Diversified medical science giant

Abbott NYSE: ABT stock made headlines regarding its gamechanger $5 coronavirus test that gives results in 15 minutes. Shares have been wildly outperforming the benchmark

S&P 500 index NYSEARCA: SPY. The recent pullbacks from a sell-the-news reaction is discounting the onboarding opportunities the COVID rapid test brings the company. The network effect of introducing potentially hundreds of millions of new end-user customers to the brand has been largely overlooked in the

race for a COVID-19 vaccine. This is a blue-chip stock with a diversified portfolio of healthcare and lifestyle products addressing the most widespread chronic illnesses from cardiovascular and pulmonary to diabetic and COVID-19. Abbott’s portfolio of healthcare products make it a one-stop shop that addresses full lifecycle needs from infants to the elderly. Long-term investors on their toes monitoring opportunistic pullback entries to gain exposure in this dividend aristocrat.

Q2 FY 2020 Earnings Release

On July 16, 2020, ABT released its fiscal second-quarter 2020 results for the quarter ending June 2020. The Company reported an earnings-per-share (EPS) profit of $0.57 excluding non-recurring items versus consensus analyst estimates for a profit of $0.42, beating estimates by $0.15. Revenues fell 8.2% year-over-year (YoY) to $7.33 billion beating analyst estimates of $6.85 billion. Global diagnostic test sales grew by 4.7%. Diabetic care saw sales grow 30% YoY lead by the Freestyle Libre blood glucose monitor sales rising 40% YoY. The Company will be launching its next-gen Libre 2 in Q3. The Libre is a non-fingerstick glucose monitoring device. Finger sticks require sticking a patient’s finger to draw a drop of blood for glucose readings. It can be painful and messy with chance of infections. Libre eliminates all that. Diagnostic business grew 7% YoY. Abbott has launched several COVID-19 tests and sold 40 million to date. Abbott declared a $0.38 dividend making it the 386th consecutive dividend since 1924 and a member of the S&P 500 Dividend Aristocrat Index, composed of companies paying a dividend for at least a 25 years consistently.

BinaxNOW COVID-19 Rapid Test Game Changer

While most investors may shrug off the significance of a $5 test as not making any money, they don’t realize the opportunity for Abbott to expand its active end-user network base. Measuring at the size of a credit card, the $5 COVID-19 rapid test provides results in just under 15 minutes with 98.5% accuracy (based on clinical trials) in detecting coronavirus infections. This alleviates the long wait times with traditional labs to obtain results. This kicker is the Abbott’s free app that will record and display user’s BinaxNOW results. This gives potentially millions of new end users an introduction to the Abbott brand. The robust data it will collect on COVID-19 infection metrics can help improve future products and services. Abbott has always focused on synergizing its product portfolio (IE: stents and pacemakers) to galvanize customer loyalty.

U.S. Government Purchases 150 Million COVID-19 Tests

President Trump confirmed that the U.S. government has placed an order for 150 million BinaxNOW COVID-19 rapid tests for distribution to high risk facilities. The U.S. Defense Logistics Agency awarded a $760 million contract to Abbott. The tests will be distributed to nursing homes (18 million tests), assisted living facilities (15 million tests), hospice facilities (10 million tests) and 100 tests distributed to states to assist in reopening of schools. Abbot plans to ramp up production to over 50 million tests monthly. The first 6.5 million tests are expected to ship out in early October and up to 100 million total tests by the end of year. The Canadian government also signed an agreement to purchase up to 7.9 million ID Now rapid point-of-care tests and also up to 3,800 analyzer devices that perform the tests and subsequent results.

Look Beneath the Surface

The ability to prove negative test results for COVID-19 is a powerful tool that can enable restarts to accelerate. People can verify they are COVID-19 free with their smartphones displaying test results at work, school, during travel and so forth. The test is so cheap because it is a way to bolster their network of end-users to the family of Abbott products and bring more trust to the brand. The Abbott app has the potential for becoming one of the most downloaded apps in the near future as people taking the $5-and-15-minute test download the app and engage out of necessity. This will bring awareness of Abbott products to millions of new end-users. Insightful and prudent investors who realize this must-watch for opportunistic pullback entries as the test rolls out.

