Gene-editing companies are making headlines for the potential to reshape the future of healthcare and the treatment of hereditary diseases. The U.S. Federal Drug Administration (FDA) approved a sickle-cell disease treatment, Casgevy, utilizing gene-editing technology developed by Vertex Pharmaceuticals Inc. NASDAQ: VRTX and CRISPR Therapeutics AG NASDAQ: CRSP. Controversy also surrounds the potential to create customized babies and build genetically altered super soldiers like Captain America.

But that’s getting ahead of the technology in the medical sector. Science fiction aside, the practical applications are to correct genetic disease-causing mutations.

CRISPR/Cas9 technology

A primary method relies on utilizing clustered, regularly interspaced short palindromic repeats (CRISPR) gene-editing technology. Using a guide RNA like a homing missile attached to the Cas9 enzyme, which acts like molecular genetic scissors, CRISPR can track down the targeted genetic sequences and cut them out of the genome.

Scientists can then edit the remaining genome with new or modified sequences. Here are two gene-editing companies that are evolving the technology and enhancing the landscape of science.

Editas Medicine Inc. NASDAQ: EDIT

As amazing as the human body is, it isn’t perfect. Unfortunately, there are errors in the human genome that are responsible for various rare and genetic diseases for the unlucky. Editas seeks to correct the disease-causing mutations utilizing both Cas9 and its proprietary AsCas12a technology. They seek to repair broken genes. The company has $446 million in cash, which is enough to fund it through to Q3 2025.

Love-hate relationship with CRISPR Therapeutics

Unlike CRISPR Therapeutics, which uses ex-vivo gene therapy, which takes the cells out of the body to modify in a lab and infuses them back into the body, Editas uses in-vivo to deliver the genes directly into the cells in the body. According to Editas, AsCas12a has demonstrated superior characteristics that increase efficiency and significantly reduce off-target editing compared to Cas9 and other CRISPR nuclease.

Incidentally, Editas has a love-hate relationship with CRISPR Therapeutics as they are both pioneers in CRISPR gene-editing technology. They initially collaborated on gene editing for Duchenne muscular dystrophy and then competed and have been locked in complex ongoing legal disputes over various Cas9 patents. Get AI-powered insights on MarketBeat.

EDIT-301 in-vivo approach

Editas is primarily focused on its experimental in-vivo AsCas12 gene-editing therapy called EDIT-301, which is used for the design of reni-cel. In-vivo is much more scalable and sustainable than ex-vivo, which is often used for proof of concept purposes. EDIT 301 is used for the treatment of sickle cell disease (SCD), which requires a lifetime of treatment, shortening lifespan to a median age of death of around 45 years. Check out the sector heatmap on MarketBeat.

Cas9 licensing and royalties

It is lagging behind Casgevy, the ex vivo treatment developed by CRISPR Therapeutics and Vertex Pharmaceuticals, which was granted FDA approval on Dec. 8, 2023. Editas has a non-binding license agreement for Cas9 with Vertex Pharmaceuticals, in which they collect licensing and royalties.

Casgevy showed efficacy in 16 out of 17 patients for primary endpoint freedom from vaso-occlusive crises (VOCs) for at least 12 months. Editas collects licensing fees and royalties and will go to market with EDIT-301, which takes an ex vivo approach utilizing AsCas12a. Editas also entered into a Cas9 licensing agreement with Vor Bio for the development of ex vivo Cas9 gen edited hematopoietic stem cell (HSC) therapies.

RMAT designation granted by FDA

EDIT-301 enrolled 27 patients with SCD and eight patients with transfusion-dependent beta-thalassemia (TDT) for the RUBY (Phase 1) and EdiTHAL (Phase 2) clinical trials. The FDA granted EDIT-301 a regenerative medicine advanced therapy (RMAT) designation, which is better than a fast-track or breakthrough therapy indication.

It enables an expedited process and rolling review of their biological license application, which can accelerate its path to the market exponentially.

Editas Medicine analyst ratings and price targets are at MarketBeat. Editas Medicine peers and competitor stocks can be found with the MarketBeat stock screener. Editas has an 18.33% short interest.

Daily Golden Cross breakout

The weekly candlestick chart on EDIT illustrates a Golden Cross pattern. The daily 50-period moving average at $9.22 crossed over the 200-period moving average at $8.62 for a breakout and uptrend. Preceding the breakout, EDIT shares bottomed at $6.08 on Oct. 3, 2023, and formed a daily market structure low (MSL) buy trigger on at breakout through $6.97.

Shares climbed higher after the breakout to rally up through the $9.44 prior resistance and squeeze up to a peak of $11.69. The daily relative strength index (RSI) is falling through the 50-band. Pullback support levels are at $9.44, $8.26, $7.66 and $7.15.

