In the post COVID landscape, it’s become very easy to see companies that are worryingly exposed to a global pandemic and those who can continue to grow their business and offer attractive returns. One of the most well-positioned industries for the latter group

is e-commerce.

With no brick and mortar stores to worry about and incredible economies of scale, in many ways these companies have been able to expand their business far beyond what they were initially expecting at the start of the year.

Shopify offers an e-commerce platform for small to midsize online retailers. Their platform supports "payments, marketing, shipping and customer engagement tools to simplify the process of running an online store for merchants.”

Since IPOing in 2015, their shares have rallied more than 4,000% and since March alone, they’re up 200%. There’s no doubt that they’ve been able to capitalize on the consumer shift to online shopping and purchasing. Their last earning report in May had revenue jumping 45% year on year and in recent weeks they’ve announced partnerships with the likes of Pinterest, Walmart NYSE: WMT and Chipotle NYSE: CMG.

Piper Sandler has them named as one of the ‘best positioned’ digital businesses for the coming decade while RBC recently slapped a street high $1,000 price target on shares, noting that Shopify’s total addressable commerce is still being underestimated.

Alibaba recently made headlines for all the right reasons when it announced its plans to have 1 billion customers by 2025. Since March, their shares are up more than 50% which is no mean feat when you consider their size. With a $700 billion market cap, the Chinese e-commerce behemoth is second only to Amazon (NASDAQ: AMZN) in the digital selling world.

They’ve also been able to continue expanding their business in the midst of the pandemic and last quarter’s earnings report showed revenue increasing 16% year on year. While the bulk of the company’s dollars come from e-commerce, they’ve been making efforts to diversify into other business lines.

Like Amazon, they’re exploring the cloud computing industry and this was part of the reason KeyBanc upgraded them last week and upped their price target to $301. This suggests a 20% move is in the making and based on recent history, you wouldn’t bet against them.

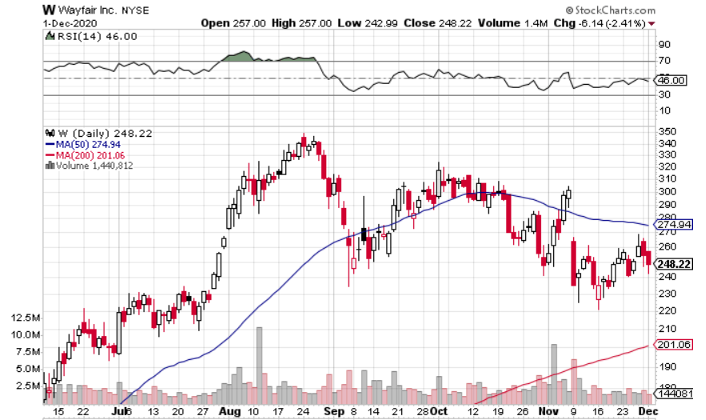

Coming into the coronavirus pandemic, shares of Wayfair were already under sustained pressure and down more than 40% since last summer. Including their dip in Q1, by the end of March they were down nearly 90% in just a year. For many investors, the writing was on the wall and they can’t really be blamed for walking away.

However, like a phoenix from the ashes, COVID has lifted shares from close to all-time lows and sent them up nearly 1,000% since. Investors got a hint of what was happening in May when the company said their Q2 revenue was up nearly 90% to Q1 and the wolf was being kept firmly away from the door. Their earnings report confirmed this and showed revenue jumping 20% year on year as they crushed analyst expectations.

Since then, they’ve gathered plenty of bulls in their camp. Only last week Wedbush upgraded them, noting that the pandemic will have a long-lasting effect on the company as consumer spending habits and trends have undergone a fundamental shift.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.