Five of the hottest stock buys for April have what it takes for their stock prices to move higher: solid results, favorable outlook, profits, and the support of analysts and institutions. Analysts and institutional support are critical because they account for the bulk of market activity and provide a powerful tailwind for stock price action.

Cybersecurity Firm Okta Is the Most Upgraded Stock for March

Okta Stock Forecast Today

12-Month Stock Price Forecast:$116.0910.03% UpsideModerate BuyBased on 34 Analyst Ratings | Current Price | $105.51 |

|---|

| High Forecast | $140.00 |

|---|

| Average Forecast | $116.09 |

|---|

| Low Forecast | $75.00 |

|---|

Okta Stock Forecast DetailsAccording to MarketBeat data, cybersecurity firm Okta NASDAQ: OKTA is the most upgraded stock for March, receiving 18 positive revisions and upgrades and no negative revisions.

The consensus price target aligns with market action at the end of the month but is up a significant 850 basis points for the period, with most revisions leading to the high-end range.

That adds $25 or about 20%, sufficient to put the stock at a two-year high and the market into a complete technical reversal. The reason for the analysts' love is the results and outlook, which came in better than expected, forecasting another year of double-digit growth.

Critical details include improving earnings quality and shareholder value with operating results at record highs, the cash balance increasing, liabilities decreasing, and equity rising by nearly 900 basis points.

NVIDIA Is Still Deeply Undervalued

NVIDIA Stock Forecast Today

12-Month Stock Price Forecast:$171.5155.71% UpsideModerate BuyBased on 42 Analyst Ratings | Current Price | $110.15 |

|---|

| High Forecast | $220.00 |

|---|

| Average Forecast | $171.51 |

|---|

| Low Forecast | $102.50 |

|---|

NVIDIA Stock Forecast DetailsNVIDIA NASDAQ: NVDA remains the most important stock for the market and is deeply undervalued. It is trading at less than 10x its 2035 earnings forecast, with double-digit growth expected to be sustained through the end of the next decade.

Among the critical details for investors are the company’s market-leading position, deep moat, and cash flow, which has grown exponentially along with the business.

Balance sheet highlights include a robust double-digit increase in the cash balance, a net cash position, and an outlook for sustained positive free cash flow sufficient to continue improving balance sheet health despite heavy investment in AI.

Regarding the analysts, trends are positive, including a firm Moderate Buy rating and a rising consensus price target forecasting more than 40% upside by year’s end.

Starbucks Shows Signs the Turnaround Gains Traction

Starbucks Stock Forecast Today

12-Month Stock Price Forecast:$106.128.03% UpsideModerate BuyBased on 28 Analyst Ratings | Current Price | $98.23 |

|---|

| High Forecast | $125.00 |

|---|

| Average Forecast | $106.12 |

|---|

| Low Forecast | $76.00 |

|---|

Starbucks Stock Forecast DetailsStarbucks NASDAQ: SBUX received notable analyst attention in March.

Analysts from Deutsche Bank to Argus see early signs that the Brian Niccol-led turnaround is gaining traction.

Mr. Niccol’s focus on digital improvement, branding, and coffee-house vibe drives improvement in in-store visits, while the lean into digital and branding is expected to drive comparable store growth across the network.

Signs of success include fewer promotions and a 300% increase in customers choosing ceramic mugs over paper cups.

Analysts rate this stock as a Moderate Buy. Sentiment firmed in March, and revision trends suggest a 15% to 20% upside is possible.

