In an era of streaming videos and podcasting, who would have expected television- and radio-industry stocks like

Gray Television NYSE: GTN,

Townsquare Media NYSE: TSQ and

Entravision NYSE: EVC to show technical strength? The industry, in general, is home to a number of stocks with strong price action lately.

In some cases, as with Discovery Nasdaq: DISCA and AMC Networks NASDAQ: AMCX, short squeezes drove price increases.

But what’s up with some of these other stocks, particularly the ones where short interest has declined?

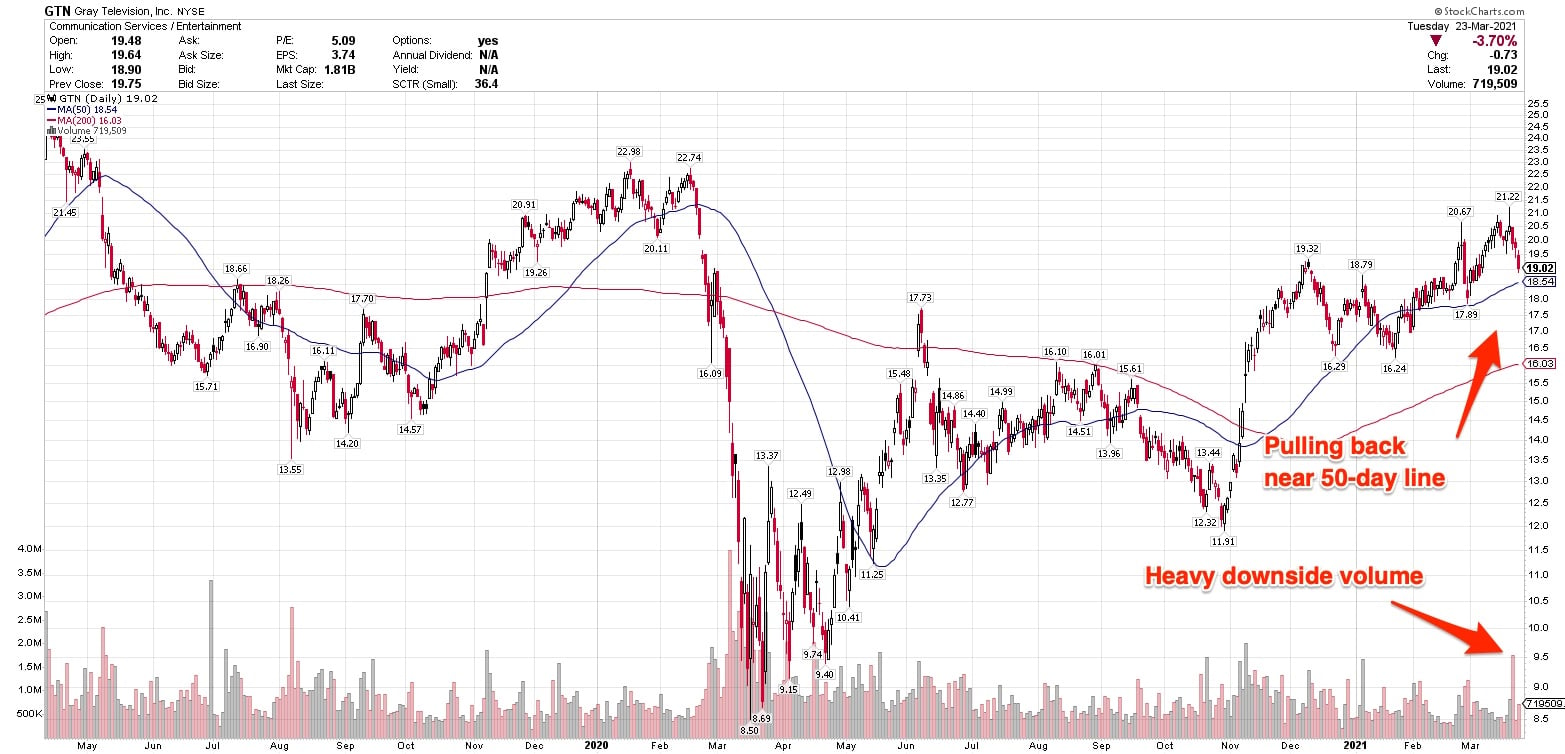

Gray Television: Triple-Digit Earnings Growth

Gray Television is an Atlanta-based small cap with a one-year gain of 101.52%. It pulled back from its March 18 high of $21.22 and is now trading below its 10-day moving average and above its 50-day.

