In uncertain macroeconomic climates, conscious consumers try to stretch their dollars at dollar stores. These microenvironments should be strong drivers for these discount retail sector stocks. However, a rift has formed between two of the largest dollar store franchises, where they are taking different paths on the same coin. Here are two dollar stores with different outcomes on their paths to profitability.

Dollar Tree Stock Outlook

Dollar Tree Inc. (NASDAQ DLTR) operates two brands in the dollar store segment, Dollar Tree and Family Dollar. These stores sell household products, food, candy, frozen foods, seasonal items, greeting cards, toys and party items. Most items at Dollar Tree cost around $1.25 or more. The average store ranges in size from 8,000 to 12,000 square feet with a minimum of 70 feet of frontage.

Migration to Dollar or More Stores

The dollar doesn't seem to buy what it used to these days. To keep margins from collapsing, Dollar Tree has signaled that it will be increasing its prices to different dollar increments. The $3 and $5 center-store merchandise is now available at nearly 5,000 Dollar Tree stores. The $3, $4, and $5 frozen refrigerated items are available are over 6,500 Dollar Tree stores.

Swing and a Miss for Dollar Tree

On March 13, 2024, Dollar Tree reported EPS of $2.55, missing consensus analyst estimates for $2.67 by 12 cents. Diluted loss per share was $7.85. Revenues rose 11.9% YoY to $8.63 billion, falling short of the $8.66 billion consensus analyst estimates. Enterprise same-store net sales rose 3%, driven by a 4.6% increase in traffic and partially offset by a 1.5% decrease in average tickets. The results include a $594.4 million charge for portfolio optimization, a $950 million trade name intangible asset impairment charge and a $1.07 billion goodwill impairment charge.

Store Closings Identified

The Dollar Tree segment comps rose 6.3% YoY, driven by a 7.1% increase in traffic offset by a 0.7% decline in average tickets. Familiar Dollar comps fell 1.2% YoY, driven by a 0.7% increase in traffic, partially offset by a 2% drop in average tickets. The company identified 600 Family Dollar stores for closure in the first half of 2024 and an additional 370 stores as their leases expire. The company opened 219 new stores in the quarter, for a total of 641 new store openings in 2023. Get AI-powered insights on MarketBeat.

Lowered Guidance

Dollar Tree lowered guidance for its fiscal Q1 2024 EPS to $1.33 to $1.48 versus $1.71 consensus analyst estimates. Revenues are expected between $7.6 billion to $7.9 billion versus $7.68 billion consensus estimates. Guidance is based on low-to-mid single-digit increase in same-store sales for the enterprise and Dollar Tree segment and approximately flat same-store sales growth in the Family dollar segment.

For full-year 2024, The company sees EPS between $6.70 to $7.70 versus $7.04 consensus estimates. Full-year 2024 revenues are expected to be $31 billion to $32 billion versus $31.72 consensus estimates.

CEO Comments

Dollar Tree CEO Rick Dreiling commented, "While we are still in the early stages of our transformation journey, I am proud of what our team accomplished in 2023 and see a long runway of growth ahead of us. As we look forward to 2024, we are accelerating our multi-price rollout at Dollar Tree and taking decisive action to improve profitability and unlock value at Family Dollar."

Dollar Tree analyst ratings and price targets are at MarketBeat. The MarketBeat stock screener can help you find Dollar Tree’s peers and competitor stocks.

Daily Ascending Triangle Breakdown

The daily candlestick chart on DLTR illustrates an Ascending triangle breakdown pattern. The ascending trendline commenced at $102.77 on October 5, 2023. DLTR rose to the flat-top upper trendline resistance at $148.69 into earnings. However, the earnings miss and lowered guidance resulted in a gap down through the ascending triangle. The 14% gap down formed at $133.37 as shares continued to sell off afterward. The daily relative strength index fell sharply through the 30-band but may be attempting to coil a bounce. Pullback support levels are at $118.60, $111.91, $102.77 and $94.01.

Dollar General Stock Outlook

Dollar General Co. NYSE: DG operates over 17,000 stores across 46 states in the country. While Dollar General is a discount retailer, the products and goods are more priced above $1, usually falling into the $5 or more category. Because of the high price points, Dollar General is able to provide more merchandise, including groceries, fruits, deli meats and dairy products. In fact, Dollar General functions as a tiny box store averaging 7,400 square feet located in small and rural towns with a population of 20,000 or less. It's a big fish in a tiny pond model. Get AI-powered insights on MarketBeat.

A Better Quarter than Dollar Tree

Dollar General reported Q4 2023 EPS of $1.83, beating analyst expectations of $1.73 by 10 cents. Revenues fell 3.4% YoY to $9.86 billion, beating $9.77 billion consensus expectations. Fourth-quarter same-store sales rose 0.7% YoY, and fiscal year same-store sales rose 0.2%. The company returned to positive same-store sales after two prior quarters of negative same-store sales. Customer traffic rose 4%, offset by a decline in average tickets from a few items per basket. This underscores the sentiment that consumers are still reeling from inflation, causing trade downs in the stores. The Board of Directors declared a cash dividend of 59 cents per share.

Mixed Guidance for Dollar General

Dollar General provided downside guidance for Q1 2024 EPS of $1.50 to $1.60 versus $1.88 consensus analyst estimates. Sale store sales are expected to rise 1.5% to 2%. Full-year 2024 EPS is expected between $6.80 to $7.75 versus $7.42 consensus estimates. Full-year revenues are expected to rise 6% to 6.7% or $41 billion to $41.3 billion versus $40.27 billion. Same-store sales growth is expected between 2% to 2.7%.