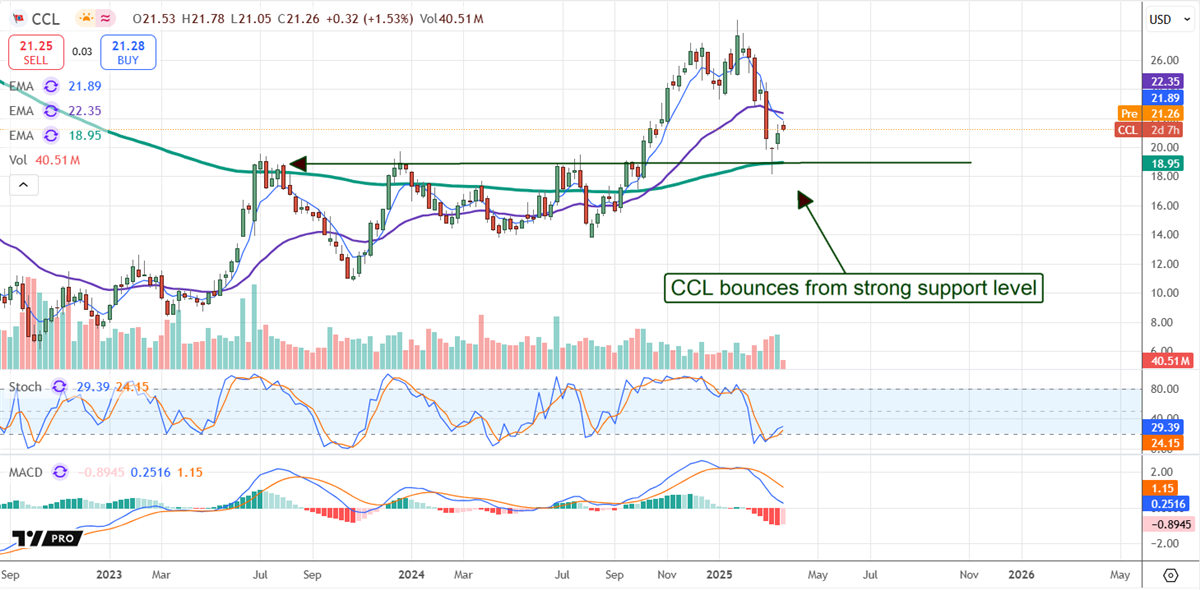

Carnival Corporation Sailing to Higher Price Points by Year’s End

Carnival Co. & Stock Forecast Today

12-Month Stock Price Forecast:$26.8937.18% UpsideModerate BuyBased on 20 Analyst Ratings | Current Price | $19.61 |

|---|

| High Forecast | $33.00 |

|---|

| Average Forecast | $26.89 |

|---|

| Low Forecast | $19.00 |

|---|

Carnival Co. & Stock Forecast DetailsCarnival Corporation’s NYSE: CCL FQ1 results and guidance have the stock on track to move higher as the year progresses.

The results were better than expected due to volume and yield, with booking and on-board purchases contributing to the strength.

The company expects these trends to continue and to post record results this year and next. Among the critical details is the rapidly improving cash flow, which allowed for accelerated debt reduction.

The debt reduction has the company on track to meet its goals a year ahead of schedule and achieve investment-quality ratings by early 2026. Analysts rate CCL as a Moderate Buy and see it advancing by 25%.

Amprius Technologies Next-Gen Batteries Gain Traction

Amprius Technologies Stock Forecast Today

12-Month Stock Price Forecast:$9.43249.85% UpsideBuyBased on 8 Analyst Ratings | Current Price | $2.70 |

|---|

| High Forecast | $15.00 |

|---|

| Average Forecast | $9.43 |

|---|

| Low Forecast | $6.00 |

|---|

Amprius Technologies Stock Forecast DetailsAmprius Technology NYSE: AMPX is an emerging tech growth company focused on Silicon-anode lithium-ion batteries.

These batteries provide higher energy density and improved discharge/charging at a lower cost than traditional batteries and are gaining traction with end-market users.

The catalyst for 2025 is the improving manufacturing capability and growing backlog, which point to hyper-growth over the next five to eight years.

Eight analysts rate this stock as a firm Buy; four issued notes in March.

Two reiterated their price targets, and two increased theirs, leaving the consensus 185% above the March-end trading levels and the stock nearly 100% below the lowest analyst target.

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.