The third-quarter 2023 earnings season is in the books as markets prepare for the year-end holiday shopping season. Sports retailers showed very impressive performance in Q3 2023 and raised their outlook for Q4 2023.

An investor would assume that a blowout performance and raised forecast would result in shares gapping sharply and rising higher. When consumer discretionary retailers like Target Co. NYSE: TGT achieved a 17% price gap that rose to 20% in the following days after a strong Q3 and tempered Q4 guidance, one would assume at least the same for a retailer that achieved even better results with a raised outlook.

Here are two sports retailers with a 10% short interest that crushed earnings estimates and raised Q4 2023 guidance, resulting in a price gap that sold off afterward.

As the nation's largest retail sporting goods chain, Dick's Sporting Goods has grown from a single store in 1948 to 869 locations. Today, this footprint covers 47 states and includes many specialty store brands like House of Sport and Golf Galaxy.

The company owns an 8% market share in the category. Its big box stores average 50,000 to 80,000 square feet, offering a broad selection of sporting equipment, athletic apparel, footwear and outdoor gear. DICK's has been rolling out its DICK'S House of Sport concept stores, which feature rock climbing walls, ice rinks and batting cages, which 9 of the 12 locations opened in 2023.

Improved margins and inventory reduction

The theme in 2023 among retailers is reducing inventory to boost margins. DICK'S hit the mark with its Q3 2023 earnings release. The company reported non-GAAP EPS of $2.85 versus $2.45 consensus analyst estimates, a 40-cent beat. Net income was $201 million, and non-GAAP net income was $240 million. Merchandise margins had a 23 basis point (bps) improvement in October. Shrink (theft) remains a problem as it cut 50 bps from margins but still achieved 10% bottom line growth.

Raising the bar

DICK'S raised its full-year 2023 non-GAAP EPS forecast of $12.00 to $12.60 versus $11.78 consensus analyst estimates. This excludes business optimization charges of $62.5 million. Comparable store sales growth is expected to be between 0.5% and 2%, up from previous guidance of flat to 2% on a 52-week basis. Cap-exp is expected to be $670 million to $720 million on a gross basis and $550 million to $600 million on a net basis.

CEO Insights

DICK'S CEO Lauren Hobart noted that the solid back-to-school season helped drive robust sales. Comps were driven by increases in average ticket and transactions from more athletes spending more per trip. The company will expand on concepts like House of Sport and the new next-generation 50,000-square-foot prototype. DICK's House of Sport opened two new locations at the start of Q3 2023, for a total of 12 locations, of which 9 were opened in 2023. The company plans to open 10 more locations in 2024 and have 75 to 100 open by 2027. Next-gen DICK's has 12 open locations showing relatively good performance.

There are 13 Golf Galaxy Performance Centers and 100 Golf Galaxy stores, with plans to open 40-50 performance centers in the next four years. She concluded, "In closing, we're very pleased with our strong third-quarter results and remain enthusiastic about the future of our business. We're excited for the upcoming holiday season and the product, service and experience we're providing to our athletes."

DICK'S Sport Goods analyst ratings and price targets are at MarketBeat. DICK'S peers and competitor stocks can be found with the MarketBeat stock screener.

Daily cup and handle breakout and earnings gap and crap

DKS shares initially gapped over 12% the following morning after its Q3 2023 earnings release. Shares peaked at $133.82 early on before selling off near the daily lows at $121.57. Shares fell back under the daily market structure low (MSL) trigger at $126.62 and the daily 200-period moving average at $126.99. This is the very definition of a gap and crap. Shares were able to bottom out at $120.11 the following day before attempting to stage a rally back to $123.28.

Prior to earnings, the daily candlestick chart displayed a cup and handle breakout as shares retested the cup lip line at $117.71, rising to $120.11 in the earnings report. The daily relative strength index continues to rise to the overbought 70 band. Pullback supports are at $117.71, $112.77, $110.06 and $105.15.

As the operator of City Gear and Hibbett sports stores, Hibbett carries a smaller footprint than DICK'S in terms of sales and size of locations. While DICK'S stores are massive 50,000 to 80,000 square feet behemoths, Hibbett operates over 1,100 stores that average around 5,000 to 6,000 square feet serving small to mid-sized markets, often in shopping malls and strip centers.

Its stores sell athletic apparel, footwear, accessories and team sports equipment through its brick-and-mortar stores and online. Unlike Foot Locker Inc. NYSE: FL, Hibbett continues to carry Nike Inc. NYSE: NKE merchandise as they signed a Connected partnership that connects Hibbett and Nike loyalty programs.

EPS crushed, but revenues fall

Hibbett reported fiscal Q3 2024 EPS of $2.05, beating consensus analyst estimates for $1.18 by hopping 87 cents. Revenues fell 0.3% YoY to $431.9 million, beating consensus analyst estimates of $416.17 million. Comparable store sales fell 2.7% YoY. Brick-and-mortar comparable sales fell 5.4%, while e-commerce sales rose 12.6% YoY. The company also gained from a strong back-to-school season.

Team sports and apparel were the weakest segments in the quarter. Product margins fell 40 bps to 33.9%, driven by lower product margin, which was 130 bps lower YoY. Higher promotional activity across footwear and apparel and YoY sales declines were partially offset by lower freight, shipping, shrink and logistics expenses.

