While investing in dividend capture stocks can be risky, it offers the potential for short-term gains without the entire risk of day trading. However, these strategies come with risks you must consider. Read on to learn more about dividend capture stocks and strategies and some of the best stocks for dividend capture trading today.

What is the dividend capture strategy?

Investors use dividend capture strategies to generate income from stocks by capturing the dividend payout without holding the stock for a long time. Income-oriented investors, such as retirees or those seeking additional income from their investments, usually use these strategies.

The basic idea of a dividend capture strategy is to purchase a stock a few days before the ex-dividend date, which is the date by which a shareholder must be on record to receive the dividend payout. The investor then holds the stock just long enough to receive the dividend and then sells the stock shortly after the ex-dividend date. You can also use this strategy with some of the best dividend ETFs, which follow the same dividend distribution methods as individual stocks you may buy and sell.

While this strategy can generate income from dividends, there are risks involved. For example, if the stock price drops after you purchase the stock, the dividend income may be offset by the capital loss when the stock sells. Additionally, the strategy may not work well in a volatile market, where stock prices may fluctuate significantly.

It's also worth noting that some investors may use more complex dividend capture strategies, such as buying call options on stocks with upcoming dividends or using dividend futures contracts to capture dividend income.

Dividend capture strategies allow income-oriented investors to generate additional income from their stock investments. Still, they are not without risks, and you should carefully consider them in the context of your financial goals and risk tolerance.

The art of dividend capture

Many investors are attracted to individual stocks that pay out a high dividend, a percentage of a company's profits paid out to shareholders that own the stock. Some companies elect to pay an annual, monthly or quarterly dividend to encourage customers to hold onto their shares rather than actively trading them.

Holding stocks that pay the highest dividends long-term isn't usually a viable strategy. Dividend traps can attract investors to buy into stocks without researching fundamentals — only to cut its dividend shortly after it gets the investment boost it needs. High dividend yields may also signify an unsustainable dividend payment, which is likely to be cut soon as the company downsizes in an attempt to increase revenue or share price.

The dividend capture strategy allows you to take advantage of high or potentially unsustainable dividend yields while avoiding holding these stocks long-term. Here's how to do it.

- Identify stocks that pay a dividend: Most stocks announce their dividend payments months in advance. Companies will announce an ex-dividend date and a date of record, which are both important for the dividend capture strategy.

- Find the ex-dividend date: The ex-dividend date is the date before you must be invested in a stock to qualify for the upcoming dividend. In other words, if you purchase shares of a stock on or after the ex-dividend date, you will not be eligible for a payment until the next period arrives.

Locate and mark both the ex-dividend date and the date of record, the day the company records shareholders for dividend payments. The date of record is usually set one day after the ex-dividend date.

- Purchase and hold the shares: Purchase the shares before the ex-dividend date, and be sure to hold them through the stock’s payment date to be sure the dividend is paid.

- Collect a dividend payment: After the company pays out the dividend, you'll see a cash payment in your account. Be sure to turn off dividend reinvestment, which uses the dividend payment to repurchase additional shares upon payment.

- Sell the stock: After your dividend has cleared, sell the shares of stock. Depending on your risk tolerance, you may want to wait for the share's values to recover following the dividend payment.

The dividend capture strategy can generate income if you want short-term cash flow. This can be appealing, especially in a low-interest-rate environment, as dividends provide a steady income stream. The dividend capture strategy also mitigates the risk associated with holding stocks with a high dividend yield long-term, which may be at risk of paying out too much of their revenue.

Identifying top dividend capture stocks

Selecting the right stocks for the dividend capture strategy is crucial to success. Start by narrowing down companies by dividend yield — look for companies with higher yields, but also investigate payment history and revenue trends to assess sustainability. Choose stocks with a history of consistent dividend payments.

Companies with a reliable track record of paying and increasing dividends may be likelier to continue doing so, which can further compound value.

In addition to company health, the market calendar plays a significant role in the dividend capture strategy. Focus on stocks about to go ex-dividend or have recently gone ex-dividend, ensuring you are eligible to receive the upcoming dividend payment and won't need to hold the stock until the next payment period.

Sector spotlight

As you compare stock sectors that have historically done well with the dividend capture strategy, there are a few sectors you might want to focus on.

- Utilities: The utility sector is one of the most frequently used for the dividend capture strategy thanks to its consistent demand and relatively predictable profits. Economic downturns may have a limited impact on utility stocks due to the essential nature of their services, but be sure to pay attention to regulatory environmental changes, which can impact stock price.

- Real estate: Real estate stocks, particularly real estate investment trusts (REITs), are also useful for the dividend capture strategy. REITs are some of the only companies required to pay out a portion of revenue as dividends, making payment schedules relatively consistent. Interest rates and economic conditions can impact the real estate market, as can sector-specific issues related to commercial or industrial REITs.

- Healthcare: Like utilities, healthcare stocks show consistent demand across economic strength and uncertainty periods. As the population of the United States continues to age, this trend should continue beyond 2025, which might increase dividend payments across the sector. Large pharmaceutical companies with a history of dividend payments can be powerful options for dividend capture. However, these stocks may also present more risk than blue-chip healthcare options.

