $42.34, surging shares to peak at $45.73. The daily RSI fell back under the overbought 70-band. Pullback support levels are at $42.34 daily MSL trigger, $40.29, $37.70 and $36.02.

Before you consider Spirit AeroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spirit AeroSystems wasn't on the list.

While Spirit AeroSystems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.