With sales of electric vehicles expected to rise in the coming years, EV suppliers such as

Luminar Technologies NASDAQ: LAZR and

Wolfspeed NYSE: WOLF saw large post-earnings bounces recently.

A February study from S&P Global Platts Analytics found that “global light duty electric vehicle sales reached a record high of 6.3 million units in 2021, up 102% year on year, with this number expected to rise to 26.8 million units in 2030.”

The updated 2030 forecast is 23% higher than an earlier forecast, published in June 2021.

Platts Analytics Low Carbon Transport Analyst David Capati said in a statement that the forecast was upped due to several factors, including faster-than-expected consumer adoption, increased policy support and pressure from governments.

When an industry is poised for growth over the medium-to-long term, companies that supply that industry can also show significant gains.

More Deals With EV Makers

Luminar, which makes sensors for autonomous vehicles, with the aim of increasing safety, last year said its lidar sensors would be incorporated into EVs manufactured by SAIC Motor, China’s largest automaker.

Luminar also has deals with Volvo, Daimler Truck AG and Intel’s NASDAQ: INTC Mobileye, among others.

On August 8, Luminar reported a second-quarter loss of $0.18 per share on revenue of $9.9 million. Revenue was ahead of company expectations and marked a 57% year-over-year gain, and a gain of 45% sequentially.

The company raised its full-year 2022 revenue outlook to a range of $40 million to $45 million, up from previous guidance of $40 million.

Luminar went public in December 2020, merging with special purpose acquisition company Gores Metropoulos. It’s not at all unusual to see new companies in fast-paced businesses put an emphasis on growth as opposed to profitability.

Yes, that has echoes of the dot-com boom in the late 1990s, when investors piled into all manner of unprofitable Internet companies. However, there is also some validity to the notion of investing in ramping up the business operations, with an eye on eventual profitability.

The stock climbed 46% in heavy volume the week of its report, indicating strong institutional buying. It’s pulled back somewhat since the week ended August 19, but that’s very common, as some investors take profits after a big run-up.

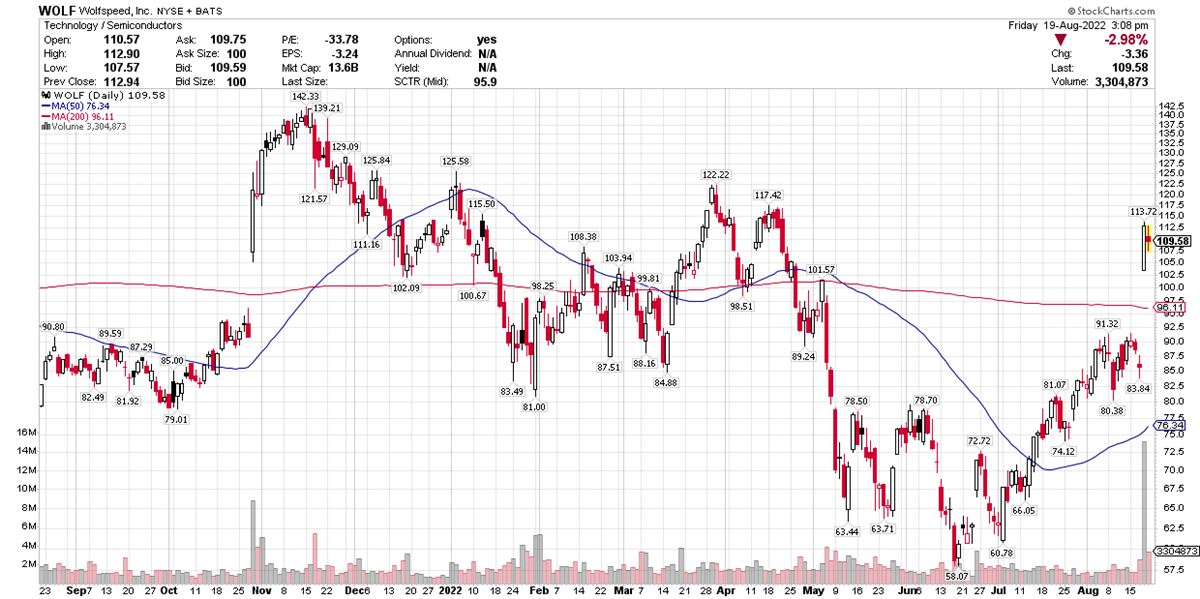

Chip maker Wolfspeed is also racing ahead on exposure to the EV industry. The stock rocketed 31% in July and is up another 33% so far in August.

Wolfspeed Gaps Up 32%

Wolfspeed is a market leader in Silicon Carbide and gallium nitride (GaN) technologies. Its product lines include Silicon Carbide and GaN materials, power devices and radio frequency devices for various applications including electric vehicles, fast charging, 5G, renewable energy and storage, as well as aerospace and defense.

It gapped up nearly 32% in one day, August 18, following the company’s fourth-quarter report that handily trounced views.

Wolfspeed’s revenue climbed 56.7% year-over-year to $228.5 million, outpacing estimates by about $21 million. Despite reporting a loss of $0.02 per share, that was also a beat. Analysts had expected a $0.10 per share loss.

According to MarketBeat earnings data, it marked the fifth quarter in a row that Wolfspeed topped bottom-line estimates.

The company also said it expects revenue in a range between $232.5 million and $247.5 million in the current quarter, also above forecasts.

Analysts expect Wolfspeed to swing to profitability in fiscal 2023, with earnings of $0.15 per share. In fiscal 2024, profit is expected to leap to $1.74 per share.

The stock has been correcting since November, essentially in tandem with the S&P 500 and Nasdaq Composite. But unlike many stocks, as well as the broader indexes, Wolfspeed has been shown price gains on a one-year basis, as well as year-to-date.

Clearly, companies involved in high-potential businesses, such as the EV industry, appear well positioned to post further gains in the coming years. Investors sometimes need to exercise some patience, if they intend to hold one of these stocks for any length of time, in the hope of capturing monster gains.

It’s worth noting that even leading stocks such as Amazon NASDAQ: AMZN slogged through times of correction before rebounding to become big leaders. There’s no guarantee about any stock’s future potential, of course, but sometimes, if you have conviction in a stock, patience may be all that’s needed.

Before you consider Luminar Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Luminar Technologies wasn't on the list.

While Luminar Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report