ABT Opportunistic Pullback Levels

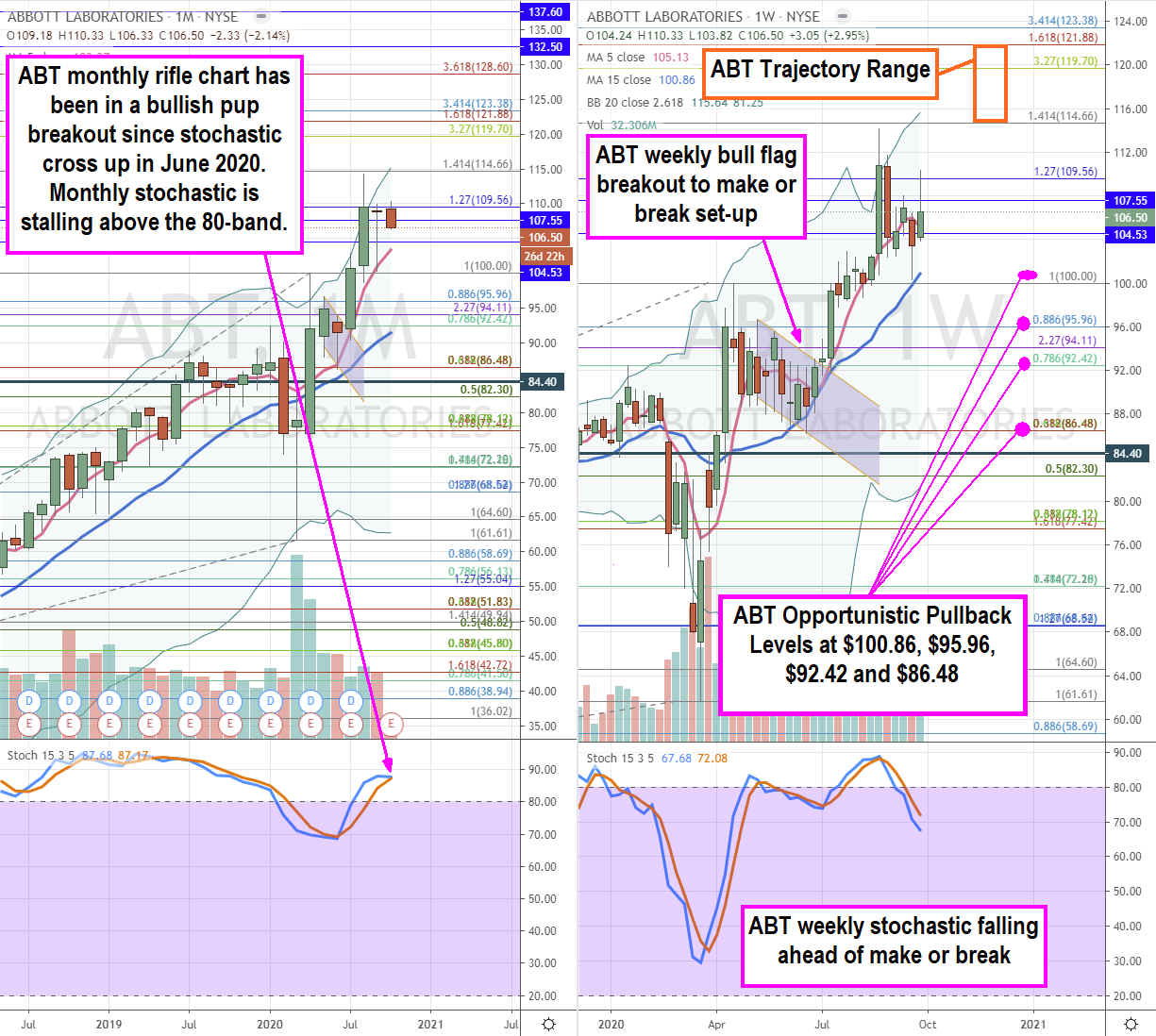

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for ABT stock. The monthly rifle chart has been uptrending since the June pup breakout as it peaked near the $114.66 Fibonacci (fib) level. The weekly rifle chart triggered a market structure low (MSL) buy above $84.40 in June as the weekly stochastic made a full oscillation through the 80-band. After initially peaking off the $100 level, ABT formed a weekly bull flag breakout towards the $114.66 fib highs. The weekly stochastic peaked and fell under the 80-band to set up a weekly make or break which could resolve itself with a pup breakout or a stochastic mini inverse pup. Prudent investors should monitor opportunistic pullback levels at the $100.86 weekly 15-period MA, $95.96 fib, $92.42 fib and the $86.48 overlapping fib. The upside trajectories sit at the $114.66 monthly upper Bollinger Bands (BBs) and fib, $119.70 fib, and $121.88 fib. This is also stock that long-term investors can feel comfortable holding as a dividend play with upside price action.

Before you consider Abbott Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abbott Laboratories wasn't on the list.

While Abbott Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.