Recent IPOs

ZIM Integrates Shipping Services (NYSE: ZIM),

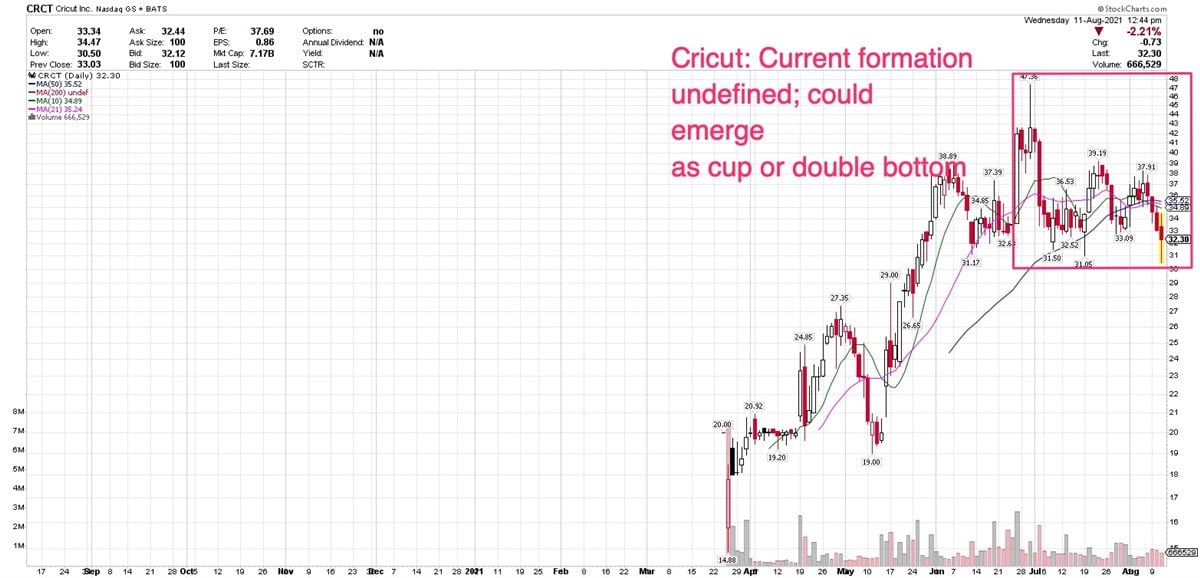

Cricut NASDAQ: CRCT and

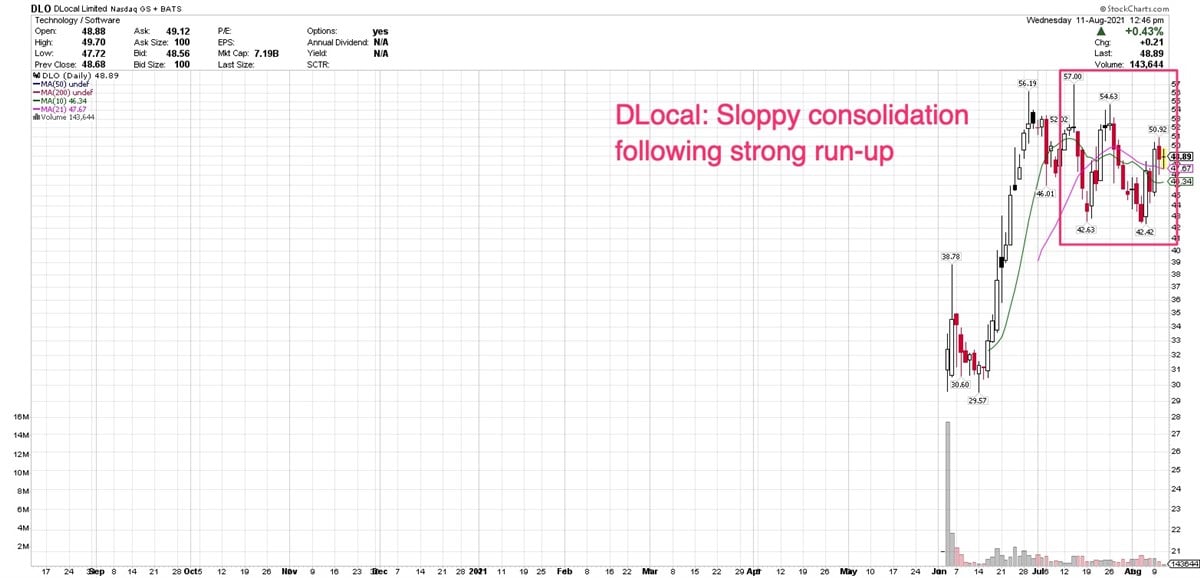

DLocal (NASDAQ: DLO) are showing behaviors very typical of promising young stocks.

All three rose higher after their initial public offerings, and all three settled into potentially constructive areas of consolidation.

New stocks tend to get outsized attention before they go public, and for a day or two after.

That’s particularly true of high-profile companies, a raft of which are set to go public this year. Those large, well-studied names include electronic payment company Stripe, Amazon-backed electric pickup truck maker Rivian Automotive, delivery service InstaCart, digital chat platform Discord, digital lender Better.com, neighborhood social networking platform NextDoor, third-party financial record keeper Ascensus, cloud computing specialist Couchbase and Krispy Kreme - which really needs no explanation.

But once the media hype fades, even these prominent companies tend to trade mostly unnoticed below the attention levels they garnered for their IPOs.

That’s probably a good thing, as it allows stocks to establish a trading history without being under the microscope.

Israel-based ZIM Integrated Shipping Services went public on January 28.

Despite the current frenzy about container shipping, the company slashed both the IPO pricing and the size of the offering.

Still, the company managed an initial market valuation of $1.75 billion, which has only risen over time.

The stock rallied to a high of $49.90 on June 29, easily finding support above key moving averages as it sailed upward.

It’s been consolidating since then and is currently etching a picture-perfect cup formation. Trading volume has been muted during the correction, which is exactly as you’d hope to see.

Revenue growth accelerated in the past two quarters, and earnings are expected to increase 350% this year, to $19.40 per share. ZIM reports its second-quarter on August 18, with analysts expecting earnings of $5.22 per share on revenue of $1.77 billion.

If met, those results would mark significant year-over-year gains.