The company owns and operates TV stations in 94 U.S. markets, and is in the process of closing acquisitions that will bring that total to 102 markets. The company also owns video production units, as well as

This month, the company said it was leading a group of investors in a $40 million equity investment round for Envy Gaming, an online sports and gaming company. Envy’s stake is $28.5 million.

Gray also owns video production units, including Raycom Sports, Tupelo Honey, and RTM Studios.

The company reported triple-digit earnings growth in the past two quarters. Meanwhile, revenue grew at double-digit rates. Both top- and bottom-line results were turnarounds from the quarter ending in June 2020, which saw earnings and revenue declines.

On February 22, the stock cleared a double-bottom pattern with a pivot point of $18.86 in light turnover, but upside trading volume picked up in the following two sessions. The current pullback may offer investors a new opportunity to add shares.

Townsquare Media: Shares Up 200%

Townsquare Media: Shares Up 200%

Townsquare Media, with a market capitalization of just $180.6 million, is considered a microcap. As such, it’s more prone to volatile trade than larger, more liquid securities.

The company’s media properties include radio stations and local Web sites in smaller U.S. markets. It also owns a streaming radio app, radioPup.

The company reported fourth-quarter earnings on March 16. Net income was $0.15 per share on revenue of $108.5 million.

Townsquare shares have risen 202.41% over the past year, and 78.23% year-to-date.

As a microcap stock, don’t expect to see much institutional ownership. Fifty-six funds owned shares at the end of 2020, down from 61 in the prior quarter.

Its up/down volume ratio over the past 50 days is 2.0. This ratio is calculated by dividing trading volume on days when the stock closes a session higher by volume on days with a lower close. A ratio above 1.0 may be a signal that further gains are to come, as investors are putting money into the stock, rather than selling.

On Tuesday, the stock rallied to a session high of $12.52, its best levels in four years. However, it retraced those gains, mirroring the day’s action in the broader markets. Trading became more volatile since the start of this year; that’s often due to short covering, and can be more pronounced in a stock like this with a small market cap.

Investors should use caution with stock this size, even if it shows promise. It’s easy to get shaken out with volatile trade, even if one or two large holders exit or pare their positions.

Entravision: One Fund Owns 9%

Entravision: One Fund Owns 9%

Entravision Communications owns a range of media properties in the U.S., Mexico, Spain and other Spanish-language markets.

This is another micro-cap stock, with a market cap of $250.4 million. It’s been trading in a sideways formation for the past three weeks. That’s a potentially good sign, as it may indicate large owners are holding shares, rather than selling. That often precedes further gains.

One fund, the American Century Small Cap Value Fund, owns 9.12% of shares outstanding. That adds risk. If that fund decides to sell even part of its position, it will make a dent in the stock’s price.

Revenue resumed growth in the most recent quarter, after seven quarters in a row of declines.

The stock soared 10% after its earnings report on March 11, and is maintaining those gains.

In addition to being thinly traded, Entravision is a low-priced stock. It’s trading in a range between $4.06 and $4.20, finding solid support above its 10-day moving average.

In the earnings conference call, CEO Walter Ulloa cited increases in advertising revenue as revenue drivers.

He noted that national advertising revenue was up 20% driven mainly by the automotive and healthcare sectors, excluding election-season political advertising. He said local ad revenue was up 2%, driven by legal services and healthcare.

Before you consider Gray Television, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gray Television wasn't on the list.

While Gray Television currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report