Buyers are snapping up new homes, often sight unseen and paying with cash, generating booming business for companies such as

Owens Corning NYSE: OC,

Builders FirstSource NASDAQ: BLDR and

Cornerstone Building Brands NYSE: CNR.

A new-to-you home generally involves some repairs and remodels. That’s benefiting the building and construction products industry.

On top of the remodeling trend, homeowners are remodeling their existing homes as they spend more time inside, and want to upgrade their living spaces. According to the Joint Center of Housing Studies at Harvard, remodeling activity will grow this year, but at a slower rate than in 2020.

Meanwhile, supply chains are tight, costs for goods like lumber are rising fast and construction projects are taking longer than usual, due to high demand and the wait for materials.

Owens Corning makes materials used for insulation, roofing and in other building applications.

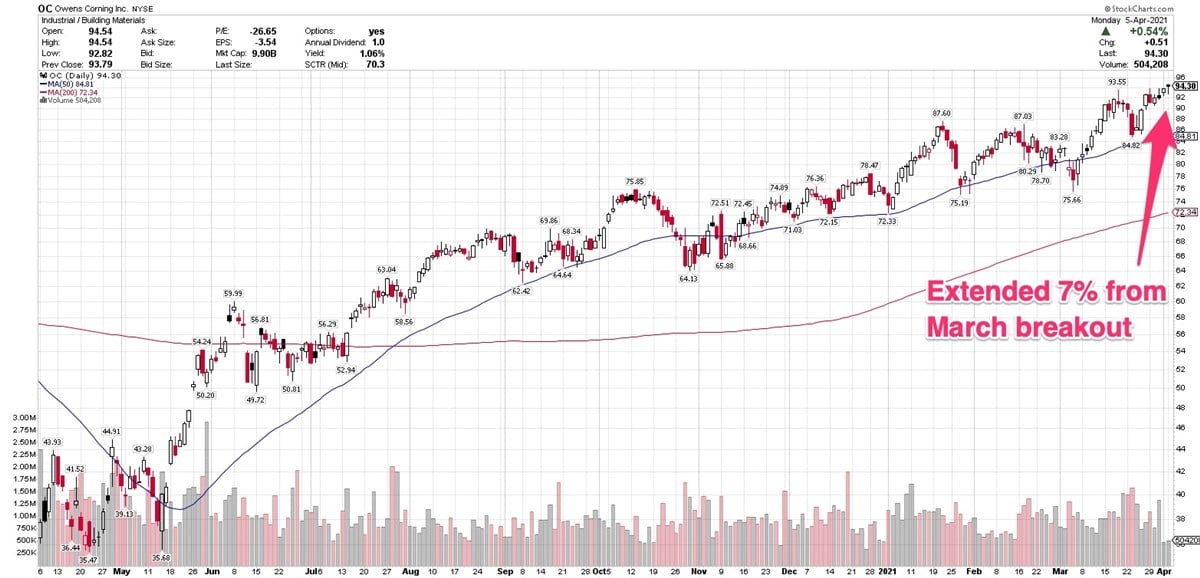

The stock cleared a consolidation in average volume on March 12, overcoming resistance between $88 and $89. The stock closed higher for the past three weeks, and closed Monday at $94.30, at the upper end of its session range and at its best level since January 2018.

The company reported fourth-quarter results in February. It earned $1.90 per share on revenue of $1.925 billion, beating analysts’ estimates on both the top- and bottom line.

Owens Corning said its results were driven by growing demand in the single-family home markets for new construction, as well as remodeling. Its commercial market segment was also strong.

The stock is up 14% since its earnings report.

Year-to-date, Owens Corning is up 25.16% year-to-date and 172.44% over the past year.

The stock is extended 7% from its March breakout. At that level, there starts to be a greater risk of getting shaken out in even a minor pullback.

Builders FirstSource sells building products for the construction and remodeling industry.

The stock is trading at all-time highs. On Monday, it rallied to a new session high of $49.04, but reversed lower to close at $47.59, up $0.22 or 0.45%. Volume was light.

In March, Stifel Nicolaus resumed coverage of the stock with a buy rating and a price target of $56. The analyst cited the company’s own strength in a fragmented industry, and noted that “the outlook for housing in the U.S. remains robust as low rates/inventories have driven a significant supply/demand imbalance.”

Earnings growth accelerated in the past three quarters, with revenue growing in the past two.

The stock last broke out of a base in July 2020, and has traveled higher since then, bouncing around its 50-day moving average. This is another stock that’s technically frothy. It wouldn’t be surprising to see another base soon, as institutional investors take some profits. That would potentially clear the way for a new entry point at a slightly lower price.

Cornerstone Building Brands provides materials for the residential and commercial construction industries. The stock has been on a tear, gaining 58.41% year-to-date and 252.52% over the past year.

Shares closed Monday at $14.70, a two-and-a-half year high. The stock broke out of a cup-shaped base on March 8. It retreated the following week, but found support above its 50-day moving average and resumed its rally.

One drawback of this stock is the company’s high debt level of $3.6 billion, which can add risk. However, Cornerstone has been deleveraging, and analysts believe it’s on the right path.

In its most recent quarterly report, the company said it expects robust revenue growth, due to strong demand from single-family home building. It also expects commercial construction to bounce back following pandemic-era slowdowns in that segment.

All that should help Cornerstone generate cash to help pay down the debt.

The stock is currently in a buy range; however, it’s very volatile, with a beta of 1.96, meaning that it is likely to show more whipsaw action than the broader market. Investors should be prepared for a wild ride, and have stops in place if nervous about pullbacks.

Before you consider Owens Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens Corning wasn't on the list.

While Owens Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report