Cricut is well known to crafters but may be a new name for those unfamiliar with the Utah-based company’s DIY and crafting technology. The company went public on March 25.

This company priced its IPO at $20, the low end of its expected range. Even so, it began trading at $15.80.

Cricut offers a good example of how institutional buyers drive a stock’s price higher, and why it’s a good idea for retail investors to follow in their footsteps. According to SEC filings, investment firm Abdiel Capital was adding to an already hefty position in June, propelling the stock 26.15% higher for the month.

Prior to June, Cricut shares rebounded nicely from a pullback in April and May, artfully crafting an easy path above key moving averages. Since retreating from a June 30 high of $47.36, the stock has been forming a consolidation without any definitive shape, although it could ultimately become a cup, cup with handle or double bottom.

The company reports earnings on August 12. Wall Street is eyeing earnings of $0.20 per share on revenue of $319.08 million. Both would be year-over-year gains.

Uruguay-based global online payment platform DLocal made its public debut on June 3.

DLocal’s focus is emerging markets. The company has a presence in 29 countries in Latin America, Africa, the Middle East and the Asia-Pacific region. Its platform allows merchants to easily facilitate cross-currency transactions.

The company priced 29.4 million shares at $21 apiece, above its anticipated range of $16-$18. After the offering, the company’s market cap was $6.06 billion. It’s now $14.13 billion, after rallying in June, but retreating in July.

The stock reached a high of $57 on July 14, then began forming its current consolidation, which is sloppy and riddled with erratic trade.

Nonetheless, even a sloppy consolidation can lead up to a successful rally, particularly in a newer stock that has not yet established a more orderly trading history.

DLocal reports its second quarter on August 18. Analysts expect earnings of $0.05 per share and revenue of $41.76 million. Both would be year-over-year gains.

Before you consider Cricut, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cricut wasn't on the list.

While Cricut currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report