Risk management strategies

While the dividend capture strategy carries less risk than holding stocks with high dividend yields long-term, all strategies have the potential for capital loss. One of the primary risks is market efficiency, as stock prices often adjust quickly around ex-dividend dates. It's challenging to consistently capture dividends without exposure to price movements, which erodes profits with differences in share purchase and sale prices. Additionally, transaction costs can erode potential gains, especially for frequent traders.

Conduct thorough research on each stock you're considering buying to manage these risks. Pay attention to dividend history, financial stability, and overall market conditions. Use limit orders to make your investment purchases can help control transaction costs by specifying the maximum purchase or sale price, helping you lock in profits. Stop-loss orders can also limit maximum losses — an especially important consideration if you use stocks with more historic volatility in your trading strategy.

Diversification is also a fundamental risk management technique, and it plays a vital role in mitigating the specific risks associated with dividend capture. By spreading investments across multiple sectors and stocks, you reduce exposure to the performance of any single company or industry.

You'll face limited losses if that company or industry suffers a sudden unexpected loss. Consider incorporating multiple-sector stocks into your dividend capture strategy to limit losses.

How to use the dividend capture strategy

Suppose you plan to implement the dividend capture strategy. In that case, it's important to start by researching the best monthly dividend stocks and ETFs and keeping track of which assets' ex-dividend dates are approaching. Use these steps to get started as you look for the best stocks for dividend capture strategy.

- Identify stocks with upcoming dividend payments: Identify which stocks are about to pay dividends. You can find this information by checking the company's website or through online financial resources like stock screeners. MarketBeat's list of the best dividend stocks can be an excellent resource. Look for each stock's most recent "dividend declaration date," a company's official announcement of an upcoming dividend.

- Determine the ex-dividend date: Once you have identified a dividend stock, determine the ex-dividend date. The ex-dividend date is the date when a company looks at its list of shareholders to determine the dividend each investor is entitled to. You must own your stock before the ex-dividend date to be on record to receive a payout.

- Buy the stock: Buy the stock a few days before the ex-dividend date to ensure that you are on the record as a shareholder and will receive the dividend payment.

- Hold the stock until the ex-dividend date: Hold the stock until the ex-dividend date, typically one day before the dividend payment date.

- Sell the stock: Sell the stock shortly after the ex-dividend date. Most investors sell within a few days of the ex-dividend date to capture the dividend payment and potentially profit from the stock price increase.

Remember that a stock is not guaranteed to hold its value past the ex-dividend date. If the value of the stock drops significantly after the dividend distribution, you could see a significant loss, even adding in the value of the dividend payment.

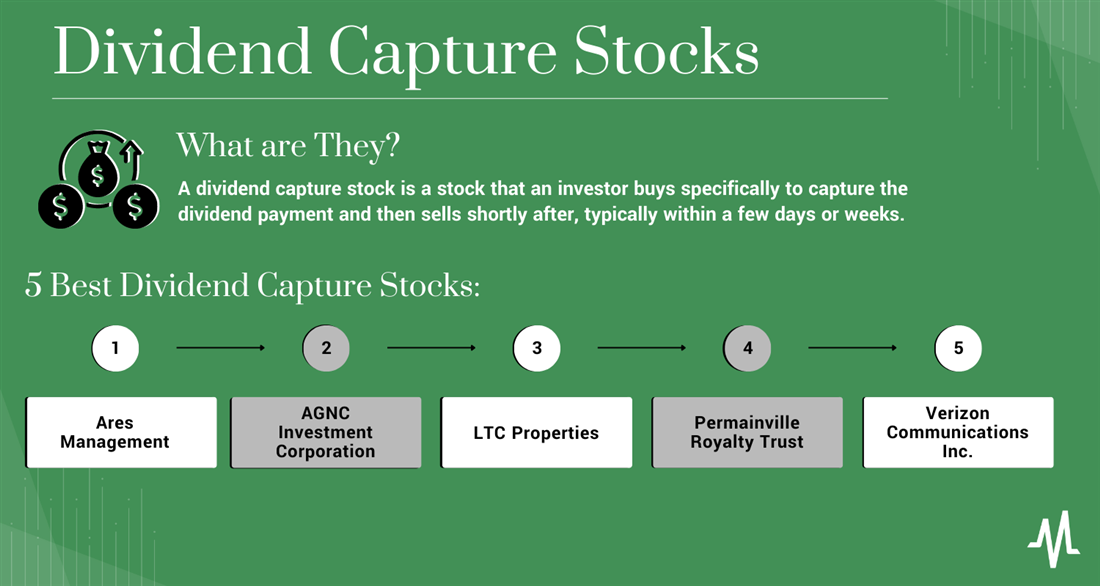

5 best dividend capture stocks

Before buying the best dividend stocks, exploring multiple investment vehicle options is a good idea.

Ares Management Corp.

