CenturyLink merged with Qwest to become the third-largest telecommunications company in the U.S. in 2010. The Company continued to gobble up technology companies like Savvis, a

cloud infrastructure company in 2012 and broadband provider Level 3 Communications in 2017. The Company changed its name from CenturyLink to

Lumen Technologies NYSE: LUMN on Sept. 18, 2020.

Legacy copper-based services would continue under CenturyLink and fiber-based products and services would service under the Quantum Fiber brand. The Company provides cloud, IT, voice, TV, infrastructure, internet, and

broadband services to enterprise, small business, and residential customers. It's Quantum Fiber is the growth engine as it expands in over 30 U.S. cities and metro areas expanding access to millions of new consumers.

Value investors may be interested in its assets which include over 400,000 route fiber miles serving customers in over 60 countries.

Google Fiber NASDAQ: GOOG has deployed 50,000 miles of fiber in 60 markets at a cost of over $14 billion, twice the market cap of Lumen stock. The cheap price-to-book ratio of 0.5 makes it an asset play if it continues to sell off more

pieces of the whole, gets acquired, or goes private. Can the new CEO effectively change its downward trajectory?

Raising Cash and Fending Off Competition

The Company has been shedding some of its businesses to pay down debt which will be reduced to $20.4 billion after paying it tax bill between $900 million to $1 billion for its 20-state ILEC sales of its LATAM business to Apollo for $7.5 billion. The Board of Directors made the decision to eliminate the $1.00 annual dividend and implement a stock buyback program up to $1.5 billion with a two-year time. The Company expects an inflation impact for the full-year next year. Further focus on the digitization of front and back office functions is a top priority. Lumen faces competition from the big broadband providers like AT&T NYSE: T, Verizon NYSE: VZ, and Comcast NASDAQ: CMCSA as well as cloud service and applications providers including Amazon Web Services NASDAQ: AMZN, Microsoft Azure NASDAQ: MSFT, and Google Cloud NASDAQ: GOOG.

Top and Bottom Line Downward Trajectories

Lumen reported its Q3 2022 earnings on Nov. 2, 2022. The Company reported earnings-per-share (EPS) of $0.14 missing consensus analyst estimates for $0.35 by (-$0.21). Net income was $578 million versus $544 million in the year-ago period. Special items of (-$527 million) and (-$31 million) dropped EPS from $0.57 to $0.14. Revenues continued to drop (-10.2%) year-over-year (YoY) to $4.39 billion missing analyst estimates of $4.41 billion. Adjusted EBITDA fell to $1.688 billion compared to $2.078 billion in the year ago period. The Company completed the $2.7 billion divestiture of its Latin American business Stonepeak. The Company generated $620 million in free cash flow. Lumen completed its $7.5 billion divestiture of its 20-state ILEC business to Apollo on Oct. 3, 2022. The Company eliminated its stock dividend and authorized a two-year and up to $1.5 billion share buyback program. Entered into an exclusive arrangement to sell its EMEA business to Colt Technology for $1.8 billion. Incoming Lumen President and CEO Kate Johnson who commented, "The opportunity for Lumen is significant, and I am eager to leverage today's announcements and the adjusted capital allocation priorities to drive profitable growth and shareholder value. Jeff, the Lumen Board, and I are fully aligned on these decisions. I look forward to hitting the ground running on November 7." The Company expects adjusted EBITDA in the range of $6.9 billion to $7.1 billion for fiscal full-year 2022.

Department of Defense Contract

On Nov. 1, 2022, Lumen announced it won a $1.5 billion cap 10-year defense contract from the Defense Information Systems Agency. Lumen will provide essential network transport and communications services to enable the U.S. Department of Defense (DOD) to recognizes its national security objectives in the Asia Pacific region and Alaska. The contract services range from internet, ethernet, and wavelength to protect America’s interests. Lumen’s dark fiber has been used exclusively for government contract services and is posted under the CenturyLink segment.

