Warren Buffett's Berkshire Hathaway NYSE: BRK.B, a financial powerhouse, regularly discloses its current holdings to shareholders through a 13F regulatory filing with the Securities and Exchange Commission (SEC) each quarter. This transparency lets investors and market enthusiasts track the company's investment decisions and portfolio changes.

Warren Buffett's Berkshire Hathaway recently made a move that surprised many by acquiring a fresh stake of 9.68 million shares in Sirius XM Holdings NASDAQ: SIRI, a prominent satellite radio provider. This strategic investment amounted to approximately $43.8 million in value by the end of the third quarter.

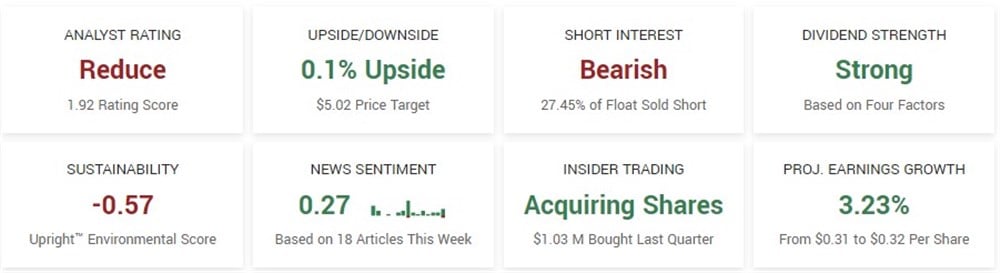

Despite Sirius XM Holdings not being favored by analysts and currently residing on the list of Lowest-Rated Stocks, Berkshire Hathaway and Buffett clearly see potential in this investment.

Known as one of the most successful investors in history, Warren Buffett's moves within his investment portfolio are closely followed and eagerly awaited by the investment community. So, let's take a closer look at Sirius XM Holdings, one of Buffett's latest portfolio additions.

Sirius XM Holdings

Sirius operates as an audio entertainment company in the U.S. through its Sirius XM, Pandora, and off-platform segments. It provides subscription-based music, sports, news, and podcast services via satellite radio and mobile applications. Additionally, the company offers personalized streaming, distributes satellite radios, provides location-based services, and delivers satellite television and data services.

At first glance, the stock appears to meet some of the basic criteria that many of Buffett's other investments possess. SIRI has an attractive P/E of 15.97, placing it in value territory, a dividend yield of 2.15%, and projected earnings growth of 3.23%. However, the stock has greatly underperformed the overall market year-to-date, with shares down almost 13.7%.

Recent earnings and a potential catalyst for SIRI

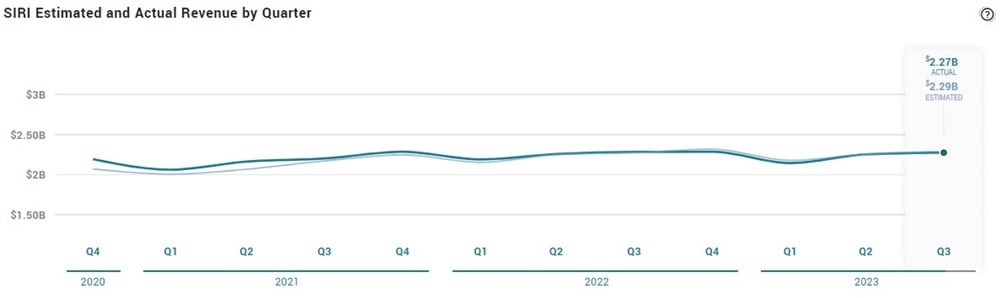

Sirius released its quarterly earnings data on October 31, 2023. The reported earnings per share stood at nine cents, surpassing analysts' consensus estimates by one cent. Despite this, the company's revenue for the quarter hit $2.27 billion, slightly below the anticipated $2.29 billion, marking a 0.4% decline compared to the previous year.

The decrease was primarily attributed to a 0.3% drop in subscriber revenue, even though advertising revenue defied industry trends, rising 0.7% to $460 million amidst an uncertain economic environment.

In September, Liberty Media unveiled a proposal for a potential merger, aiming to unite Liberty SiriusXM Group (LSXM) with SiriusXM to establish a fresh, unified public company. During Liberty's recent investor day, Jennifer Witz, CEO and president of SiriusXM, highlighted that an independent committee of directors is actively assessing this proposal. She emphasized the company's assurance in swiftly achieving their communicated long-term leverage target, irrespective of the outcome of Liberty's proposal or any associated transaction scenarios.

Analysts see downside for shares of Sirius XM

As previously noted, SIRI has fallen out of favor with analysts, landing itself on the Lowest-Rated Stocks list. The stock currently holds a Reduce rating based on twelve analyst ratings, with a consensus price target of $5.02, signaling a potential downside of over 2%. Notably, Bank of America recently revised its target for SIRI on September 27, 2023, slashing it from $5.50 to $4.50.

Before you consider Sirius XM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sirius XM wasn't on the list.

While Sirius XM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.