The Ares Management Corp. NYSE: ARES is a global alternative investment management firm offering investment solutions to investors worldwide. The company manages assets across various asset classes, including private equity, real estate, credit and traditional asset management. The company also provides a limited range of credit and lending services. As of January 2024, the company had a total market capitalization of $36.2 billion, making it a large-cap option for investors looking to stabilize larger operations.

AGNC Investment Corp.

AGNC Investment Corp. NYSE: AGNC is a real estate investment trust (REIT) primarily investing in agency mortgage-backed securities. The company uses leverage to enhance returns and hedges its interest rate risk through various financial instruments. As a REIT, AGNC is required by law to distribute at least 90% of its taxable income out to shareholders. It pays out a monthly dividend instead of a quarterly option like other options on our list of the best stocks for the dividend capture strategy.

As of January 2024, AGNC showcased a dividend yield of 15.24%, making it an option for investors looking for higher-risk, higher-reward opportunities.

LTC Properties Inc.

LTC Properties Inc. NYSE: LTC is another REIT that pays monthly dividends. The company invests primarily in long-term care facilities, such as nursing homes, assisted living facilities and rehabilitation centers. LTC Properties generates revenue from renting out these facilities to operators who manage and provide care services to residents.

As of January 2024, LTC Properties showcased a respectable 7.11% dividend yield.

Verizon Communications Inc.

Verizon Communications Inc. NYSE: VZ is a multinational telecommunications company best known for providing communication and technology services to consumers, businesses and governments.

Verizon's primary product is its wireless phone services, which it offers in all 50 states alongside landline phone and internet services. Verizon is a member of the S&P 500 Index and various additional major indexes, leading to increased demand and liquidity compared to most other items on our list.

As of January 2024, the telecommunications giant had a dividend yield of 6.72%, one of the highest yields of S&P 500 companies.

Amplify High Income ETF

While not an individual stock, the Amplify High Income ETF NYSE: YYY is designed to produce higher-than-average dividend returns, making it ideal for the dividend capture strategy.

This ETF tracks the ISE High Income Index and maintains an average dividend yield of 12.3% in January 2024. Investments are well diversified, with utilities making up the largest percentage of the fund’s holdings at 20.38%. However, investors must be wary of the exceptionally high management expense ratio: 2.26% in January 2024.

Pros and cons of investing in dividend capture stocks

While the dividend capture strategy does provide the opportunity for short-term profits, it does come with risks. Consider the benefits and drawbacks before buying items from our best dividend capture stocks list.

Pros

The following benefits can help boost dividend capture stocks in your eyes:

- Income generation: The primary advantage of buying stocks that pay out a dividend is that they offer a potential source of income for investors seeking to generate short-term income. When buying before the ex-dividend date and selling shortly afterward, you won't need to worry about long-term value growth potential while also seeing income through dividends.

- Potential for capital appreciation: While most dividend capture investors sell shortly after buying their preferred stock, no law requires you to sell following dividend distributions. Dividend capture stocks may also offer the potential for capital appreciation, especially if the stock price rises after the ex-dividend date.

- Diversification: Dividend capture stocks may benefit a portfolio, especially if the stocks are from different sectors and industries.

Cons

However, the downsides of following the best dividend capture strategy can include:

- Market volatility: Dividend capture stocks can be affected by market volatility, leading to losses if the stock price falls significantly after the ex-dividend date.

- Short-term focus: Dividend capture stocks are a short-term strategy that may not be suitable for all investors, especially those with a long-term investment horizon.

- Active management: To earn the most from dividend capture stocks, you'll need to devote a lot of time to research, comparing stocks with upcoming dividend dates, examining dividend sustainability, making ex-dividend dates and more. If you're an investor looking for a more hands-off approach to wealth building, this strategy may not be for you.

Consider investing in dividend-paying stocks

While the dividend capture strategy may provide short-term profits, it could be more suitable for investors looking for a long-term route toward primary financial goals. Investing in the best dividend capture stocks using an ETF may provide a less volatile way to invest in dividend payers without the risk of holding individual stocks. Consider a mutual fund or ETF if you're looking for a more long-term way to invest in dividend-paying assets.

FAQs

Consider these important frequently asked questions before you choose this investment method.

Is dividend capture profitable?

The profitability of the dividend capture strategy depends on various factors, such as transaction costs, market volatility and the stock price movement after the ex-dividend date. Many investors profit from this strategy, but an equal number of investors may lose funds due to drops in share price following distribution. Overall, the dividend capture strategy is a short-term strategy that may not be suitable for all investors.

What stock pays the highest dividend?

Dividend payments are constantly changing based on the value of the underlying companies. Some companies with the highest dividend yield rates as of January 2024 include Brandywine Realty Trust, AGNC Investment Corporation and Stellus Capital Investment.

Can you get rich buying stocks that pay you a dividend?

It is possible to generate wealth by investing in stocks that pay dividends, but it is important to understand that there is no guarantee of future profits or returns after you buy. Most companies can cut dividend payments at any point, meaning dividend yield could drop sharply after investing. Be mindful of the risks and reevaluate your portfolio regularly if you invest heavily in dividend capture ETFs or stocks.

Before you consider AGNC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGNC Investment wasn't on the list.

While AGNC Investment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.