Rivian Automotive’s NASDAQ: RIVN hugely successful IPO last week is generating plenty of headlines and attention, despite the company being pre-revenue, but don’t overlook smaller new companies like Dutch Bros NYSE: BROS or Trinity Capital NASDAQ: TRIN.

There are also several 2021 IPOs like AppLovin NASDAQ: APP that instantly vaulted to large-cap status, and are showing excellent price growth.

According to private-equity database PitchBook, the value of all companies going public on domestic exchanges passed $1 trillion this year, a record, across 981 deals.

Newly public companies this year include IPOs, SPACs and direct listings, although the lion’s share of deals were in the traditional IPO form.

Coffee chain Dutch Bros. made its public debut at $23 on September 15, finishing that session at $36.68.

The Oregon-based company operates 471 drive-through coffee shops in 11 states. The company started in western states, but is gradually expanding eastward. It’s planning to open two locations in Tennessee soon.

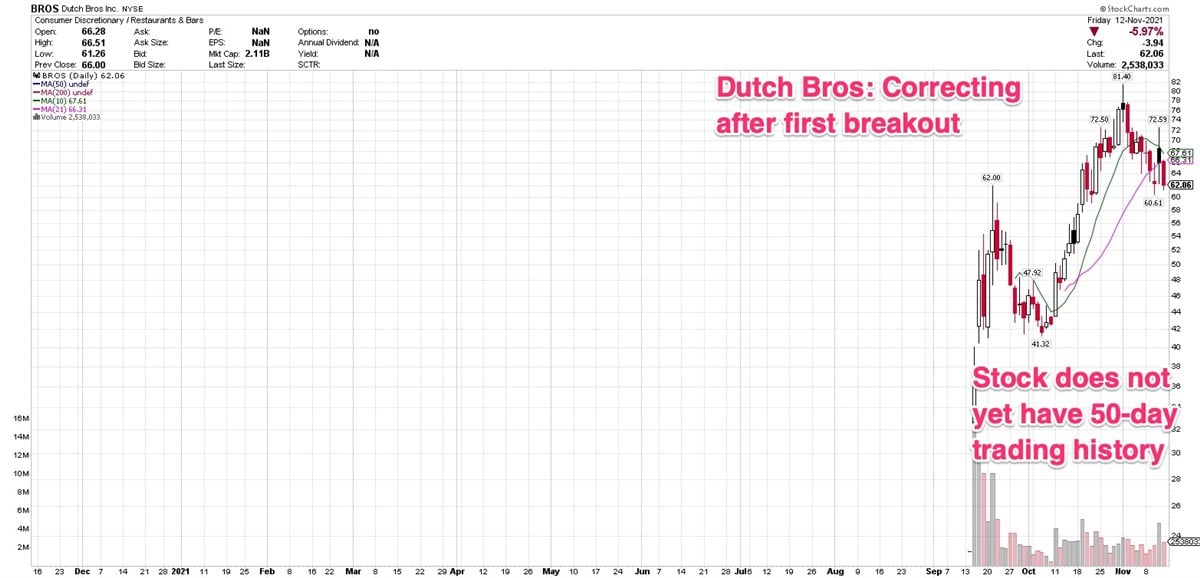

After rallying to a September 21 high of $62, the stock pulled back into its first post-IPO base. This is a common scenario: A stock will rally after going public, then pull into a base within a few weeks or in this case, days.

It cleared that base on October 19, and rallied to a high of $81.40 on November 1 before retreating again. Shares slipped below their 10- and 21-day moving averages. Because the stock is so new to public markets, it does not yet have a 50-day trading history.

Fundamentally, the company is in growth mode. Revenue increased at double-digit rates in each of the past six quarters. Earnings have been a bit more erratic, but that’s often common in new young, companies putting their money into growth, rather than profitability. Earnings fell in 2020, even as revenue increased, but that’s seen bouncing back to the tune of 350% this year, to $0.18 per share.

Trinity Capital provides venture debt to startup companies seeking capital to grow their businesses while minimizing equity dilution. The company says this is a complement to equity financing. It facilitates transactions structured in tandem with other venture investors.

Trinity’s transactions include $19.5 million to plant-based food producer Impossible. Major investors were Khosla Ventures, Horizons Ventures and Google Ventures.

Trinity went public on January 29 at $14, and ended its first day at $15. The stock is up 17.47% in the past three months as it staged a choppy, volatile rebound from its first post-IPO base.

On August 27 the stock cleared a base above $16, then rallied to a high of $16.89 before pulling into a five-week flat base with a peak-to-trough correction of just 8%.

This is a very small stock, with a market capitalization of only $459.1 million. It has 25.5 million shares in float, fewer than you’ll find in larger companies. As such, it trades in a somewhat erratic fashion with wide price swings.

It’s currently trading above its 10-day moving average, and is extended from its most recent buy point. If the current area of sideways trade holds, you may see another base or add-on buy point at a moving average line.

AppLovin, with a market cap of $41.84 billion, has had a successful run since its disappointing IPO in April, when shares closed 18.5% lower on their first trading day.

The company raised $1.8 billion in its initial public offering, and after rallying 97.26% in the past three months is perched in new high ground.

AppLovin helps mobile developers market, monetize and publish their apps.

Shares gapped up nearly 20% Thursday after the company’s third-quarter revenue beat. Analysts expected sales of $698 million. Revenue came in at $727 million, up 90% from the year-ago quarter. Earnings were a penny per share, up from a year-ago loss of $0.25 per share. That missed views, but investors clearly didn’t care, seeing the potential in better-than-expected sales.

The stock retraced some gains in Friday’s session, but didn’t even come near to closing Thursday’s gap higher - which is a good thing. The stock was already extended beyond its last buy point prior to the earnings report, so it’s a good idea to wait for a pullback with support at a key moving average before making a buy.

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report