Raising full-year fiscal 2024 guidance

Hibbett raised fiscal full-year 2024 EPS to $8.00 to $8.30, up from prior guidance of $7.00 to $7.75 versus $7.27 consensus analyst estimates. Fiscal full-year 2024 revenues are expected to be flat to up 2% or $1.708 billion to $1.742 billion versus $1.720 billion analyst estimates.

Hibbett CEO Mike Longo commented, "As we enter the fourth quarter and our busy holiday selling season, we believe we are well positioned for a strong finish to Fiscal 2024. We expect to benefit from additional new product launches that will continue to attract and retain customers and extend our market reach."

Hibbett analyst ratings and price targets are at MarketBeat.

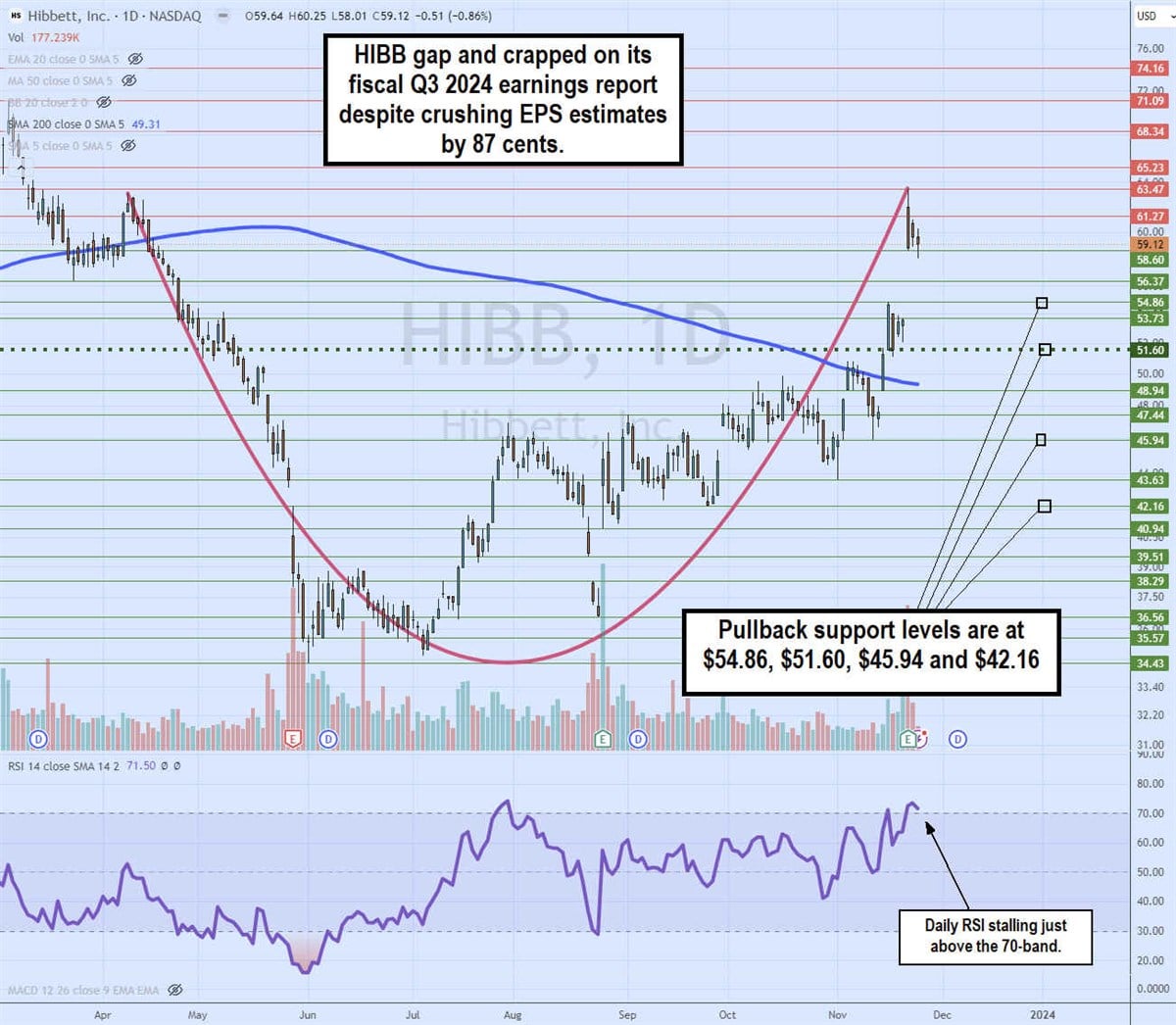

Daily cup completion

The daily candlestick chart on HIBB illustrates the cup completion near $63.47. The cup lip line commenced in April 2023 before sinking to a low of $34.43 by June 2023. HIBB continued to make higher lows heading into the fiscal Q3 2024 earnings report. Shares gapped to a high of $63.47 the following day before sinking to close at $58.85 on a gap and trap. The daily RSI is stalling just above the overbought 70-band. Pullback support levels are at $54.86, $51.60, $45.94 and $42.16.

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report