Shareholders of Advanced Micro Devices NASDAQ: AMD are undoubtedly happy campers, with the stock up over 65% year-to-date. However, shareholders might be less content in the short term, with shares down almost 16% over the previous three months.

That may be about to change, though, as the higher time frame view of AMD is beginning to look increasingly bullish, with the stock consolidating within an uptrend, nearing a critical breakout level.

So, could AMD be about to pair back its short-term losses and add to its already year-to-date mouthwatering gains? Let’s take a closer look.

AMD is a well-established semiconductor company founded in 1969 and headquartered in Santa Clara, California. It plays a crucial role in various sectors of the global economy.

The company operates in two segments: computing and graphics, and enterprise, embedded, and semi-custom. Their product portfolio includes microprocessors, chipsets, GPUs, data center solutions, and technology for gaming consoles, making them one of the most versatile semiconductor companies in the market today.

The Technical Setup in AMD

From a technical analysis point of view, shares of AMD appear to be gearing up for a potential breakout and leg higher. That is if the stock can break above resistance near $110.

For several months, AMD has been consolidating above the previous pivot high near $100, now acting as critical support. Recently, the range has begun to contract along with a near-converging 5-day and 50-day Simple Moving Average (SMA). A breakout over $110 could signal a clear momentum shift and the potential for significant upside.

Positive Institutional Flow

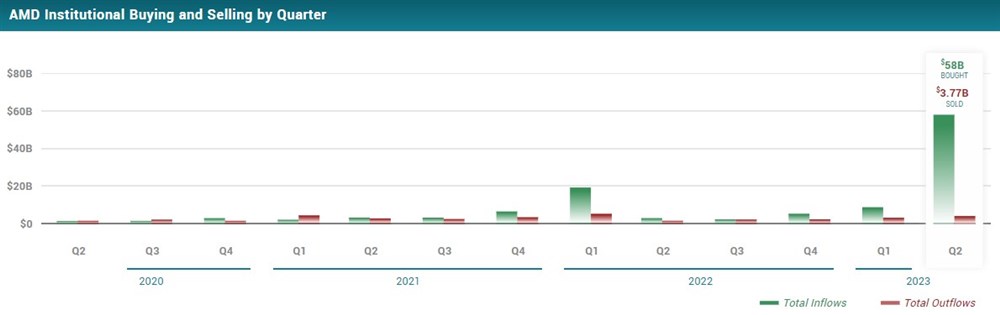

Institutional ownership in AMD has recently experienced an uptick and now stands at 68.43%, thanks to 1507 institutional buyers over the previous twelve months compared to just 1004 sellers.

A closer look at the institutional activity signals a promising vote of confidence in AMD’s prospects. Institutions, often called “smart money,” have recently poured a large amount of capital into AMD stock, which might make AMD an even more attractive proposition for individual investors who are looking to ride the coattails of the pros.

Over the previous twelve months, $73.38 billion has been inflowed from institutions, compared to $10.56 billion in outflows. More recently, in the second quarter, the institutional inflow was a whopping $58 billion compared to just $3.77 billion in outflows.

Analysts See Upside

Although shares of AMD are up almost 65% year-to-date, analysts are on the same page as the institutions, with a consensus price target of $135.19, predicting a nearly 27% possible upside.

AMD has a Moderate Buy rating based on thirty analyst ratings. Of the thirty ratings, twenty-two analysts have AMD as a Buy, one analyst as a Strong Buy, and seven have AMD at Hold. Over a three-month period, the consensus price target has risen from $125.06 to the current target of $135.19.

Most recently, Morgan Stanley reiterated its rating and price target of $138, and Susquehanna boosted its target from $135 to $145.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.