The technology sector, which has been the top-performing sector this year, has seen a minor decline this week. The Invesco QQQ Trust NASDAQ: QQQ has retreated by 1.38% this week. Although the ETF's value is still comfortably above its steadily increasing 200-day SMA, it dipped below its 20-day SMA this week and is presently trading at its 50-day SMA level.

It's important to note that the sector is still firmly in an upward trend that began earlier this year. As a result, this pullback could offer an excellent opportunity for patient investors who have been observing from the sidelines. Two prominent stocks within the sector that provide a favorable risk-to-reward ratio compared to the overall sector are Microsoft NASDAQ: MSFT and Apple NASDAQ: AAPL.

Microsoft NASDAQ: MSFT

Microsoft operates worldwide by creating, licensing, and offering support for software, services, devices, and solutions. Its operations are divided into three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. In 2022, Microsoft's Azure platform held a significant global presence, powering over 20% of the Cloud market share, securing its position as the second-largest player in the industry. Microsoft is the second largest company in the world by market capitalization, with a current market cap of $2.4 trillion.

Last month MSFT made a new all-time high as the stock reached $366.78. However, since achieving new heights, shares have pulled back to a current price of $322. Even after experiencing a significant pullback from the high, the stock remains in a firm uptrend on the year, up almost 35% year-to-date, trading well above its rising 200-day SMA. $320 serves as an important area of support. Therefore, a solid buying opportunity could emerge if the stock can firm up in this area and digest the recent pullback.

Analysts agree, with a consensus analyst price target of $371.84, predicting a 15.14% upside for the stock. Based on the thirty-five analyst ratings, the stock has a rating of Moderate Buy, with thirty-one analysts rating MSFT as a Buy.

Apple NASDAQ: AAPL

Apple is the most valuable company in the world, boasting a valuation greater than most countries' GDP, with a market capitalization of nearly $2.8 trillion. The company creates and sells smartphones, computers, tablets, wearables, and accessories globally. Apple also offers platforms, services, and a popular digital ecosystem centered around the Apple App Store. This ecosystem includes a vast collection of games, apps, and digital content such as music, TV shows, movies, books, podcasts, and more.

Similarly to MSFT, shares of AAPL hit a new all-time high in July when the stock reached $198.23. However, since doing so, shares have pulled back to $177.97. The pullback might be welcomed by many investors looking to add or initiate a position in AAPL, as the stock was yet to pull back since beginning its uptrend at the start of the year.

Year-to-date, shares of AAPL are up almost 37%, and the recent pullback off the highs represents the first time the stock has pulled back since March 2023. Currently trading near an important area of support, near $175, investors will want to see the stock firm up and put in a bottom, which could indicate a great spot to pick up some shares.

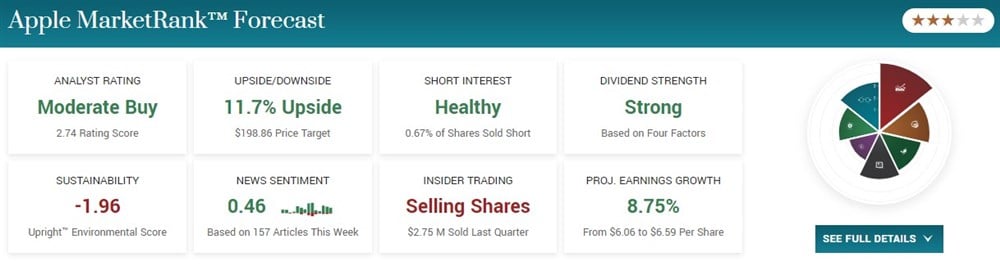

Of the thirty-five analyst ratings on AAPL, twenty-six rate AAPL as a Buy and nine as a Hold. Based on the thirty-five ratings, the stock has a consensus rating as a Moderate Buy and a consensus price target predicting 11.74% upside, with a $198.86 price target.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.