While Advanced Micro Devices NASDAQ: AMD lost GPU market share to NVIDIA NASDAQ: NVDA during the initial AI boom, it stands to retake that share and more over time.

The primary cause is NVIDIA’s first-mover advantage and well-developed ecosystem. Advanced Micro Devices was less prepared for the AI shift but has worked diligently to flesh out its AI stack to include an end-to-end, developer-friendly ecosystem and is gaining traction in 2025.

Performance, Efficiency, and Cost Lead to AMD Share Gains

Advanced Micro Devices Today

AMD

Advanced Micro Devices

$93.40 +4.70 (+5.30%) As of 04/11/2025 04:00 PM Eastern

- 52-Week Range

- $76.48

▼

$187.28 - P/E Ratio

- 94.34

- Price Target

- $148.76

The reasons for believing that AMD can take the share lie in its performance and operating costs. AMD’s Instinct MI325X provides industry-leading HBM3E capacity and operational efficiency, helping to improve inference, optimize performance, and reduce the total cost of AI ownership.

The industry agrees that AMD GPUs and AI infrastructure provide value. Tech companies from Super Micro Computer NASDAQ: SMCI to Dell NYSE: DELL, Lenovo OTCMKTS: LNVGY, and Hewlett Packard Enterprises NYSE: HPE use their product in their most advanced AI supercomputers and servers. They also work to embed AMD’s edge AI into PCs, mobile, and IoT devices.

Meanwhile, Advanced Micro Devices is taking a share in the data center CPU and PC market. The data from Q4 shows AMD with a record-high 25.1% unit share and 35.5% in revenue, surpassing Intel for the first time. EPYC CPUs are the top performers and are projected to grow from a $5 billion business in 2025 to tens of billions within years, adding significant top-line growth relative to the 2025 forecast.

Regarding the edge, the Advanced Micro Devices Ryzen line increases device performance, enhances user output, reduces latency, and improves audio and video quality. It took share each quarter in 2024, increasing by nearly 500 basis points at year’s end and expected to continue growing in 2025.

Advanced Micro Devices Provides a Value Opportunity in AI

Advanced Micro Devices 2024/2025 price correction has created a value opportunity in this AI stock. Trading at only 22x earnings, it is fairly valued relative to the S&P 500, with no AI premium attached to the stock, while the business has a more robust growth outlook.

Advanced Micro Devices Stock Forecast Today

12-Month Stock Price Forecast:$148.7659.27% UpsideModerate BuyBased on 32 Analyst Ratings | Current Price | $93.40 |

|---|

| High Forecast | $250.00 |

|---|

| Average Forecast | $148.76 |

|---|

| Low Forecast | $100.00 |

|---|

Advanced Micro Devices Stock Forecast DetailsAdvanced Micro Devices is forecasted to grow earnings at a high double-digit CAGR through 2030, more than double the forecasted pace of the S&P 500, and the estimates are likely low.

Regardless, AMD stock trades below 9x its 2030 EPS forecast, suggesting a minimum 100% upside within the next five years and potential for a 200% to 300% increase to align with other leading blue chip tech names.

Analysts' sentiment trends also suggest this stock is deeply undervalued. The analysts reset their price targets in 2024 and extended the trend in early Q1 2025 but remain bullish overall. The price target reductions shaved about 20% off of the consensus target in the preceding 12 months.

Still, the consensus forecasts a nearly 50% upside from mid-March price levels, and the market sell-off overran the reset. Most targets align with the forecast for a 50% upside, and the low target is well above the current price action, suggesting a minimum 10% upside by year’s end.

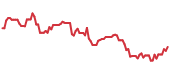

Advanced Micro Devices Hit Bottom in March

Advanced Micro Devices' stock price decline reached a critical long-term support level in early March and began to rebound. The critical level aligns with lows set in fall 2023 before the AI bubble formed, suggesting a bottom is in for the market.

AMD stock price may move sideways until late April, when the Q1 results are released, and then advance, assuming no bad news is included. The critical resistance point is now the 30-day EMA near $106; if the market can move above, it could advance to the $115 to $120 region before hitting the top of the range.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.