Alibaba Group NYSE: BABA has been increasing in the markets as the company is riding on a cocktail of tailwinds forming within its domestic and international markets. As the United States reports lower-than-expected inflation rates, with a 4.0% against 4.1% consensus, posing a different beat to the previous reading of 4.9%, the nation's economy may be beginning to send out bottoming signs.

In China, the story is completely flipped on its head as the second-largest economy in the world has yet to find enough traction, especially carrying a 0.1% inflation rate.

Considering that the United States inflation rate, as officially reported, is a lagging indicator (meaning backward-looking), other less official sources may help investors form a world view for the near future. According to Truflation, which considers prices of various product baskets on a shorter trailing basis, the actual inflation rate may be closer to 2.75%.

As the U.S. FED is looking to return to its 2% long-term objective, this unofficial reading may give more weight to the possibility of a pause in rate hikes. A rebound in consumer spending and American economic activity may help Alibaba gain momentum; however, as China sales represent the majority of revenues, investors may benefit from breaking down what the government wants to do there.

The Macro Puzzle

The Caixin composite PMI index, a monthly reading which can act as a proxy for economic activity in China, had been hovering below 50% for the third and fourth quarters of 2022. As any reading below 50% represents contracting economic activity, stock indices in the region suffered.

Further, names like the iShares MSCI China ETF NASDAQ: MCHI have been on an official bear market for a year. However, the story has begun to flip, as the same PMI index has read above 50% (signaling economic expansion) for 2023, even without much government intervention.

The Chinese government has rolled out its latest round of stimulus packages to sustain the PMI's momentum and help inflation rise to more healthy levels. The PBOC (People's Bank of China) lowered its seven-day reverse repurchase rate by ten basis points, bringing the net rate to 1.9% compared to 2.2% a year prior.

The short-term financing rate cut may trickle down into consumer borrowing and spending, as money effectively becomes 'cheaper,' a definitive good sign for Alibaba's China sales. The stance from the PBOC comes before the nation decides on the more significant interest rate path it will undertake, as Thursday, June 15, will act as a powerful catalyst.

Perceiving these trends before they became apparent to the broader markets, some investors decided to buy into Alibaba as it is positioned to be the principal benefactor - and value play - once these stimulus packages start to take effect on China's economy.

As of the first quarter of 2023, Dr. Michael Burry had reported a new position in the retail giant's stock. The same guy who predicted and handsomely profited from the 2008 financial crisis; is the same guy who has caught wind of one of the possible best comeback stories of the decade.

Value Gap

Alibaba analyst rating points to a median 63% upside scenario from today's prices, with a top-side scenario pointing to a $180 price target. As the company announced plans to break up its various businesses in a spin-off wave, investors have yet another reason to consider Alibaba a value play.

Considering that the spin-off IPOs will likely fall around dates when the underlying Chinese economy and stock market, as a result of stimulus and recovering PMI, valuations for the respective sales of each business will be much higher than they are today.

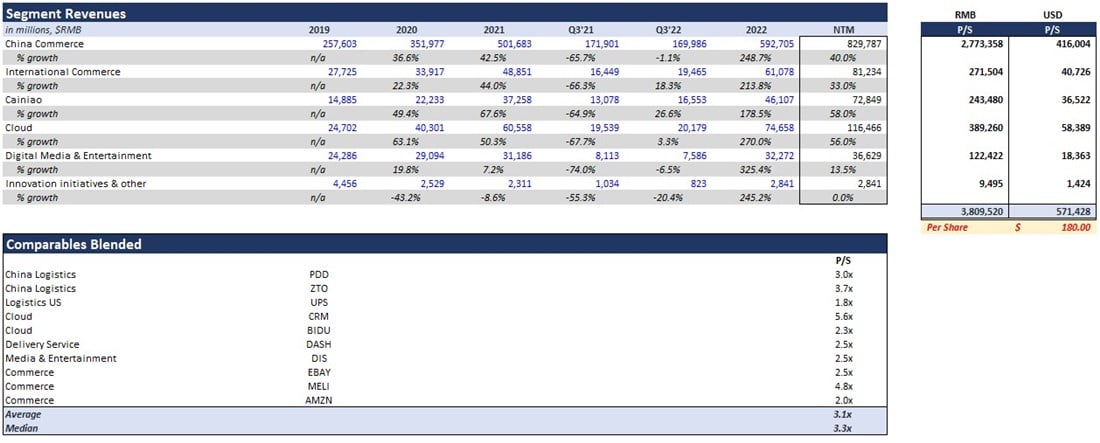

By analyzing past trends in the six underlying businesses that operate under the Alibaba brand, investors can understand what 2023 and 2024 may look like and how much value there is. By projecting the next twelve months of revenue within each respective business, using the previous five years as a guideline, investors can assign a reasonable valuation multiple to the sum of these revenues to gauge the underlying value.

Known as the 'sum of the parts valuation method, investors can take the expected net income of these businesses and assign a 3.3x sales multiple as it has been the historical norm for the blended entities.

Following these metrics and adjusting for individual beliefs, investors can arrive at the absolute ranges analysts also lean towards. Keeping all things the same and projecting on the above assumptions, the spin-off value for Alibaba could fall as high as $180 per share, as broken down in the image below.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report