Artificial intelligence, AI, is hot. It is taking over the data center and Internet Infrastructure industries and will drive gains in the sectors for many quarters if not years. The companies that stand to gain the most are at the bleeding edge of the technology, the AI start-ups and incubators that are developing the models, not the kind of stocks that blue-chip, risk-averse, and income investors tend to favor.

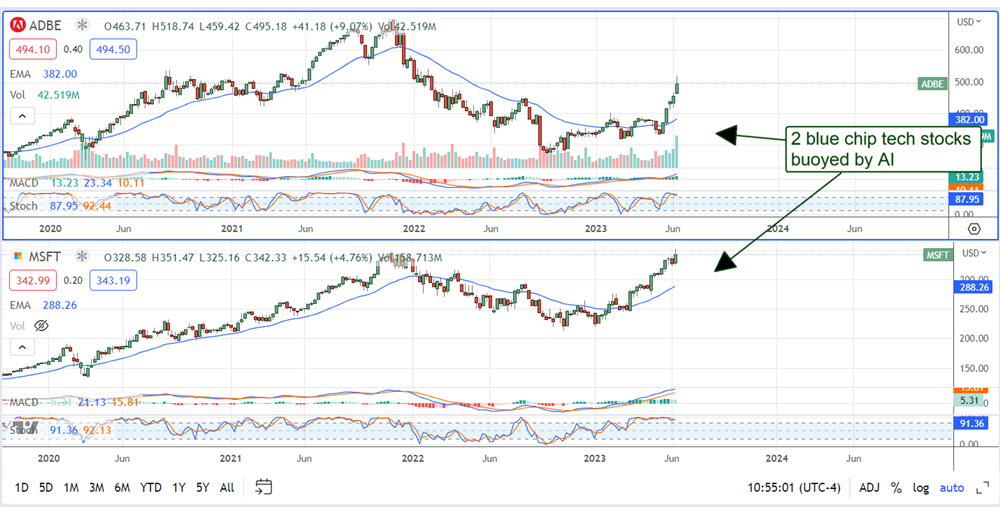

That does not mean there are no ways to gain exposure to AI safely and with income. Remember, at the heart of AI is technology, and technology is constantly advancing. The blue-chip tech companies that have dominated the industry for the last 3 decades will continue to dominate the AI world. What Oracle NYSE: ORCL, Adobe NASDAQ: ADBE, and Microsoft NASDAQ: MSFT have in common are established businesses and cash flow that will benefit from the rise of AI and are not dependent on it.

Oracle Controls The Data

AI is all about data. It begins with the torrential stream of data created by the Internet; it moves on to Big Data science which studies the data, Data Mining which seeks to learn from the data; and Deep Learning which uses the data to make predictions; AI. Through it all, you will find companies like Oracle that built data-centric businesses in the cloud.

AI is driving business in the cloud, and the growth is summed up by a quote given by CEO Safra Catz, who said the company's 2 strategic cloud businesses were bigger and growing faster.

The FQ4/CQ2 results resembled what NVIDIA NASDAQ: NVDA reported weeks earlier. AI-based demand led revenue and earnings growth to double-digits for the quarter and outpaced the Marketbeat.com consensus. Cloud growth came in at 54%, led by infrastructure, up 76%. The takeaway is that the results echo AMD NASDAQ: AMD CEO Lisa Su’s prediction that AI will grow at a 50% CAGR over the next few years.

Regarding the dividend, Oracle doesn’t pay a large dividend, roughly 1.25%, with shares near $125, but it is a safely growing distribution. The company pays only 28% of its earnings and has run a 12% CAGR over the last 5. The balance sheet is healthy, and cash flow is growing, so there is every reason to believe the company will continue its trend of regular, if not annual, dividend increases.

Adobe Is Fundamental To AI

Believe it or not, Adobe is fundamental to AI. Its data-centric business is host to volumes of data that can be used to train models, but there is more to the story. Adobe is everywhere. It is an ingrained part of the Internet facilitating data transfer, making it instrumental in AI. Adobe is part of the AI infrastructure, and it is also a provider of AI-powered services.

Adobe’s results were not quite as strong as Oracle’s, but they were solid, with top and bottom-line outperformance and increased guidance. The takeaway is that growth is accelerating and may be stronger than forecast in the 2nd half of the year.

The Firefly AI application (art generator focusing on images and text effects) is only 1 driver of strength driver and is expected to gain traction. Adobe doesn’t pay a dividend, but it does repurchase shares. The company repurchases 2.7 million during CQ2, about 0.55% of the outstanding shares.

Microsoft Is The New Leader In The Cloud

Amazon NASDAQ: AMZN still commands 30% of the cloud market share, putting it in the #1 position, but Microsoft is quickly catching up. It’s in the #2 position with its Azure offerings and working hard to gain more share. Among the many forays into AI are its investment in ChatGPT maker OpenAI and a suite of AI-powered tools and services embedded across the MSFT operating network.

MSFT stock doesn’t pay an enormous dividend, only about 0.80%, with shares near $340, but it is a powerful payment. The company is paying only 28% of the earnings and has increased the payment for 20 consecutive years. That puts the stock on track to become a Dividend Aristocrat in 5 years, a significant event. Microsoft also buys back shares, although the pace of repurchases slowed in 2023.

Before you consider Adobe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adobe wasn't on the list.

While Adobe currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.