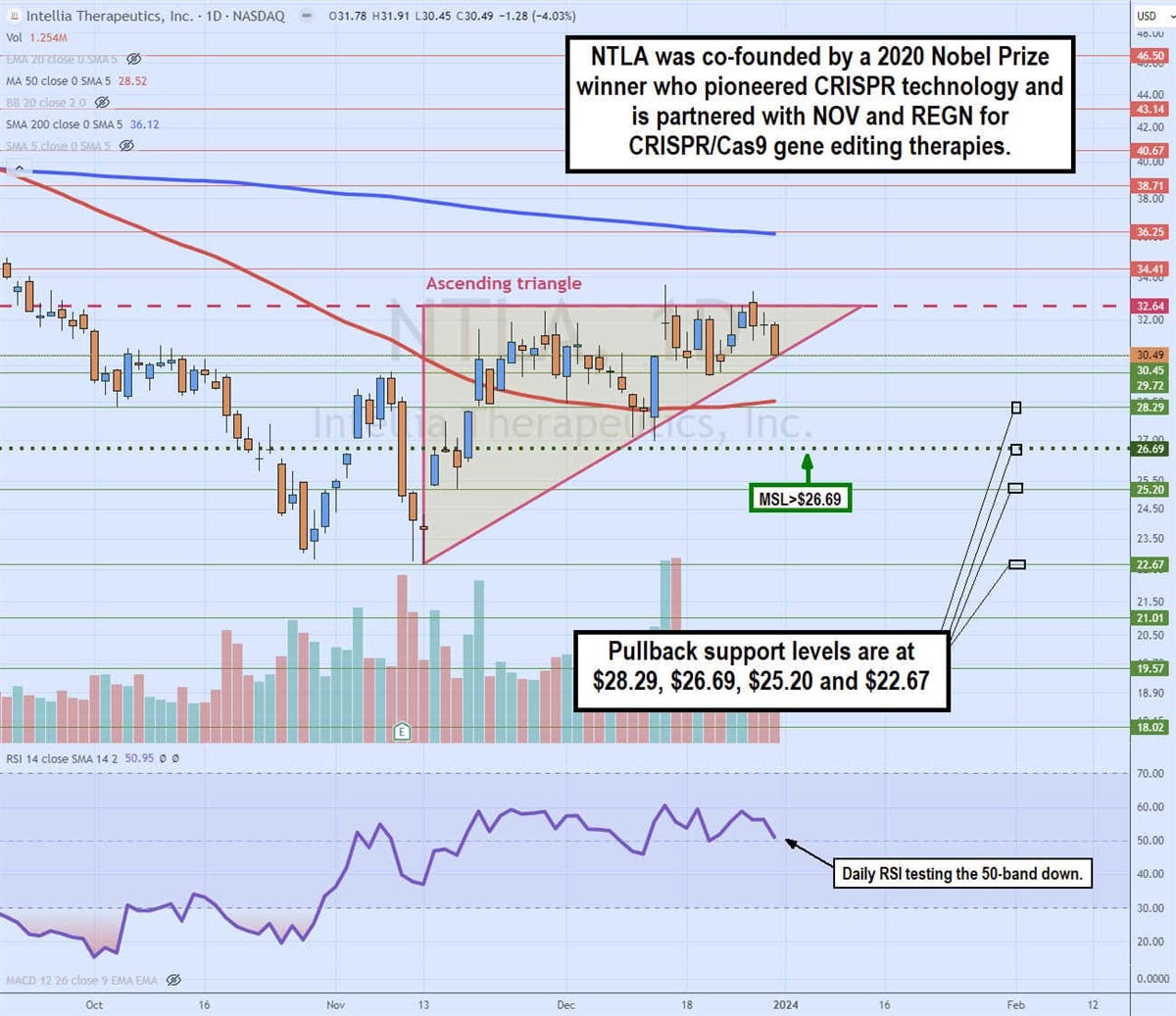

Intellia co-founder Jennifer Doudna is one of the pioneers in CRISPR technology who won the 2020 Nobel Prize. Intellia is a gene-editing company focused on in-vivo and ex-vivo CRISPR/Cas9 therapies for genetic diseases, autoimmune diseases and immuno-oncology.

They have heavyweight partners with Regeneron Pharmaceuticals Inc. NASDAQ: REGN to develop CRISPR/Cas9 liver therapies and Novartis AG NYSE: NOV to develop advanced CRISPR/Cas9 therapies utilizing chimeric antigen receptor T cells (CAR-T cell). The company has $992.5 million in cash and cash equivalents, which are enough to fund operations beyond 24 months.

NTLA-2001

Intellia's lead candidate is NTLA-2001, which uses in-vivo CRISPR/Cas9 to edit out the function of a flawed gene in the liver to treat transthyretin (ATTR) amyloidosis, a rare and often fatal disease causing abnormal protein deposit buildup (amyloids) caused by TTR proteins misfolding and clumping together to damage organs like the heart, intestines, liver and kidneys.

NTLA-2001 uses CRISPR/Cas9 delivered via lipid nanoparticles to target and deactivate the TTR gene responsible for producing the flawed protein that forms amyloid deposits. This prevents new amyloid deposits and enables the breakdown of existing ones to reduce damage to organs and improve symptoms.

Intellia partnered with Regeneron for this single-injection treatment. This therapy is awaiting FDA clearance to commence Phase 3 clinical trials.

Pipeline of Treatments

Intellia’s in-vivo pipeline has NTLA-2002 for hereditary angioedema in early-estate clinical development as Phase 2 enrollment is complete, with results expected in 2024. Its NTLA-2003 for AATD-Liver Disease and NTLA-3001 for AATD-Lung Disease treatments, and various hemophilia disease treatments are in the investigational new drug (IND)-enabling the pre-clinical stage.

Its ex-vivo programs are in the IND and research stages for the treatment of lymphomas, leukemia, solid tumors, and various immuno-oncology and autoimmune diseases.

Intellia Therapeutics analyst ratings and price targets are at MarketBeat. Intellia has an 11.72% short interest.

Daily ascending triangle

The daily candlestick chart on NTLA illustrates an ascending triangle comprised of higher lows and a flat-top upper trendline at $32.64. The ascending trendline commenced on Nov. 13, 2023, as NTLA hit a $22.67 low. The daily MSL trigger formed the following day at $26.69 on the high of the higher-low candle.

NTLA staged a rally back to the flat-top resistance area around $32.64, and each rejection led to a higher low, as indicated by the ascending trendline. NTLA is trading close to the apex point, where it will either break out through the flat-top trendline or break down through the ascending trendline. Pullback support levels are at $28.29, $26.69, $25.20 and $22.67.

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report