The biotech sector, iShares Biotechnology ETF NASDAQ: IBB, has been trading in a tight consolidation for several months. The ETF has a 50-day range of $124.38 and $131.81. While the ETF is slightly negative year-to-date, down 2.5%, it's trading near critical resistance and support, putting itself on high alert for a potential breakout in either direction.

The iShares Nasdaq Biotechnology ETF is an exchange-traded fund that aims to match the performance of the NASDAQ Biotechnology Index. This index includes biotechnology and pharmaceutical companies listed on NASDAQ, meeting specific industry and eligibility criteria set by NASDAQ. The ETF seeks to replicate the price and yield outcomes of this index.

Given the unique setup in the sector ETF, now is an optimal time to prepare for a potential breakout in the sector and to focus on sector-specific names displaying relative strength specifically.

Three Sector-Specific Stocks Displaying Relative Strength

Regeneron Pharmaceuticals NASDAQ: REGN

Regeneron Pharmaceuticals, Inc. is a global company engaged in discovering, developing, manufacturing, and commercializing medical treatments for various diseases. Their product portfolio includes EYLEA for eye-related conditions, Dupixent for dermatitis and asthma, Libtayo for skin cancer, Praluent for cholesterol management, REGEN-COV for COVID-19, and Kevzara for rheumatoid arthritis.

Regeneron is the fourth largest holding of the IBB ETF, with a 7.67% weighting. REGN has displayed impressive relative strength versus the sector, with the stock up almost 12% year-to-date. REGN has a P/E ratio of 21.30 and a market capitalization of $87.5 billion.

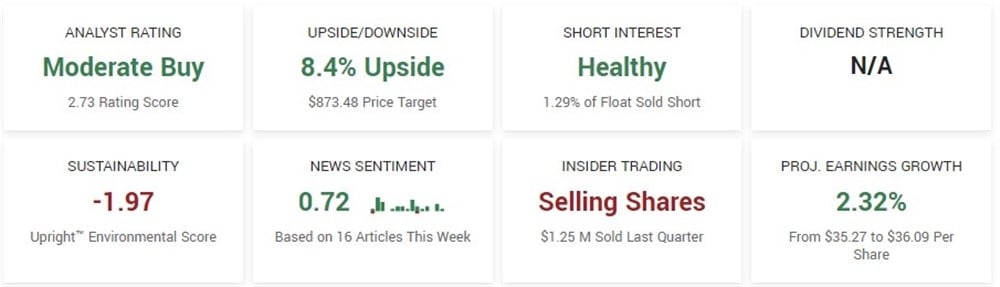

Even after its impressive sector outperformance, analysts still see an upside for the stock, with a consensus price target of $873.48, predicting an 8.38% upside. Based on the twenty-two analyst ratings, the stock has a Moderate Buy rating, with seventeen analysts rating REGN as a Buy.

Institutions favor REGN, as the stock has experienced $66.16 billion in total institutional inflows over the previous twelve months compared to just $8.53 billion in outflows.

Vertex Pharmaceuticals NASDAQ: VRTX

Vertex Pharmaceuticals Inc., a biopharmaceutical company based in Boston, was established in 1989 by Joshua Boger and Kevin J. Kinsella to revolutionize disease treatments through rational drug design. Their mission is to transform serious disease management, focusing on cystic fibrosis. Leveraging advanced science and technology, Vertex is a key player in precision medicine and has achieved significant progress in researching, developing, and commercializing innovative therapies for various medical conditions.

Vertex is the second highest weighted stock in the IBB ETF, with an 8.33% weighting. VRTX has been one of the standout performers of the sector this year, with shares soaring over 21% year-to-date, significantly outperforming the sector and its competitors. The company has a market capitalization of $90.28 billion and a P/E ratio of 27.01.

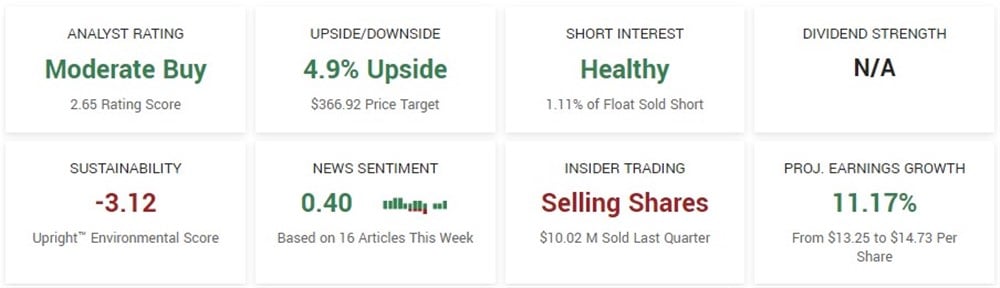

Like REGN, analysts still see some upside even after the stocks' impressive performance. The consensus price target for VRTX is $366.92, predicting a 4.9% upside. Based on seventeen analyst ratings, the stock has a consensus rating of Moderate Buy, with eleven as a Buy and six as a Hold.

VRTX, like REGN, experienced significant institutional inflow over the previous twelve months, with almost $70 billion in inflows compared to just $7.82 billion in outflows.

Exelixis NASDAQ: EXEL

Exelixis Inc., a biotech company specializing in oncology, is dedicated to discovering, developing, and commercializing novel medications for cancer treatment in the US. Their products include CABOMETYX tablets for advanced renal cell carcinoma post-anti-angiogenic therapy and COMETRIQ capsules for progressive and metastatic medullary thyroid cancer. These products stem from cabozantinib, a multi-tyrosine kinase inhibitor affecting MET, AXL, RET, and VEGF receptors.

EXEL has undoubtedly had a year to remember, especially as it relates to relative strength and outperformance, with the stock up over 34% year-to-date. Compared to the above two stocks, EXEL has a much smaller market capitalization of just $6.86 billion and a P/E ratio of 42.28. EXEL is the twenty-seventh highest weighted name in the IBB ETF, with a weighting of 0.61%.

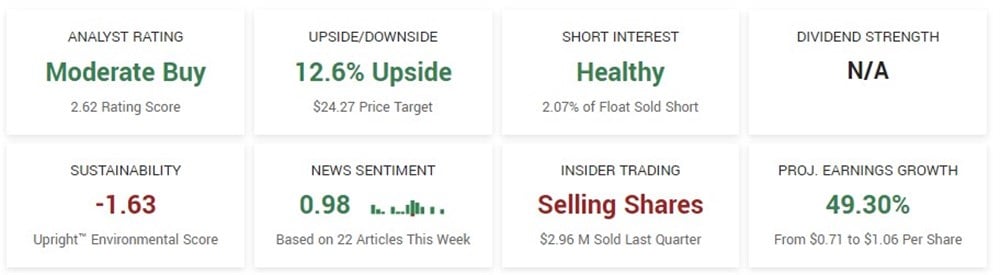

Based on thirteen analyst ratings, the stock currently has a Moderate Buy rating, with eight analysts rating the stock as a Buy and five as a Hold. The consensus price target on EXEL is $24.27, predicting a 12.55% upside for the stock.

Current institutional ownership in EXEL stands at 93.14%. However, the net institutional flow has been relatively equal over the previous twelve months, with $1.27 billion in inflows and $1.05 billion in outflows.

Before you consider Exelixis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exelixis wasn't on the list.

While Exelixis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report