As China's economy continues to face headwinds entering the new year, recent data has unveiled a harsh stock market sell-off, impacting U.S.-listed Chinese stocks such as Alibaba NYSE: BABA, Baidu NASDAQ: BIDU, and NetEase NASDAQ: NTES.

The fourth-quarter Chinese GDP growth of 5.2% fell slightly below expectations, marking the slowest annual growth since 1976, excluding the pandemic-hit year 2020. The economic picture worsens considering a Q4 growth of only 1%, a significant drop from the prior quarter. China's adherence to its zero-Covid lockdown policy until late 2022 contributed to a rebound from weak levels in the first three quarters of 2023.

Furthermore, the nominal GDP growth of 4.2% in 2023, factoring in deflating prices, raises concerns, affecting various aspects, including debt ratios, property markets, and earnings.

In this challenging economic landscape, U.S.-listed Chinese stocks experienced a significant downturn. Over the previous three months, shares of BABA have declined over 13%, BIDU declined over 3.5%, and NTES declined almost 9%.

Now, the question arises: could the selling be overdone in these three stocks with China's current challenging economic backdrop? Is there currently a favorable risk-reward scenario worth exploring? Let’s delve into each stock, examining its potential for a turnaround and approaching value territory.

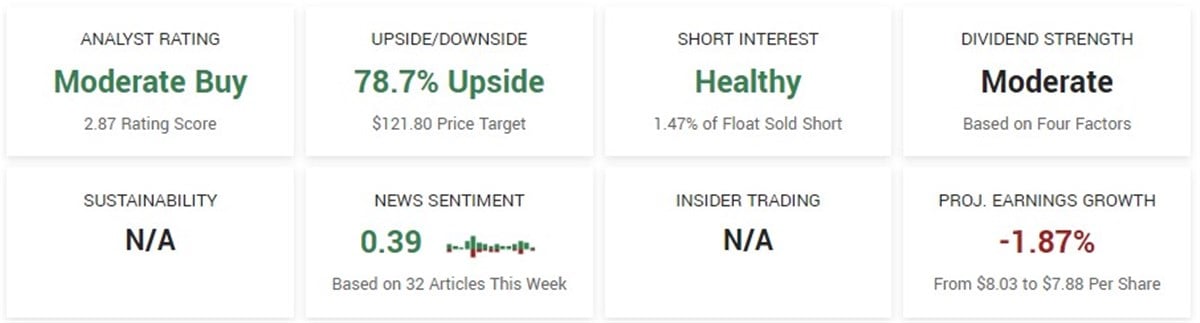

Alibaba NYSE: BABA

Alibaba is a prominent eCommerce and Internet technology giant. Its primary platform, Alibaba.com, ranks as the world's third-largest eCommerce platform by sales. Alibaba offers infrastructure and marketing support for merchants of all sizes, facilitating brand development and customer connections in China and internationally. The company extends its services globally, providing diverse digital and logistical solutions to businesses worldwide.

Alibaba’s stock has taken a pounding over the last year, now down over 42% and trading in the low range of its 52-week range. Notably, the stock is trading near a significant support area in the $60s. An area previously tested in 2023, 2015, and 2016 held firm. At current prices, the Relative Strength Index (RSI) is also beginning to indicate that BABA might be approaching oversold territory, with an RSI of 37. Additionally, BABA’s P/E has dipped below 10, currently at 9.44, firmly placing the stock in value territory on that metric alone. Analysts are calling for a significant upside in the stock, with a $119.80 consensus price target, forecasting a 72% upside.

