A Vee-Shaped Recovery? I Don’t Think So

As dark as the days may seem, a rebound is brewing in the stock market (SPY). The combination of this selloff’s suddenness and depth has left it ripe for such a move. The question is how high the rebound will go and then what comes next? With earnings growth shot for the year, dividends getting suspended and buybacks being halted there isn’t a lot of reason to own stocks right now. Or is there?

I’ve explained before how the sell-off was overdue, how fundamental factors had set it up for a fall almost as deep as what we’ve actually seen. Declining earnings outlook, record-high valuations, and secular trends all played a roll. The global coronavirus pandemic is the spark that set the selloff in motion, it’s spread caused the panic that sent stocks deep into bear-market territory, but it is not the only reason stocks fell.

The good news is there are signs already the market over-reacted. Now, with stocks trading at deep discounts there is reason to believe a rebound is not only coming, it's going to be a strong one.

1) Prepare For The Worst, Expect The Best

The selloff was scary, don’t get me wrong, but in terms of the epidemic, it was a knee-jerk reaction in preparation for what may come. The market, in its infinite wisdom, front-ran the spreading virus because of the worst-case scenario. The worst-case scenario is far from happening and evidenced by news released over the last few days.

Starbucks is only the latest operator in China to announce it was opening its stores, a sign that life is returning to normal in the hard-hit Wuhan province. Starbucks and Apple were among the first to announce store closures way back on February 1st, both have reopened all locations over the past week.

What the news of reopenings means is we can expect a similar 6-8 week lock-down in the U.S. Assuming most of America has been distancing for the last 1-2 weeks we might see the end of this thing in early to mid-May. Regardless, assuming there is no resurgence in outbreaks, life will be back to normal by summer. The end is in sight, and that is assuming Trump doesn't reopen the economy ahead of the current expectations.

2) Earnings Growth Is Still In The Picture

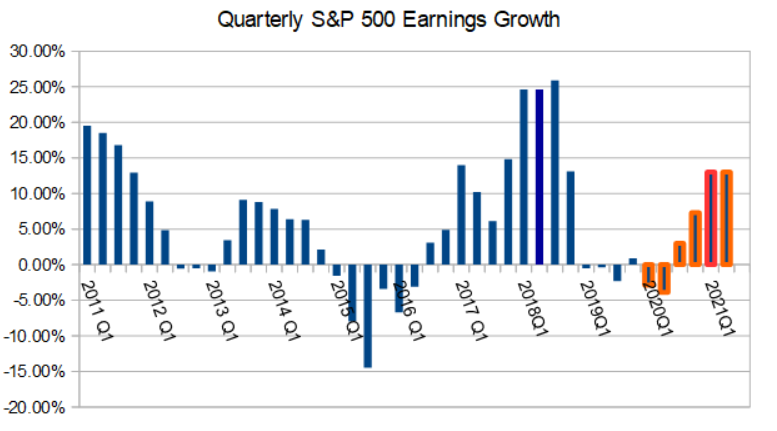

I’m not going to lie, the near-term outlook for earnings isn’t good. Both the 1st and 2nd quarters of 2020 are going to post negative EPS growth that may reach into the deep-single digits or lower. The consensus for 2020 is also hurting but that is mostly due to weakness in the first half. Looking beyond the viral impact, EPS growth improves in the second half and strengthens in 2021.

The trajectory of earnings growth is positive after the 2nd quarter. The rebound in EPS growth is expected to accelerate into next year and may not peak until the 4th quarter. The news that should get investors’ attention is that the consensus for next year’s EPS growth is rising. This is the first time we’ve seen EPS consensus outlook trend higher on an annualized basis in two years. With stocks at record low valuation, EPS growth in the outlook, rising consensus estimates, and light at the end of the pandemic-tunnel stocks should find a bottom soon.

3) Unlimited QE!

There has been so much QE unleashed upon the world I don’t even know where to begin. The bottom line is that monetary policy has become so easy on a global basis that businesses should weather the economic disruption with little trouble. Once the economic activity begins to stabilize and eventually ramp-up gaining traction should also not be a problem. The risk for central banks then will be containing expansion and controlling inflation.

The last brick in the stimulus-foundation is the spending package currently working its way through Congress. The bill could total more than $3 trillion in spending and aid intended to support and eventually stimulate the economy back into growth. The market assumes the bill is coming, its passage could be the spark that sends the market moving higher.

The Technical Outlook: This May Be The Bottom

Not to try and call the bottom, there are just too many unknowns, but there are some technical arguments that suggest this could be it. If not “The Bottom”, then at least “A Bottom”. First and foremost, price action has retreat to a very important support level and the sell-off is losing steam. The support level is the lowest low of 2018 and the ultimate bottom of a long-term consolidation range that is dominating price action.

Monday’s price action fell below the 2018 low which is not good. That move may be negated, however, because today’s trading reclaimed support and is currently moving higher. Add to this a peak in the MACD and a weak bullish crossover in stochastic and the odds of a relief rally increase. If the Congressional Aid Package is passed those odds increase again.

The risk for bulls is in support, and by that, I mean previous support targets that may offer resistance as price action moves higher. The previous support target is near 2445 and 2530 so traders should expect price action to halt at these levels before moving higher. If Congress can’t pass an aid bill these new resistance targets may keep prices from advancing.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.