Expansion Plans

In 2023, Dollar General executed over 3,000 real estate projects, including 987 new stores, 129 relocations, and 2,007 remodels. This momentum is expected to continue into 2024 as the company plans on nearly 2,385 projects, which include 800 new store openings, 1,500 remodels and 85 relocations. Stores planned to open include 30 top-shelf stores and up to 15 stores in Mexico.

CEO Insights

Dollar General Todd Vasos noted that the revenue decrease was primarily driven by the lapping sales of $678 million from the 53rd week in 2022. Its net sales performance was highlighted by accelerating its market share growth in units and dollars of consumable product sales. Fresh produce is available in 5,400 stores, and up to 1,500 additional stores are expected to carry it in 2024.

Vasos commented, “As we embark on our 85th year in business, and with store locations within five miles of approximately 75% of the U.S. population, we are uniquely positioned as a growth company that is privileged to be here for what matters for millions of customers across the country.”

Dollar General analyst ratings and price targets are at MarketBeat. The MarketBeat stock screener can help you find Dollar General’s peers and competitor stocks.

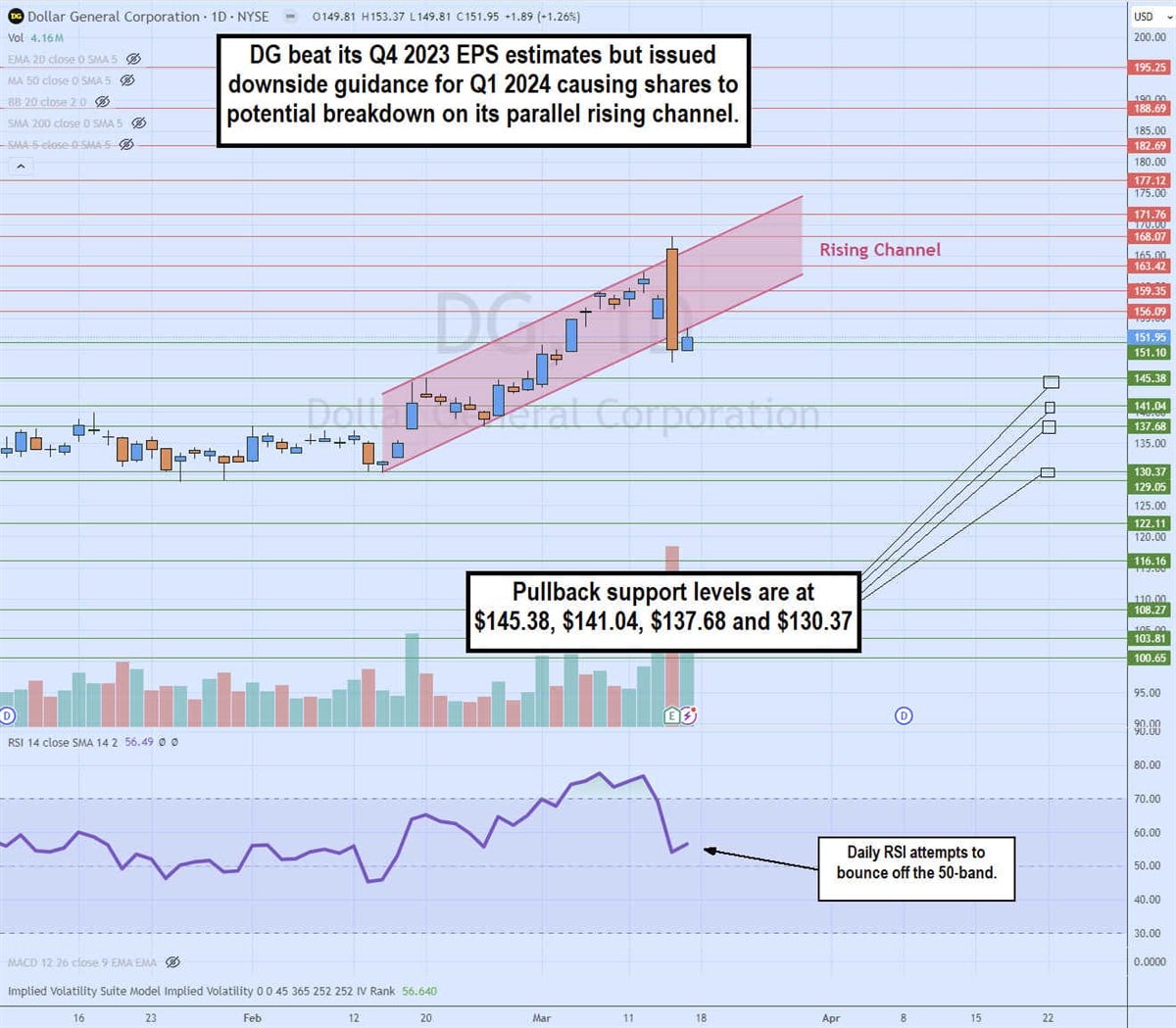

Daily Rising Channel Breakdown

The daily candlestick chart on DG illustrates a potential rising channel breakdown. The rising channel is comprised of parallel trendlines formed off the swing low at $130.37 on February 14, 2024. The breakout attempt as the upper resistance channel line initially attempted to break out on a 6% price gap, only to be faded on the gap and crap reaction that caused shares to end down 5%. The daily RSI is attempting to bounce off the 50-band. Pullback support levels are at $145.38, $141.04, $137.68 and $130.37.

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report