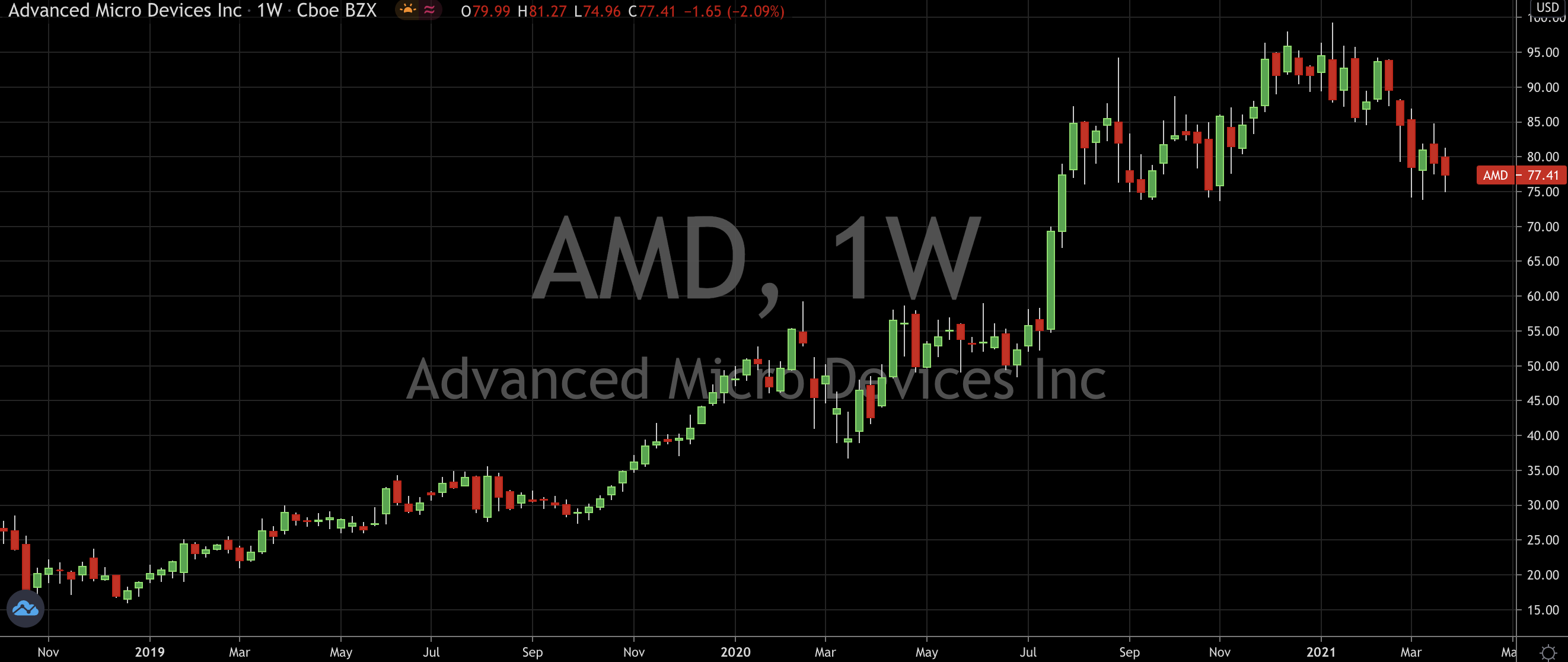

A 1.5% move on Friday was enough to keep shares of Advanced Micro Devices (

NASDAQ: AMD) from closing near their six months lows. Like many of the more well-known names in tech, the first quarter of 2021 has been tough, as rising rates have brought great scrutiny onto stocks with lofty valuations. With a price-to-earnings (P/E) ratio of the high 30s, it’s hard to put AMD in the same camp as the likes of Tesla (

NASDAQ: TSLA) who can boast four digit P/E ratios, but their shares have seen

some selling all the same.

Since

hitting all-time highs in January, shares of the microchip maker have fallen some 20%. But there are plenty of reasons to start thinking there might be a buy opportunity opening up. While some of those reasons are internal, the ripest are external.

Intel’s Mistake

AMD’s closest competitor is Intel (NASDAQ: INTC), whose blunders in the past year have helped underpin the consistent demand for AMD shares that has, notwithstanding current weakness, taken them to where they are. It seems we can now add a fresh Intel blunder to the list of reasons to look more favorably on AMD; last week Intel announced plans to launch their own $20 billion foundry business.

Wall Street’s reaction was largely negative, with Bank of America quickly pointing out that there’s "no evidence that Intel can match or exceed the leading-edge capabilities" of existing chip foundry players. They also noted that of the major chip makers, Intel is the only one that has guided their sales, gross margin, and FCF forecasts downward for 2021, even while the global PC market is set to expand in the double digits.

Gus Richard from Northland Capital was quick to see the upside on offer to AMD as their competitor’s focus takes a major dilution. He upgraded shares of AMD to Outperform from Market Perform whilst slapping a fresh price target of $96 onto them. From Friday’s closing price of $77, that suggests an attractive upside of some 24% to investors on the sidelines.

He believes Intel "made a strategic faux pas re-committing to entering the foundry business”, and it’s a mistake AMD stands to benefit from. Even with the recent drop in the latter’s shares, AMD’s stock’s performance over the past year absolutely smokes Intel’s. They’re up 60% to Intel’s 13%, and until early February Intel’s performance was actually in the red.

Getting Involved

Rosenblatt Securities and RBC have both increased their ratings on AMD stock in recent months and have price targets that are comfortably in the triple digits. Taking all this into account the current dip makes for a compelling long case, all the more so for investors with medium to long term investment horizons. The company’s most recent earnings report from January had revenue up more than 50% on the year and shares are trading right along above some decent support.

The mid $70s is where the sellers have run out of steam several times since last September so those getting involved have the security of being able to work with some tight stops. To the upside, the high $90s seems like the first obvious target. Unless we see a sudden risk-off sentiment take hold of equities in the coming weeks, there’s no reason AMD won’t be a triple-digit stock by summertime. They have a ton of internal factors and momentum carrying in place to take them there, and these external factors will do their chances no harm at all.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.