Investors Run To Cash, S&P 500 Enters Reversal

We recently saw a headline that made us ask “what?!?” because it said an uptrend in the S&P 500 (NYSEARCA: SPY) had been confirmed. Our take on the market is that not only has the near-term downtrend in the S&P 500 been confirmed but that a major reversal in the market has been confirmed as well. You can blame it on what you want: Russia’s invasion of Ukraine, inflation, supply chain hurdles, rising rates, the FOMC, or the threat of recession and you would be basically right. The reason for the reversal is because of earnings and all of those other factors play into the S&P 500’s earnings power. We’ve already been tracking a downturn in the outlook for earnings growth, after this week’s reports from the retail sector we think that trend is going to accelerate and bring the entire market down with it.

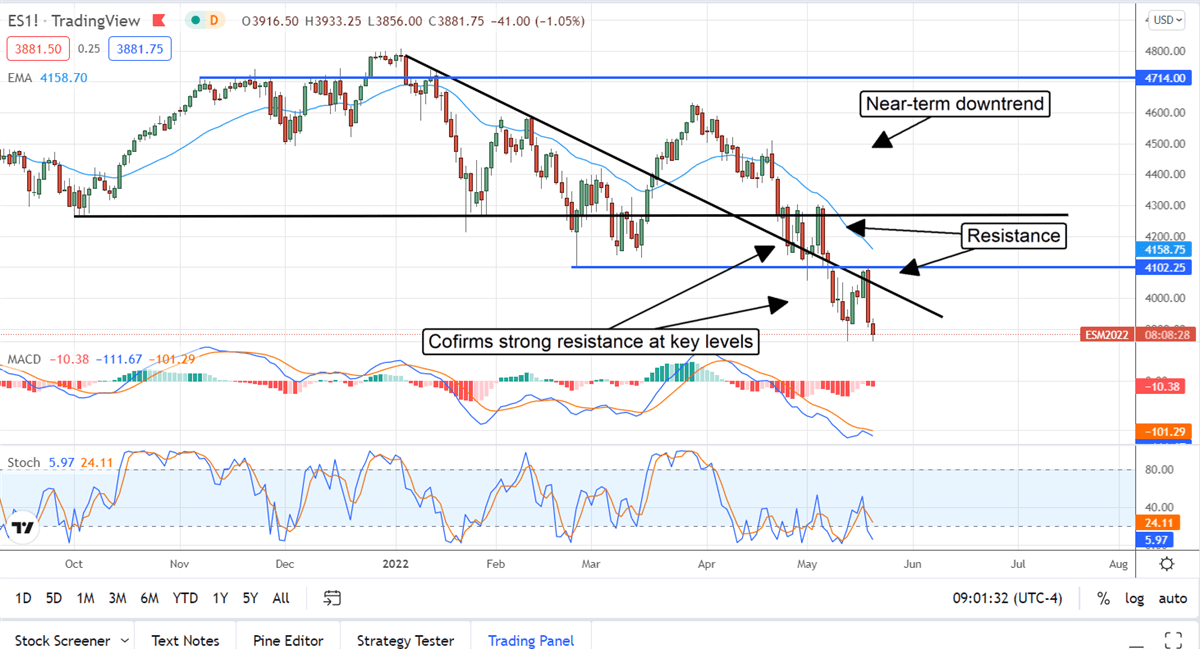

The Technical Picture Is Clear, The S&P 500 Is In A Downtrend

The S&P 500 has been in a downtrend since hitting the all-time high at the turn of the year. That downtrend was confirmed over the past two weeks when the index broke through a major support level to set a new low and then bounce back to confirm resistance at that level. That level is the 4,100 level and the fall was confirmed by the indicators as well. Both the stochastic and the MACD are showing bearish crossovers that have ample room to run which suggests prices will wallow at current levels or move lower. The scary part of this assessment is that the near-term downtrend is part of a much larger and more powerful price pattern that has also been confirmed.

We’ve been tracking a reversal in the S&P 500 since early in the year. The index made a push to new highs that was met by selling and broke the uptrend that had been in place since the pandemic bottom in 2020. At that time, the question was, is this a trend change from up to sideways or a full reversal in prices and it looked, at least for a while, as if up to sideways was the answer. The problem now is that a Head & Shoulders Reversal pattern has formed and the break to new lows confirms it as such. Price action rebounded from the new low but, as mentioned before, the rebound met resistance at the 4,100 level which just happens to be the neckline of the pattern.

Where Does The S&P 500 Go From Here?

Where the S&P 500 goes from here is a tough call but the trend is definitely downward. The first targets we get are derived from the near-term downtrend. The most recent downtrend began at the 4,550 level and hit support at 4,100 which gives a magnitude of 450. Subtract 450 from 4,100 to get a target near 3,650. That target is coincident with the market consolidation in early 2021 and a viable target for a rebound or bottom to form.

In the short to mid-term, the index could fall a little further based on the magnitude of the Head & Shoulders Pattern itself. That pattern is worth 700 points in movement and could take the index down to the 3,400 level. 3,400 is coincident with the 2020 top and consolidation so another good target for a rebound, relief rally, or bottom. If that doesn’t hold, the next target is near the 2,800 level and the long-term uptrend that we’ve been tracking for the last 13 years. It is our opinion that, unless something changes drastically very soon, the S&P 500 will move down to that level.

Before you consider SPDR S&P 500 ETF Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPDR S&P 500 ETF Trust wasn't on the list.

While SPDR S&P 500 ETF Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.