Value Is Where You Find It In The Consumer Staples Sector

I don’t have a lot of time so I am going to cut right to the chase. The consumer staples sector has been one of if not the hottest sectors during and since the pandemic began. Names like Clorox, Kellog, Campbells, and many others are all trading, if not at new all-time highs, then at least well above their pre-COVID levels. The strength is due to a combination of factors that include revenue stability, demand for home goods, and their dividends which can be substantial.

The problem is that now, after seeing their share prices stage multi-mont rallies, valuations are very high. The leader was Clorox trading over 31X its forward earnings. Shares have been selling off over the last week so the valuation has fallen but still a high 28X earnings. The group, as a whole, is trading in a range between 18X and 30X time earnings but there are a few very interesting outliers. Here they are.

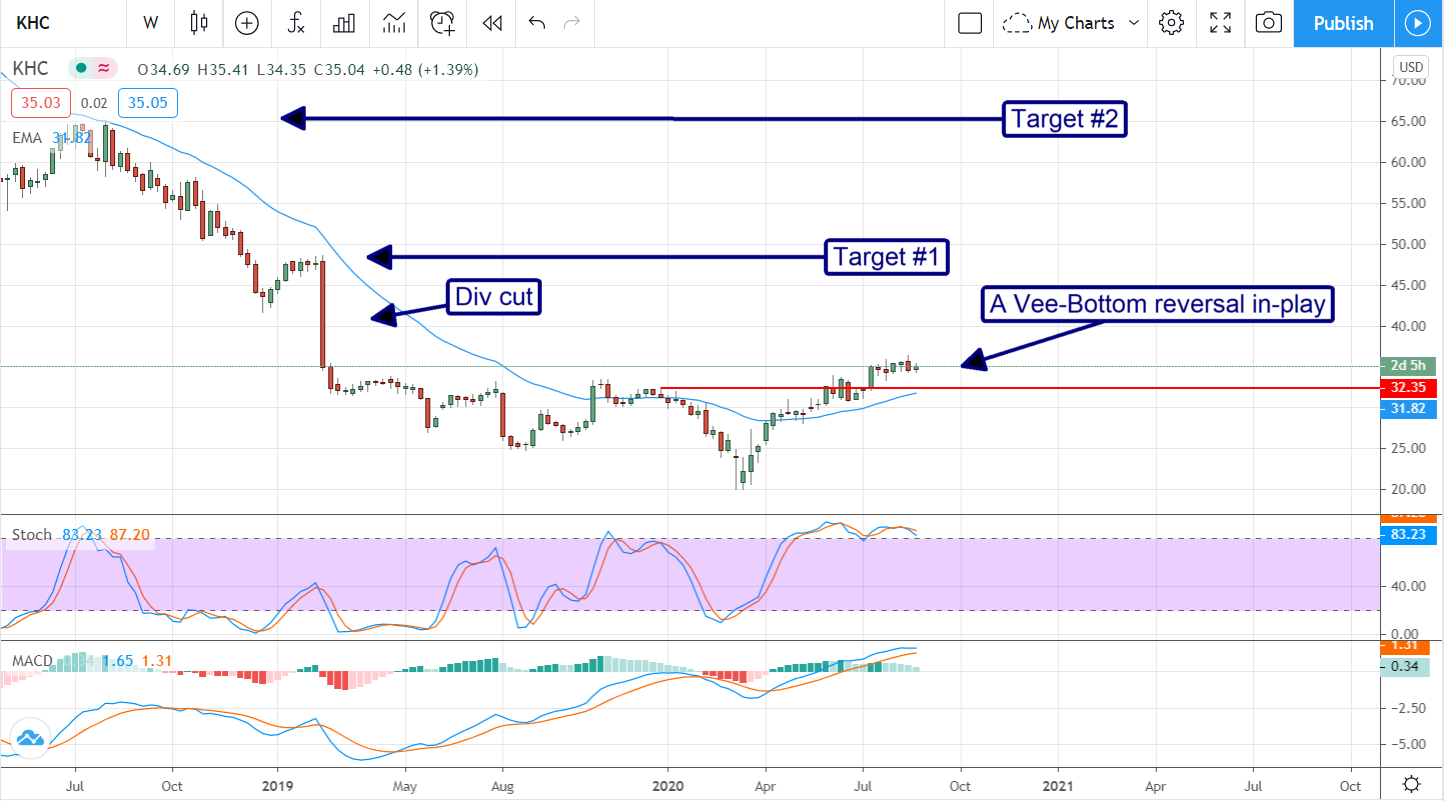

Kraft-Heinz Is A High-Yield Turnaround Story

Kraft-Heinz (NASDAQ: KHC) has a couple of things going for it that make it a high-yield deep-value. The yield is a little more than 4.50% and the highest of the entire group while the value is less than half the leader. Trading at only 14X times next year’s earrings it offers quite an opportunity for multiple expansion considering the state of the turnaround.

Backtracking a little here but Kraft-Heinz merged four or five years ago and has since struggled with the cost of the merger. A year or so ago the company took the bull by the horns, slashed the dividend, and took other measures to accelerate the financial recovery. Now, with the pandemic boosting sales, revenue growth back in play, and profits on the rise the company is in the best shape it’s been in since the merger.

Tyson Foods Is A Deep-Value Opportunity

Tyson Foods (NYSE: TSN) hasn’t seen the same change in business that others in the food industry have but that doesn’t mean business is bad. Yes, the company reported a surprisingly large decline in the 2nd quarter but there are some mitigating factors. The first is that margins expanded above consensus despite an increase in costs. The company successfully raised prices across a number of product lines and they will remain in place. The second is weakness is centered in the food-away-home categories and a rebound, if small, is already underway.

What this means for dividend investors is a stock trading at 12X this year’s and 10X next year’s earnings, compared to 20X for Pilgrim's Pride, and offering up a deep-value. What you get at this price is a 2.65% yield, a 35% payout ratio, and an expectation for aggressive growth. The 5-year CAGR is over 30% but there is a red-flag. The company should have increase with the latest declaration and didn’t, a sign we may have wait until next year for another increase.

Get On Board The J.M. Smucker Company Multiple Expansion

The J.M. Smucker Company (NYSE: SJM) reported earnings a day or so ago and delivered what we were all expecting. What’s even better, the company reported results that were so much better than expected they were well above even the expectation of outperformance. To sweeten the deal, the company raised its guidance to a range above the previous consensus paving the way for a multiple-expansion.

The stock popped on the news but still offers deep value. Even with the 7% it gained post-release the stock is still only trading at 14X this year’s earnings and yielding nearly 3.0%. When it comes to returning capital to shareholders this company is a good one. The J.M. Smucker Company has been increasing its dividend annually for 17 years and this year was no different. Looking at the chart, this stock could easily move up to retest the $130, $140, and $150 levels over the next 12 months.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.