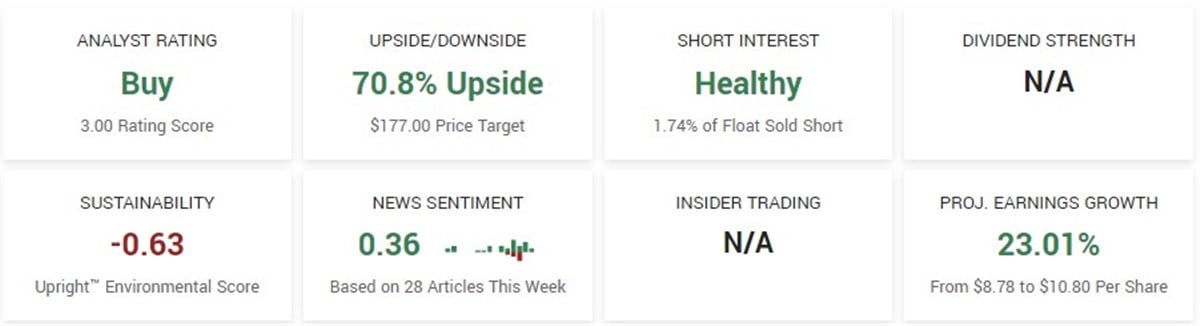

Baidu NASDAQ: BIDU

Baidu focuses on internet-related services and artificial intelligence. It offers various products and services, including the widely-used Baidu Search, China's leading search engine. The company has expanded into cloud services, providing storage, data analysis, and AI services through Baidu Cloud.

Like BABA, BIDU shares are also in a bear market, with its stock down over 24% over the previous year. Shares of the search engine giant are now fast approaching a significant area of support between $95 - $100, an area tested multiple times over the previous several years. Given the extent of weakness experienced in the stock, it now has several favorable value metrics. Its P/E is currently 11.92, an attractive value buy proposition. Its RSI is presently 32.76, firmly placing it in oversold territory. Lastly, BIDU is a Top-Rated stock, with analysts rating it as a Buy and forecasting over 72% upside based on the consensus price target of $177.

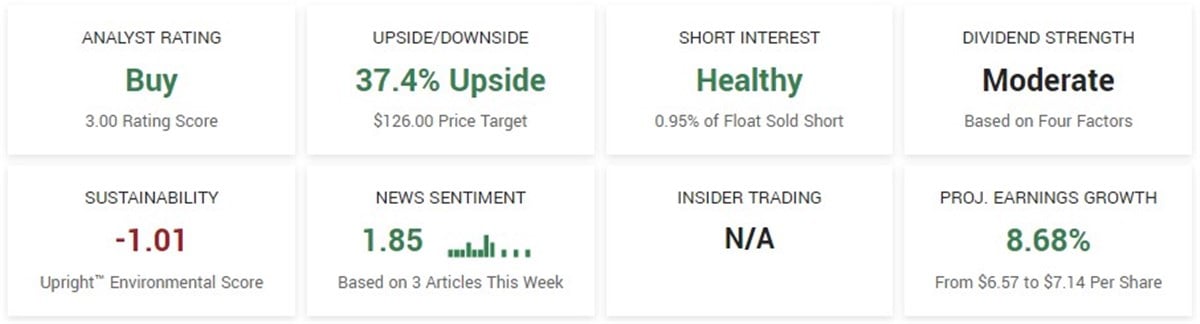

NetEase NASDAQ: NTES

NetEase is involved in various online ventures. The company operates in online games, music streaming, online intelligent learning services, and internet content services in both Chinese and international markets. NetEase is actively engaged in developing and operating PC and mobile games, including licensed games from external developers. Their business portfolio spans diverse sectors within the digital landscape, reflecting their presence and influence in the online entertainment and learning spheres.

NetEase shares are slightly positive over the previous year but have recently faced sustained selling pressure, falling over 10% over the last month. NTES has positive news sentiment and is a top-rated dividend stock, possessing an 8.68% projected earnings growth and 2.15% dividend yield. Similar to the above two-mentioned names, analysts are bullish. Based on five analyst ratings, the stock has a Buy rating and price target of $126, forecasting almost 38% upside. Most recently, Benchmark boosted its target on NTES from $130 to $140, predicting a nearly 20% upside on the report date.

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.