Breakdown After a Breakdown

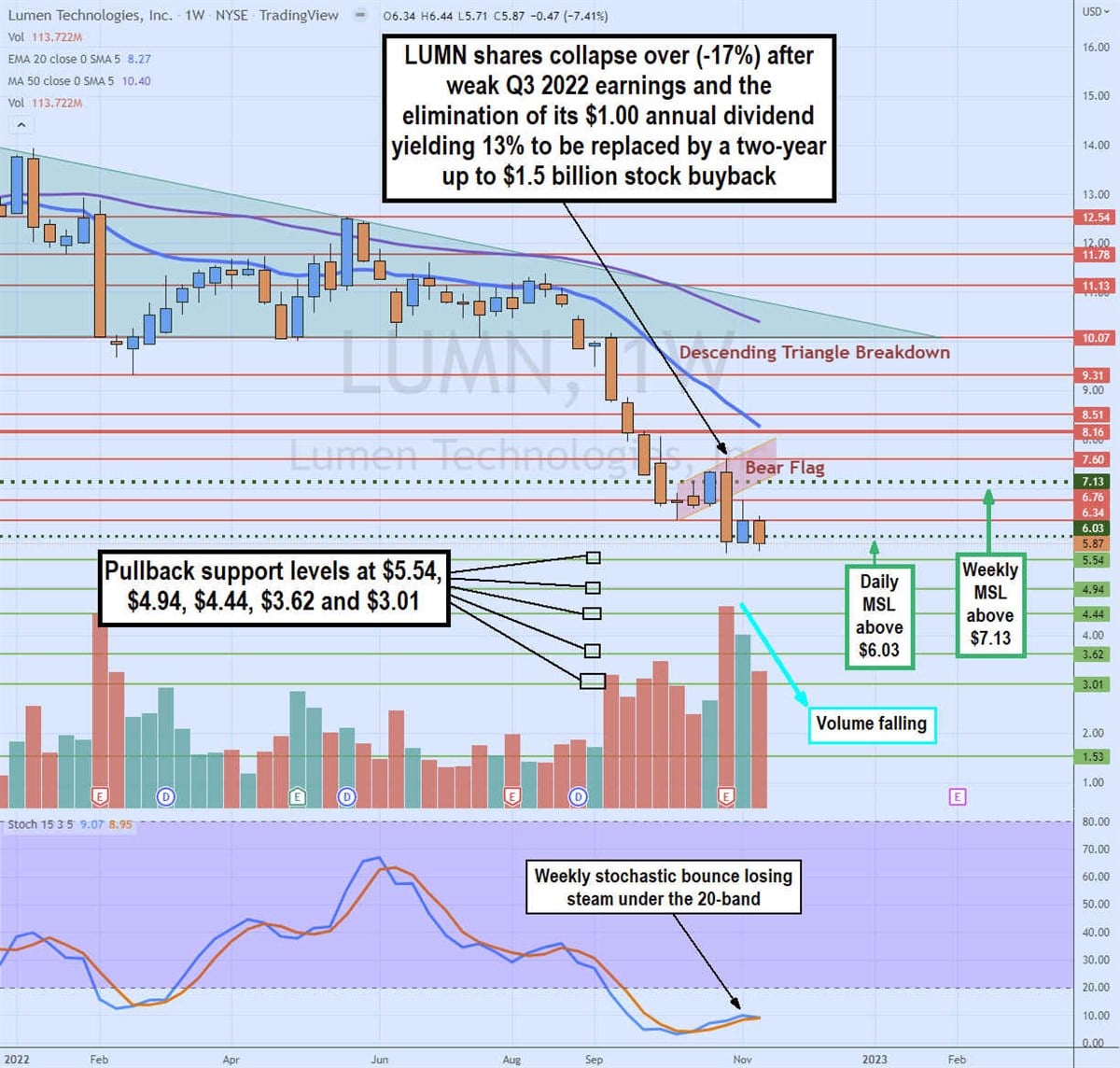

The LUMN weekly candlestick chart illustrates the descending triangle breakdown occurring in August 2022 as each preceding bounce was lower until the $10.07 support finally gave in. Shares managed to fall to a swing low of $6.34 before triggering the weekly market structure low (MSL) for a rally back up to $7.60 in October to Nov. 1, 2022. On Nov. 2, 2022, LUMN shares collapsed over (-17%) on in reaction to its Q3 2022 earnings report and dividend elimination triggering the weekly bear flag breakdown. The weekly 20-period exponential moving average (EMA) resistance hasn’t tested yet as it continues to fall to $8.27 followed by the 50-period MA at $10.40. The daily MSL trigger sets at $6.03 after making a new swing low of $5.68. Pullback support levels sit at the $5.68 swing low to $5.54, $4.94, $4.44, $3.62, and $3.01.

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.